Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

- JP Morgan analyst Anupam Rama upgraded Sarepta Therapeutics, Inc. (NASDAQ:SRPT) from Underweight to Neutral and announced a $24 price target. Sarepta Therapeutics shares closed at $13.86 on Monday. See how other analysts view this stock.

- B of A Securities analyst Andrew Obin upgraded Allegion plc (NYSE:ALLE) from Underperform to Neutral and raised the price target from $110 to $175. Allegion shares closed at $163.67 on Monday. See how other analysts view this stock.

- Macquarie analyst Tao Qiu upgraded the rating for Healthcare Services Group, Inc. (NASDAQ:HCSG) from Neutral to Outperform and boosted the price target from $15 to $16. Healthcare Services Group shares closed at $13.25 on Monday. See how other analysts view this stock.

- Raymond James analyst Alexander Sklar upgraded BlackLine, Inc. (NASDAQ:BL) from Market Perform to Outperform and announced a $67 price target. BlackLine shares closed at $55.70 on Monday. See how other analysts view this stock.

- Citigroup analyst Leandro Bastos upgraded Afya Limited (NASDAQ:AFYA) from Sell to Neutral and lowered the price target from $16 to $14. Afya shares closed at $13.83 on Monday. See how other analysts view this stock.

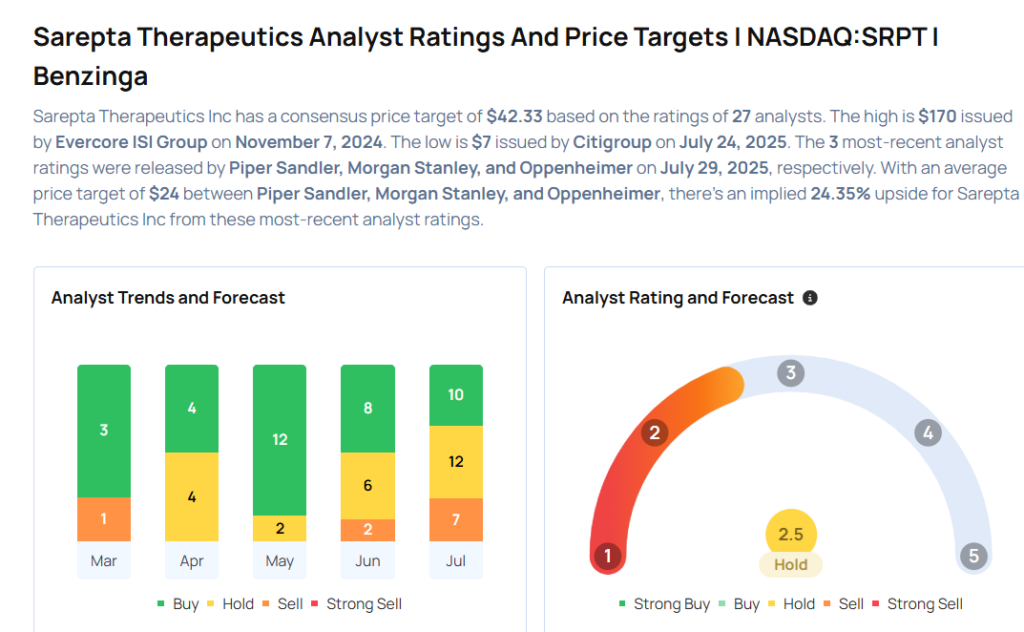

Considering buying SRPT stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock