In a world where stocks related to high-flying sectors such as artificial intelligence, quantum computing, cybersecurity, and robotics are generating returns that are scarcely believable, betting on a financial stock for “global domination” seems a bit far-fetched. Yet the popular host of CNBC’s Mad Money, Jim Cramer, is doing exactly that with Capital One Financial (COF).

Cramer’s bullish thesis on the company is based on two key aspects: the recent acquisition of credit card company Discover and the long-serving CEO, Richard Fairbank’s, strategic vision. He stated, “He’s going to go for a worldwide card, and I would not go against Richard Fairbank, hence why it is up $10 [a share] off a quarter that is very confusing, but is clearly going in the right direction.”

About Capital One

Founded in 1994 as a credit card issuer, Capital One has grown to be one of the foremost names in the financial industry, with interests in auto lending, consumer and commercial banking, and online banking, serving retail consumers, small and midsize businesses, and commercial clients.

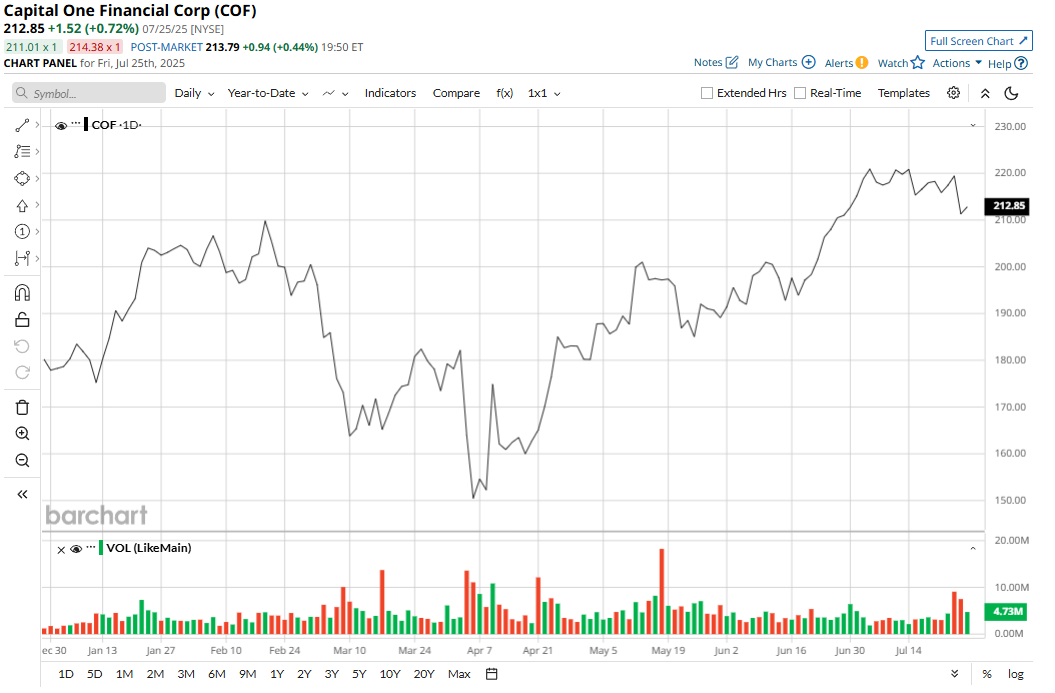

Valued at a market cap of $81.6 billion, COF stock has gained 19.6% on a YTD basis. Notably, the stock also offers a dividend yield of 1.13%, and with a payout ratio of just 12%, the scope for further growth remains.

So, is Cramer’s optimism about COF stock based on sound rationale, or will the assumptions about its “global domination” remain just a pipe dream? Let’s find out.

Financials Gaining Momentum

After reporting three consecutive earnings misses in 2024, Capital One has made a turnaround with four consecutive quarters of earnings beats. The latest quarter, Q2 2025, saw the company report adjusted EPS of $5.48. This marked a substantial YOY growth of 74.5%, accompanied by 25% growth in total net revenues to $12.5 billion in the same period. Net interest margin improved to 7.62% from 6.70% in the year-ago period, as the company also improved its capital position, reporting a Common equity Tier 1 capital ratio of 14% compared to 13.2% in the previous year.

Average loans and deposits also grew year over year. While average loans held for investment increased to $378.2 billion from $318.2 billion in the corresponding period a year ago, average deposits surged to $414.6 billion from $349.5 billion.

The rise in average loan balances was driven by increases in credit card and consumer-banking loans, having end-of-period balances of $269.7 billion (+75.2% YOY) and $81.2 billion (+7.3% YOY), respectively. Meanwhile, total deposits at the end of the quarter stood at $468.1 billion, up 33.2% from the prior year.

Capital One Is on the Right Path

Since my last piece on Capital One, which followed legendary investor Warren Buffett triming his stake, the stock has gained 14%.

The obvious strengths of the Discover acquisition are driving growth, which made Capital One the eighth-largest bank in the United States. Beyond expanding its consumer and commercial banking capabilities, the acquisition gives Capital One a new competitive edge: entry into the payments network arena, an area where Discover already has an established presence.

Operationally, things are trending in the right direction too. In the latest quarter, charge-offs totalled $3.1 billion, but crucially, credit card losses improved, falling to 5.2% from 6% in the prior year. Likewise, delinquencies over 30 days dropped to 3.6% from 4.2% a year earlier. Even excluding Discover’s metrics, Capital One saw its delinquency rate decline to 3.92%, down 22 basis points year-over-year. These shifts hint at better credit health ahead, assuming macro conditions don’t worsen. On the commercial side, nonperforming loan levels also moved lower slightly, from 1.4% to 1.3%.

Further, Capital One has also been quietly but consistently betting big on artificial intelligence. The company began working with machine learning tools as far back as the early 2000s. Today, it runs several AI-powered systems, including a smart assistant that helps users compare cars, schedule test drives, and book dealer visits. That assistant has driven a 55% increase in dealer engagement and faster customer interactions.

There’s also a powerful generative AI solution that supports customer service teams by generating virtual card numbers, replacing lost cards, and resolving complex queries. This tool now produces more relevant responses, improving internal search accuracy from 84% to 93%, and has already been adopted widely across support operations. Capital One’s tech stack also includes personalized digital features for roughly 100 million users across its platforms, helping drive better user engagement and faster testing of new features.

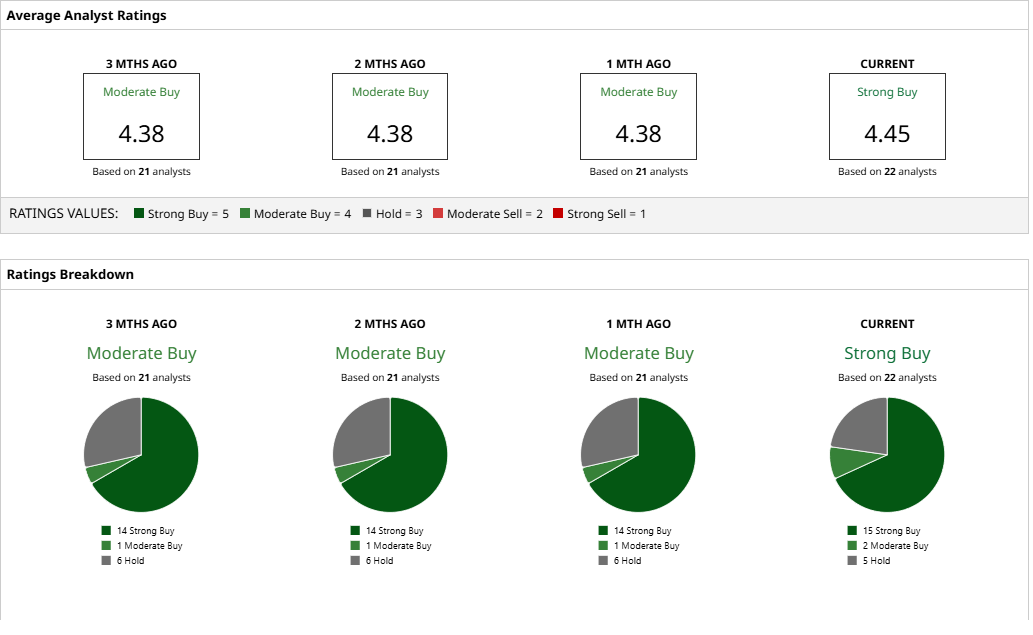

Analyst Opinions on COF Stock

Thus, analysts have given COF stock a “Strong Buy” rating with a mean target price of $240.24. This indicates upside potential of about 13% from current levels. Out of 22 analysts covering the stock, 15 have a “Strong Buy” rating, two have a “Moderate Buy” rating, and five have a “Hold” rating.