/The%20front%20of%20a%20Rocket%20Lab%20corporate%20office%20by%20Emagnetic%20via%20Shutterstock.jpg)

Space stocks are names that often capture investors’ imaginations—there's something romantic about exploring beyond Earth’s atmosphere. For more practical investors, the innovative nature of companies working to blast into outer space can provide some compelling returns—particularly if the company can secure governmental contracts and ensure a consistent stream of profits.

One interesting name in space stocks right now is Rocket Lab (RKLB), which has made more than a dozen successful launches this year and just signed a new contract with the Japan Aerospace Exploration Agency.

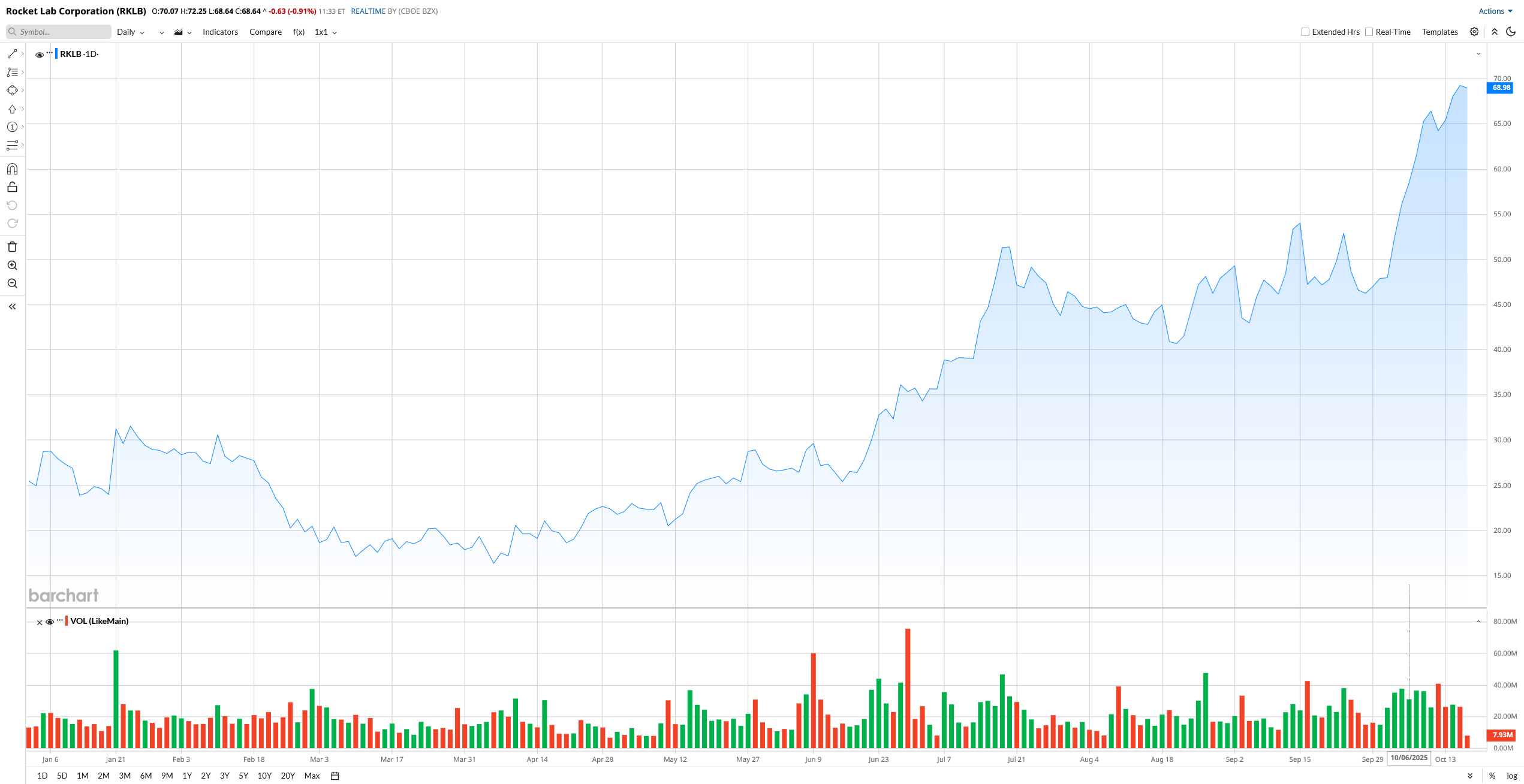

RKLB stock is taking off like, well, a rocket in recent days, up 47% in the last month alone. Is it a good investment now?

About Rocket Lab Stock

Rocket Lab, based in Long Beach, California, offers launch services and conducts space launches primarily in the U.S., Canada, and Japan. The company also provides spacecraft, satellite components, and in-orbit management to serve as an end-to-end space company.

The company, which has a market capitalization of $33 billion, offers what it calls launch-on-demand services, including three launch pads and 132 annual launch slots. “Choose your orbit, your rocket, your launch schedule, and your launch site,” the company promises on its website. “You’re in control.”

The company has conducted 73 launches with its Electron two-stage partially reusable launch vehicle, deploying 239 satellites around Earth. It's developing a medium-lift vehicle, called Neutron, to carry larger payloads.

Shares have soared this year, up 183% on a year-to-date (YTD) basis, by far outdistancing the Nasdaq Composite ($NASX), which is up just 18% in 2025.

The company is not yet turning a profit, but its price-to-sales ratio of 52.5 is frothy—investors are paying $52.50 for every dollar of revenue the company makes. Wall Street obviously has high hopes for Rocket Lab stock.

Rocket Lab Misses on Earnings

Rocket Lab's second-quarter earnings showed $145 million in revenue, up a whopping 36% from a year ago. And while the company increased its gross profit from $27.6 million a year ago to $46.4 million, operating expenses surged from $70.4 million to $106 million. In all, Rocket Lab posted a loss for the quarter of $59.6 million, an increase from $43.2 million a year ago. The loss of $0.13 per share was worse than the $0.11 EPS loss that analysts predicted.

The company completed its $330 million acquisition of Geost, a payload manufacturer whose technology is used in U.S. national security missions. CEO Sir Peter Beck said the company is “strongly positioning ourselves to meet the needs of defense initiatives like the Golden Dome with end-to-end mission solutions across launch, spacecraft – and now payloads. We’re confident our strategic investments will drive new growth opportunities that will drive us toward long-term profitability, particularly as we guide toward another potential record quarter for Q3.”

Third-quarter guidance calls for Rocket Lab to post revenue between $145 million and $155 million and an adjusted EBITDA loss between $21 million and $23 million. A year ago, Rocket Lab’s Q3 had revenue of $104.8 million and a loss of $51.9 million.

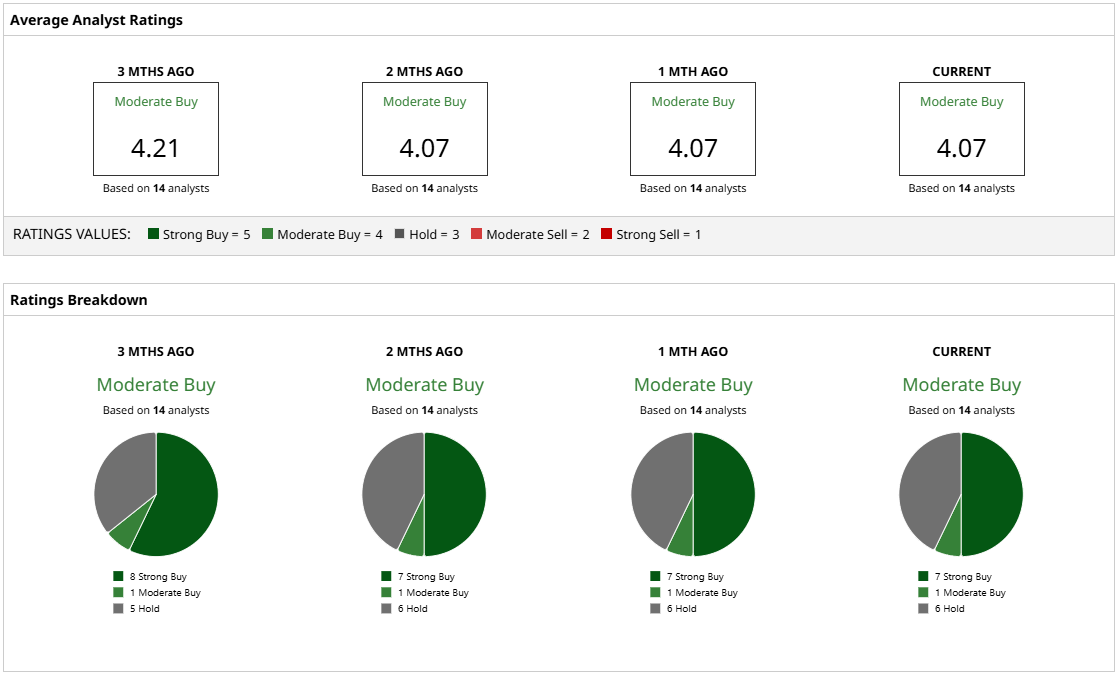

What Do Analysts Expect for RKLB Stock?

Analysts are generally bullish on RKLB stock, but with a caveat—the stock’s price has jumped so much in the last year that the current stock price is just about above the highest analyst price target. RKLB stock has a 52-week range from $9.98 to $73.50 and is currently trading extremely close to the top of that range.

Fourteen analysts who currently cover the stock view it positively, with seven ranking it a “Strong Buy” and one as a “Moderate Buy.” The remaining six analysts recommend holding. The analysts have a mean price target of $54.18 on RKLB stock, with the high target being just $68.

RKLB stock is a compelling play on the space industry. Rather than building vanity projects like Virgin Galactic (SPCE), Rocket Lab is actually creating the infrastructure needed for companies and governments to get into orbit. The company’s high valuation makes buying a risk, however, and any slowing in the company’s revenue growth will likely cause the stock price to fall back to earth.