The satellite economy is accelerating, with low Earth orbit (LEO) activity projected to hit $11.81 billion in 2025 and expected to nearly double to $20.69 billion by 2030 at an annual growth rate of 11.9%. That growth is being driven by demand for high-resolution Earth data, demand for real-time analytics, and cheaper, faster launch cycles.

No company captures that energy more than Planet Labs (PL). Its stock has nearly tripled in 2025, up about 460% over the past 52 weeks, with Wall Street indicating there is still more gas in the tank as execution improves.

In its latest quarterly report, Planet Labs posted 20% year-over-year (YoY) revenue growth and notched a record $73.4 million in sales, fueled by its recently signed expansion plans into Berlin and a strengthening government portfolio.

With the stock sprinting ahead of peers, can Planet sustain this breakout as competition intensifies, or is a breather due next? Let’s find out.

Planet Lab’s Financials Signal Strength

Specializing in daily Earth data and intelligence, Planet Labs delivers actionable imagery and analytics for governments, researchers, and corporations worldwide. PL stock is up 214% year-to-date (YTD), 467% over the past 52 weeks, and the current price is $12.81. The stock does not pay a dividend at this time.

This $3.67 billion company commands a price-to-sales (P/S) multiple of 15.07x and a price-to-book (P/B) of 7.87x, well above the sector medians of 1.67x and 3.25x, reflecting investor willingness to pay up for growth compared to peers.

The most recent earnings report was released in September 2025, covering the quarter ended July 31, 2025. This quarter, revenue increased 20% YoY, reaching a record $73.4 million. It is the highest figure recorded, and that strength reveals robust customer demand.

The percentage of recurring annual contract value stood at a firm 98%. This shows a solid revenue base that gives the company predictability. The gross margin reached 58%, compared to 53% in the prior year’s second quarter.

Non-GAAP gross margin came in higher at 61%, up from 58% last year. This underscores efficiency gains and cost discipline. The net loss narrowed to ($22.6) million, beating last year’s ($38.7) million. This progress coincides with the company hitting positive adjusted EBITDA of $6.4 million versus a year-ago ($4.4) million loss.

The GAAP net loss per share for the quarter was ($0.07), exceeding the consensus expectation by $0.01 and delivering a 12.5% positive surprise. Non-GAAP net loss per share was reported at ($0.03). YTD net cash provided by operations reached $85.1 million. This is paired with a free cash flow of $54.3 million so far this year.

The quarter ended with $271.5 million in cash, cash equivalents, and short-term investments on hand, supporting continued innovation and expansion. The company’s leadership credits performance to surging demand from key contracts, including the German government, NATO, and the U.S. Department of Defense.

PL’s Expanding Horizons

Planet Labs continues to advance its reach in satellite manufacturing and intelligence. The company recently unveiled plans to open a new state-of-the-art satellite manufacturing facility in Berlin as it aims to double its Pelican satellite production capacity and strengthen its presence in Europe. This location will focus on building high-resolution Pelican satellites designed to meet the fast-growing demands from European clients.

The move will also bring 70 new jobs to the Berlin headquarters and add to an already robust 150-person staff. The group’s parent entity remains based in San Francisco. With satellite production lines operating in both regions, Planet gains the flexibility needed to deliver advanced earth observation capabilities at scale.

The Berlin expansion follows Planet’s global success in deploying over 650 satellites. The Pelican-3 and Pelican-4 satellites were shipped to Vandenberg Space Force Base, ready for launch aboard SpaceX’s Falcon 9. The fully operational production facility demonstrates the company's ability to manufacture and prepare satellites with speed. This capability is a key factor in maintaining momentum and staying competitive.

The release of first light images from Pelican-3 over Turin, Italy, taken at an altitude of 458 kilometers, marks another milestone. These images showcase a continued focus on data quality and innovation as calibration progresses. The anniversary of Tanager-1’s first images was celebrated with a new milestone. Customers now have the option to purchase core imagery for earth and atmospheric analysis, plus a Methane Quicklook product enabled by a partnership with Carbon Mapper.

Expert Endorsements Lift Outlook

Analyst expectations set the tone for the next leg in PL’s story, and the near-term scorecard is clearly defined. For the current quarter ending October 2025, the consensus estimate calls for a loss of $0.07 per share, unchanged from the prior year period. The following quarter, ending January 2026, shows more optimism with an expected loss of $0.09 per share. This represents a 25% improvement from the prior year's $0.12 loss.

Looking at the full fiscal year ending January 2026, analysts project a loss of $0.29 per share versus $0.42 the previous year. This translates to an impressive 30.95% improvement YoY, highlighting the path toward profitability that has Wall Street excited.

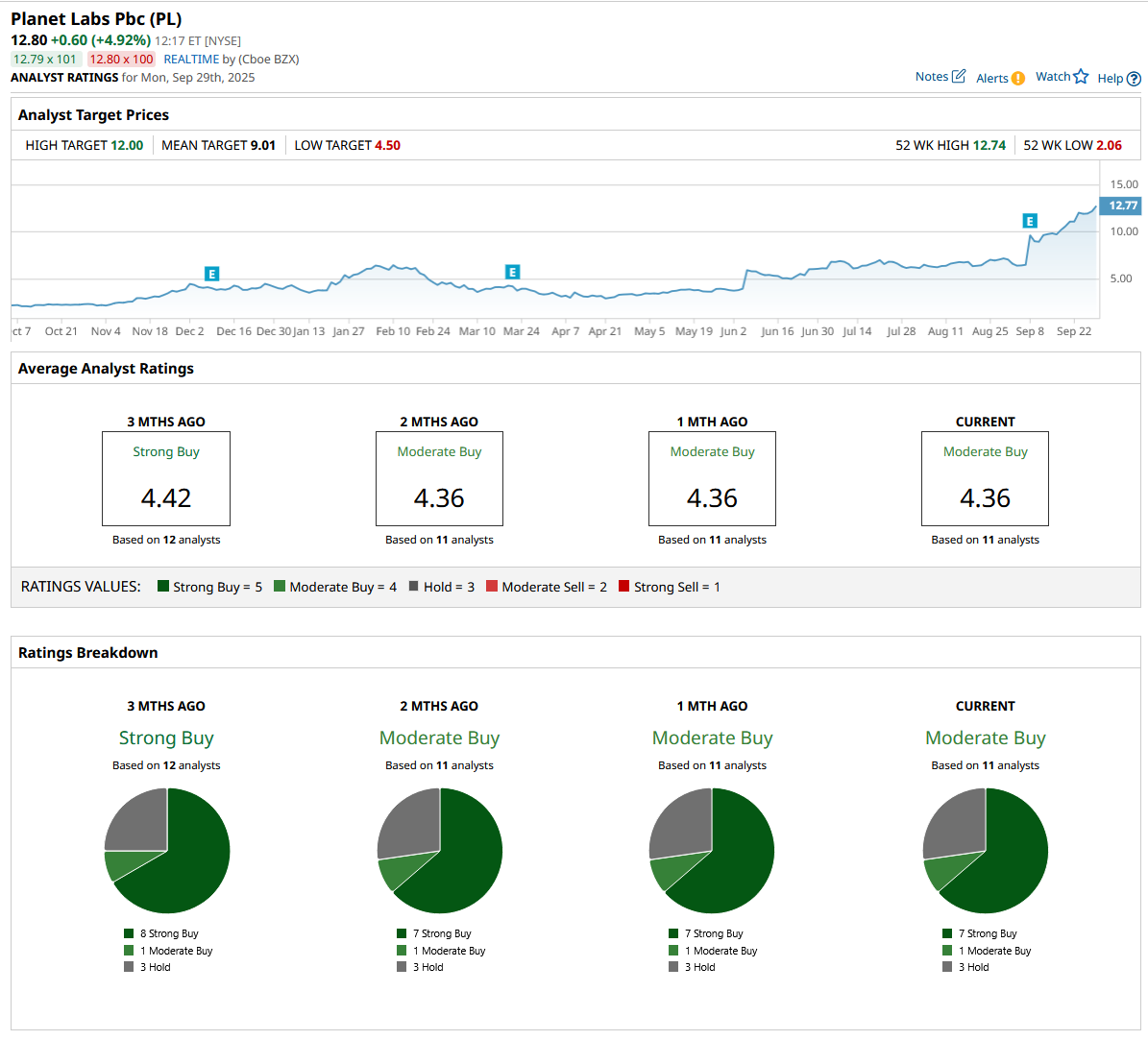

That setup flows directly into sentiment, which remains constructive after a 2025 rally that has stretched valuations. The 11 surveyed analysts maintain a consensus "Moderate Buy" rating, reflecting widespread confidence despite PL stock's meteoric rise. The average price target sits at $8.96, which actually implies a 25.08% downside from the current price point.

So, can Planet Labs maintain its impressive rally? The evidence suggests yes, but with important caveats. The company's fundamentals are undeniably strong, with revenue surging, margins expanding, and losses narrowing on a clear path toward profitability by fiscal 2026. The Berlin expansion positions PL perfectly to capitalize on massive European demand.