/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

Primoris Services (PRIM) has quietly become one of the top-performing industrial infrastructure stocks of 2025. As big-name stocks like Nvidia (NVDA) and Palantir (PLTR) continue to lead the artificial intelligence (AI) discussion, Primoris has climbed over 50% so far this year, driven by booming demand for its services in the power and utilities sectors, as well as for AI-related data centers. Second-quarter earnings surged for the company, driving shares up by a little over 17% the day before this month.

This is a narrative of less hype and more execution. As hyperscalers and businesses compete to construct AI-ready data centers, power generation, utility interconnections, and support infrastructure, demand is booming. Primoris is positioning itself as a background facilitator of the cycle, with $1.7 billion of potential data center projects already in the pipeline. That “stealth” status puts the company in play for one of the biggest secular investment cycles of the decade.

About PRIM Stock

Primoris Services is a prominent specialty contractor to the utility, energy, and industrial infrastructure markets. It is headquartered in Dallas, Texas, and has a market value of approximately $6 billion. It has a presence in the United States and constructs and maintains vital infrastructure for power, pipelines, refineries, and renewable energy facilities.

Shares of PRIM rose from a 52-week low of $48.33 to a recent high of $118.31, an increase of over 112% in the last 52-week period. So far this year, the stock has risen over 50%, significantly outperforming the S&P 500 Index ($SPX), which has increased by nearly 25% over the same period.

On a valuation basis, PRIM has a trailing and forward price-to-earnings (P/E) multiple of 23.8 and 25.8, respectively, putting it slightly above-average construction and engineering peers. It has a price-to-sales (P/S) multiple of 0.97, which translates to a reasonable valuation from a sales perspective, and an 18.3% return on equity, indicating efficient capital deployment. It has moderate leverage, with a debt-to-equity of 0.39. Not only that, but it has a solid balance sheet to sustain growth initiatives in the coming times.

In particular, Primoris is not a dividend-driven stock, and earnings are rather reinvested to expand in the areas of energy, utility, and data centers.

Primoris Services Beats Earnings Estimates

Primoris's second-quarter 2025 revenues reached $1.89 billion, a 20.9% increase from prior-year levels, surpassing Wall Street estimates by a significant margin. Net income rose to $84.3 million, or $1.54 per diluted share, from $0.91 in the prior-year period. Adjusted EPS of $1.68 similarly exceeded consensus estimates by a wide margin. Adjusted EBITDA was 32% higher at $154.8 million, reflecting solid performance by the Energy and Utilities segments.

Management increased full-year 2025 guidance, expecting EPS of $4.40–$4.60 and adjusted EPS of $4.90–$5.10. That guidance implies earnings growth of around 27%–32% compared to 2024, highlighting optimism around continued demand in its core markets.

Crucially, interim CEO David King emphasized that, while less than 10% of the company's revenue currently ties directly to data centers, it has identified $1.7 billion of potential projects. Of that, $400 million to $500 million is already shortlisted. King added that this opportunity could last for a decade or longer, reflecting how AI-driven demand for power and fiber networks aligns perfectly with Primoris’ capabilities.

The company’s proven history in utility-scale solar and natural gas generation provides additional growth levers, so it can address both traditional and new energy needs.

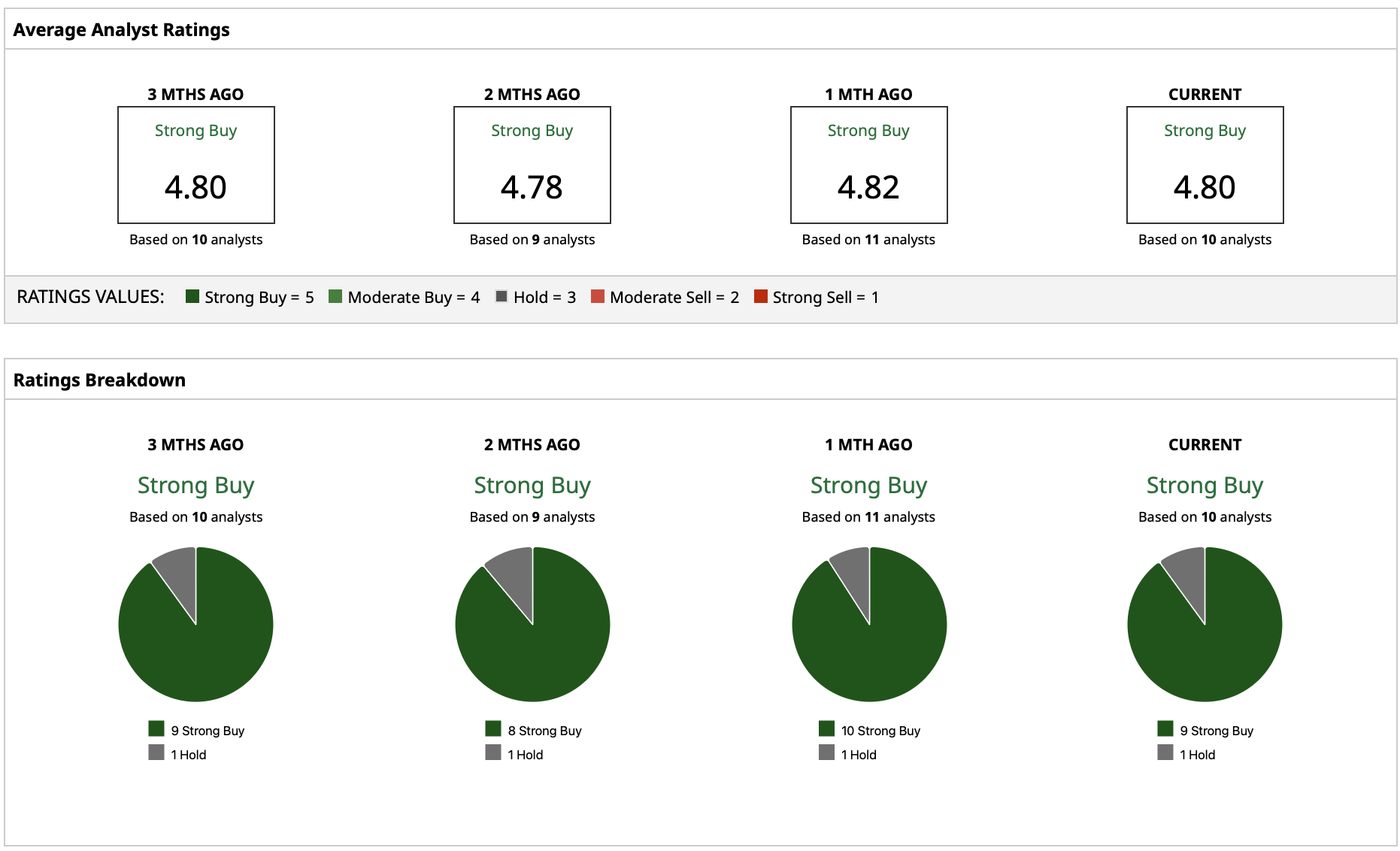

What Do Analysts Expect for Primoris Stock?

The Street remains bullish on PRIM shares, with a “Strong Buy” rating consensus. The current analyst target stands at $111.11, just below current levels, but the Street-high target of $135 still bodes upside potential. Based on the current share price of approximately $116, that high target represents 16% potential upside. Nevertheless, the low target of $67 includes the cyclical risk of construction activity.