Praxis Precision Medicines (PRAX) shares nearly tripled on Thursday after the biotechnology firm reported promising late-stage results for its experimental drug ulixacaltamide.

According to the company’s press release, ulixacaltamide significantly improved daily functioning in patients with essential tremor across two Phase 3 trials.

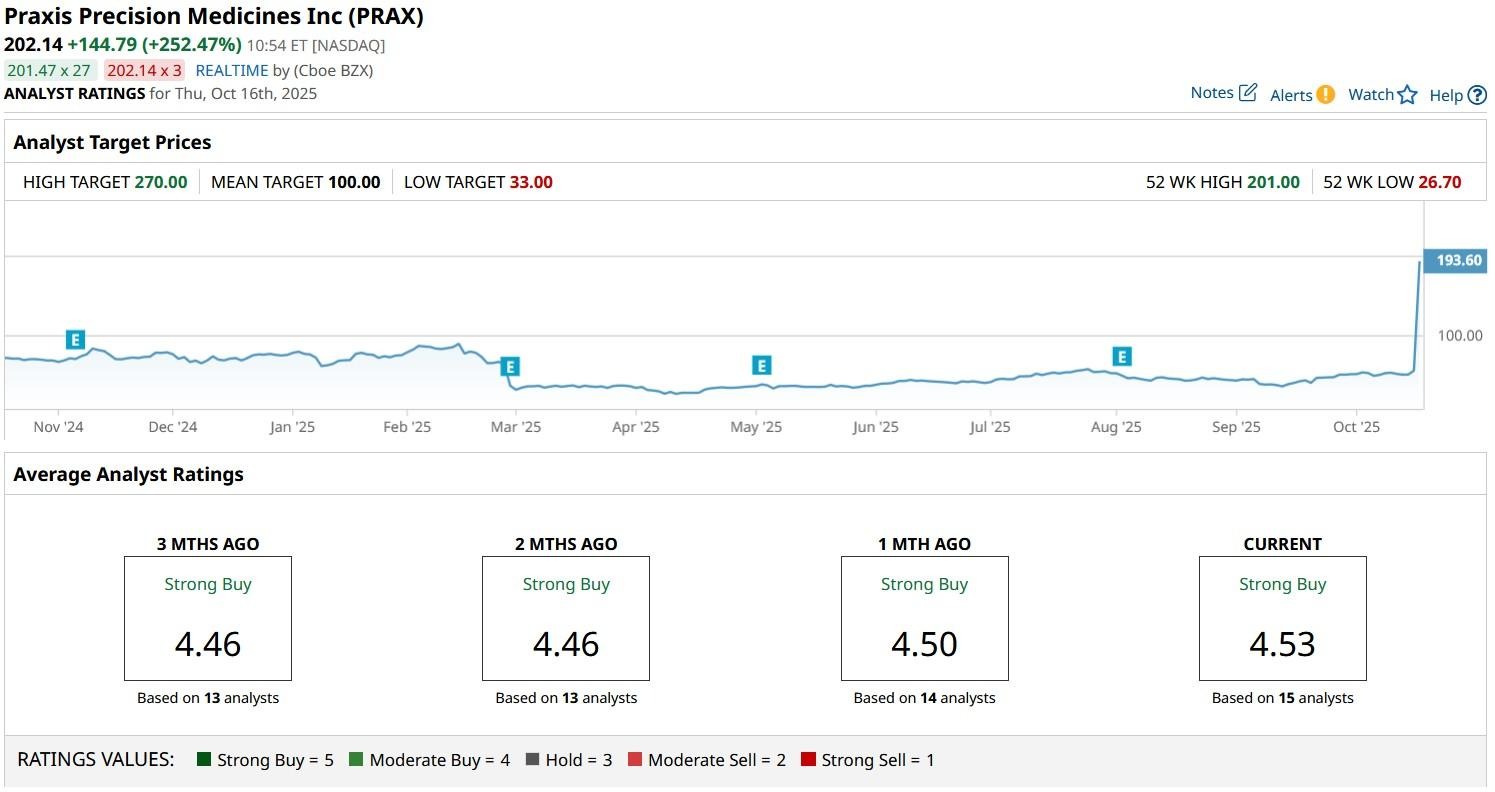

Following today’s explosive move to the upside, PRAX stock is trading at over 7x its price in early April.

Why Is Ulixacaltamide a Big Deal for Praxis Stock?

Ulixacaltamide showed a 4.3 point improvement in daily task performance versus placebo in the first clinical study and sustained efficacy in the second one.

These results not only validate the drug’s mechanism, but also position Praxis stock as a frontrunner in a high-need therapeutic area. Essential tremor affects millions worldwide.

With no FDA-approved therapies for essential tremor, ulixacaltamide could become a first-in-class blockbuster. Therefore, investors are betting on accelerated regulatory momentum and commercial upside.

Additionally, the data reverses earlier skepticism from a March trial setback, restoring confidence in Praxis’ pipeline and trial design.

What Could Drive PRAX Shares Higher From Here

Praxis shares may be attractive for investors interested in betting on a biotech company in its early innings for longer term, sustained upside.

The Boston-headquartered firm isn’t just a one-drug story. In its portfolio are three late-stage asset with blockbuster potential and PRAX expects four commercial launches by 2028.

The company holds a robust $470 million cash position, enough to fund operations through key regulatory milestones. Its antisense and small molecule platforms target broader CNS disorders, offering long-term optionality.

While its valuation has ballooned, the pipeline breadth and cash runway justify investor interest. If ulixacaltamide does secure FDA approval, PRAX shares could transition from a speculative bet to commercial-stage biotech growth story.

How Wall Street Recommends Playing Praxis Precision Medicines

Investors can also take heart in the fact that Wall Street analysts remain bullish on PRAX stock.

According to Barchart, the consensus rating on Praxis shares currently sits at “Strong Buy” with price targets going as high as $270, indicating potential upside of another 50% from here.