Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

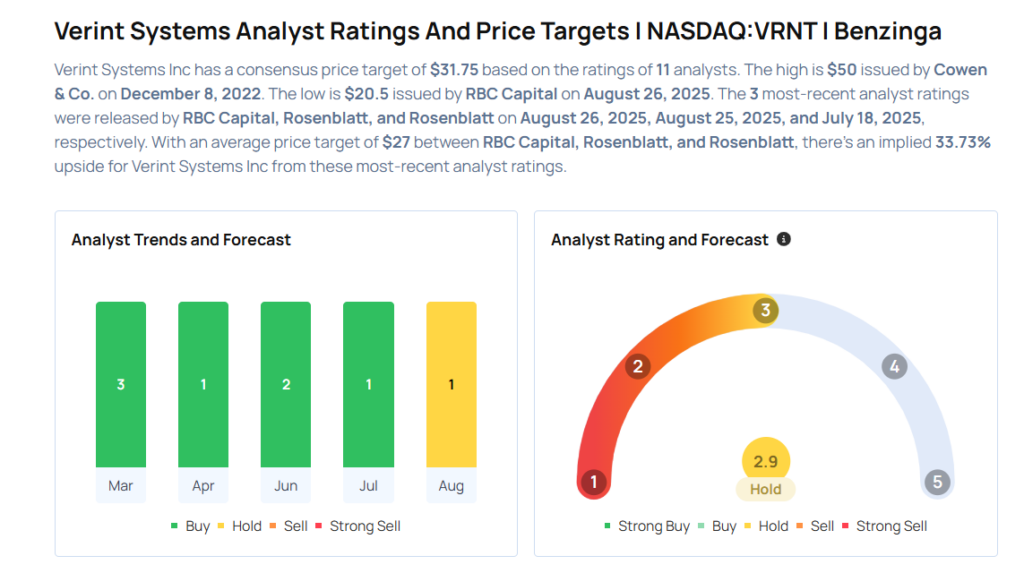

- RBC Capital analyst Dan Bergstrom downgraded the rating for Verint Systems Inc. (NASDAQ:VRNT) from Outperform to Sector Perform and cut the price target from $29 to $20.5. Verint shares closed at $20.20 on Monday. See how other analysts view this stock.

- Citigroup analyst Vikram Bagri downgraded Generac Holdings Inc. (NYSE:GNRC) from Buy to Neutral but raised the price target from $138 to $219. Generac shares closed at $193.28 on Monday. See how other analysts view this stock.

- Seaport Global analyst Mitch Kummetz downgraded the rating for Shoe Carnival, Inc. (NASDAQ:SCVL) from Buy to Neutral. Shoe Carnival shares closed at $22.34 on Monday. See how other analysts view this stock.

- HSBC analyst Sorabh Daga downgraded Keurig Dr Pepper Inc. (NASDAQ:KDP) from Buy to Hold and lowered the price target from $42 to $30. Keurig Dr Pepper shares closed at $31.10 on Monday. See how other analysts view this stock.

- Argus Research analyst John Staszak downgraded the rating for Skechers U.S.A., Inc. (NYSE:SKX) from Buy to Hold and maintained the price target of $63. Skechers shares closed at $63.00 on Monday. See how other analysts view this stock.