Live Nation Entertainment (LYV) has had a decent run on Wall Street so far this year, but the spotlight has suddenly shifted, and not in a good way. The United States federal government and a group of states are suing Ticketmaster and its parent company Live Nation. The case accuses the company of letting ticket resellers drive up prices, leaving fans to “pay substantially more than face value” for in-demand concerts and events.

In its Sept. 18 press release, the Federal Trade Commission (FTC) went after Live Nation with a list of accusations, including “bait-and-switch pricing,” where fans pay more than the advertised amount. The FTC also disputed Live Nation’s claims of “strict limits” on ticket sales, saying brokers routinely blew past those limits without consequence. Interestingly, this isn’t the first time Live Nation has faced such scrutiny.

The controversy around price gouging hit a fever pitch during Taylor Swift’s Eras Tour, when resale tickets skyrocketed into the tens of thousands of dollars. That fiasco sparked massive outrage from Swifties, lawmakers, and consumer advocates alike, who accused Ticketmaster of wielding monopoly-like power. That said, with LYV shares sliding on the latest lawsuit, here’s a closer look at this global live entertainment company.

About Live Nation Stock

California-based Live Nation Entertainment is a global giant behind the concerts and events that millions of fans flock to each year. Through its three main arms — Live Nation Concerts, Ticketmaster, and Live Nation Media & Sponsorship — the company promotes thousands of shows worldwide, manages top venues, and delivers innovative ticketing solutions. With a presence in over 40 countries, Live Nation has built its reputation on bringing artists and fans together, transforming live music into unforgettable experiences on a massive scale.

Currently valued at about $38.4 billion by market capitalization, shares of this live entertainment provider have been performing well amid growing enthusiasm from fans who continue to shell out for concerts and live events, proving that the demand for experiences remains strong even in a shaky economy. Beyond resilient fan spending, the company is also benefiting from record-breaking tours, steady growth in sponsorship revenue, and the strength of its Ticketmaster platform, which dominates the ticketing market.

LYV stock recently hit a new peak of $175.25 on Sept. 15, but shares have since pulled back about 6% from that high amid fresh regulatory setbacks. On the brighter side, while the stock tanked almost 3% on Sept. 18 after the FTC crackdown announcement, LYV's longer-term performance remains quite impressive. LYV stock is up a notable 59% over the past year and 28% so far in 2025, outshining the broader S&P 500 Index’s ($SPX) 17% and 14% gains, respectively.

Live Nation Cashes In on Surging Concert Demand

In early August, Live Nation Entertainment posted its fiscal 2025 second-quarter earnings, reporting $7 billion in revenue, up 16% year-over-year (YOY) and surpassing Wall Street’s $6.9 billion expectations. The strong results were fueled by global expansion and booming fan attendance, reflecting the surging demand for live concerts despite economic uncertainties.

The report underscores the resilience of the live entertainment sector and Live Nation’s ability to capitalize on fans’ appetite for unforgettable experiences. Concerts remained the star of the show, generating $5.9 billion in sales, up 19% YOY, while ticketing sales rose 2% and Sponsorship & Advertising climbed 9% annually. Profitability shined the brightest in the Concert segment, with adjusted operating income jumping 33% YOY to $358.7 million.

Global attendance reached 44 million fans, a 14% increase, with the company noting that stadium attendance tripled from the prior-year quarter. More than 40% of stadium shows sold nearly all tickets in the first week, showing the massive drawing power of top artists. Live Nation’s Ticketmaster also broke records, with gross transaction value (GTV) rising 7% to $9 billion.

To support future growth, Live Nation is investing $15 billion in artist events worldwide, reinforcing its role as a key financial partner for performers. On the flip side, EPS came in at $0.41, down 60% YOY, missing Wall Street’s forecast of $1.01. Management, however, is betting on expansion to capture long-term opportunities, opening four new U.S. amphitheaters last quarter and planning projects across Mexico, Colombia, and Canada, with 10 large venues expected in 2026. Moreover, the company said that its capital investments continue to deliver high returns on capital, exceeding 20%, demonstrating a clear focus on ensuring that growth initiatives translate into meaningful long-term shareholder value.

FTC Slams Live Nation Over Hidden Fees and Ticket Resellers

Live Nation, which joined forces with Ticketmaster in 2010, has long been under the spotlight for its immense influence in the live entertainment world. Over the years, fans have voiced frustration with Ticketmaster, which has become the go-to ticketing platform for countless artists, giving the company near-unmatched control over how fans access concerts and events. In fact, amid the Eras Tour debacle, Taylor Swift fans went online in full force, rallying behind a single mission to take down Ticketmaster.

Now, the leading ticketing giant under Live Nation is facing a major FTC crackdown over practices that allegedly leave fans paying far more than advertised for concerts and live events. FTC Chairman Andrew Ferguson called the lawsuit a “monumental step” to ensure Americans can enjoy live entertainment without breaking the bank.

The complaint alleges that, while Ticketmaster publicly enforces ticket limits, in practice it benefits from brokers who bypass the rules, scooping up high-demand tickets through thousands of accounts. From 2019 to 2024, fans spent over $82.6 billion on Ticketmaster, while internal documents reveal that the company knowingly “turned a blind eye” to these broker violations and even provided tech tools like TradeDesk to make resale easier.

Additionally, Ticketmaster allegedly engaged in deceptive pricing, hiding fees that could reach 44% of the ticket cost until the final stage of purchase, resulting in $16.4 billion in hidden fees over a five-year period. Executives reportedly avoided technology that could prevent such abuses because it would cut into revenue, despite publicly promoting transparency.

The lawsuit exposes how ordinary fans are often shut out of tickets while brokers and the company profit, shedding light on Ticketmaster’s hold on live entertainment and raising urgent questions about fairness in the ticketing industry.

What Do Analysts Think About Live Nation Stock

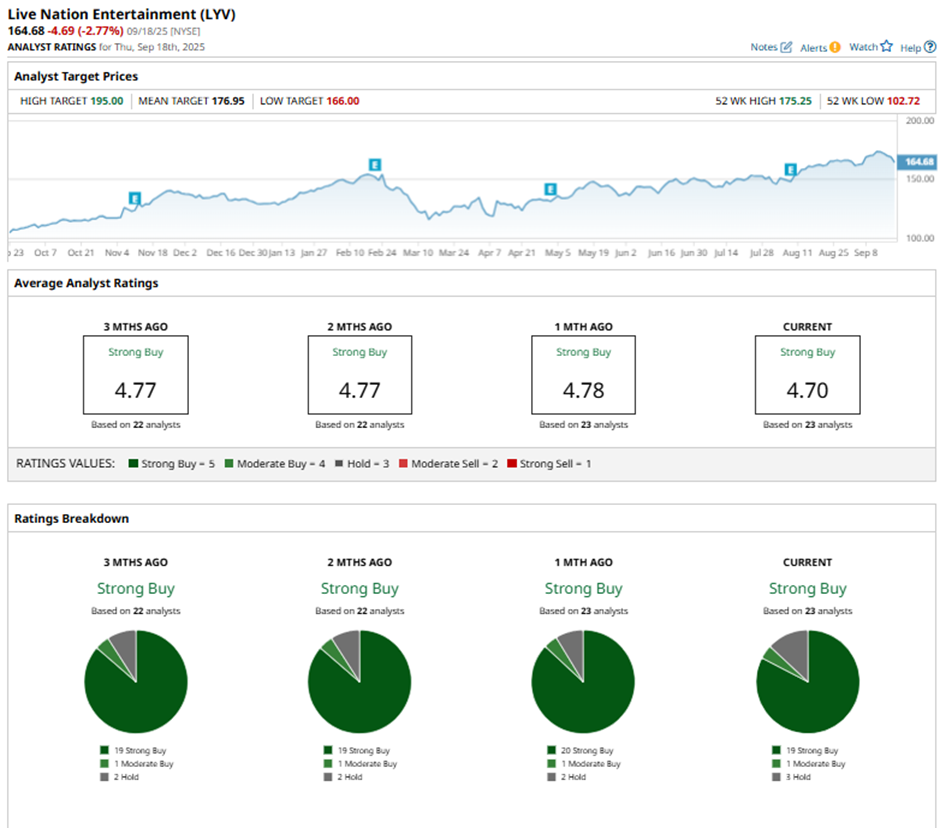

Even amid such regulatory scrutiny, Wall Street is keeping the faith in Live Nation. LYV stock carries an overall consensus “Strong Buy” rating, reflecting widespread optimism about its growth prospects. Out of 23 analysts covering LYV stock, 19 recommend a “Strong Buy,” one favors a “Moderate Buy,” and only three suggest “Hold.”

The average price target sits at $176.95, implying potential upside of 7% from here. Meanwhile, the Street-high target of $195 signals that the stock could soar as much as 18% from current levels.