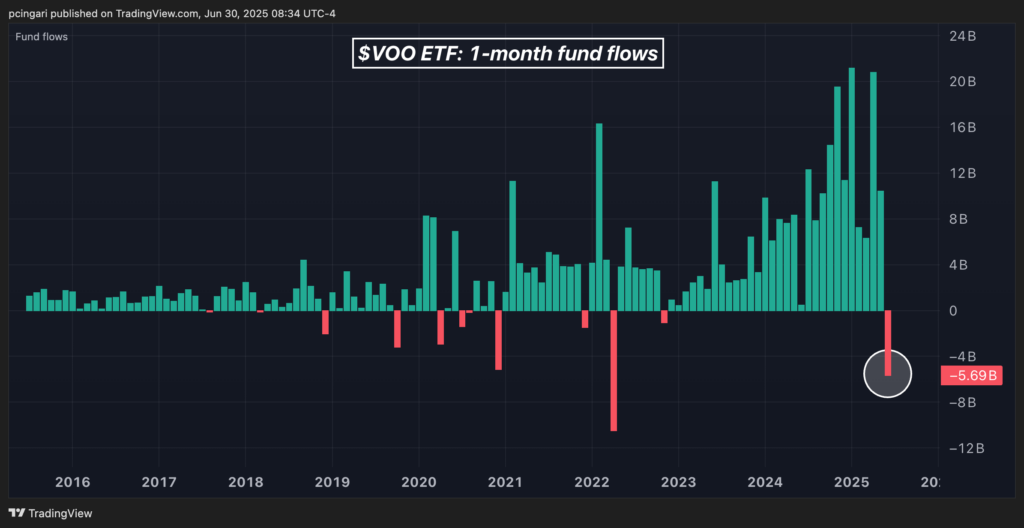

A historic inflow streak into the world’s biggest exchange traded fund has come to a sudden end in June, with the S&P 500 benchmark fund losing billions even as Wall Street celebrated fresh record highs.

The Vanguard S&P 500 ETF (NYSE:VOO) saw $5.69 billion in outflows during the month, marking its first monthly net redemption since December 2022 and the second-largest outflow since the fund's launch in 2015.

The redemptions signal a notable divergence between market performance and investor behavior. The S&P 500 reached new all-time highs in late June, yet large swaths of institutional and retail investors opted to take profits and reduce exposure.

Over the three years leading up to June 2025, the VOO ETF attracted $250 billion in inflows, overtaking the SPDR S&P 500 ETF Trust (NYSE:SPY) to become the world's largest ETF.

Broad-Based Redemptions Across Some Large-Cap ETFs

The outflows from Vanguard's S&P 500 ETF were far from an isolated case, as other major large-cap funds also saw significant investor withdrawals.

The Invesco Equal-Weight S&P 500 ETF (NYSE:RSP) shed $1.6 billion in June, marking its steepest monthly outflow since March 2020.

Meanwhile, the SPDR Dow Jones Industrial Average ETF (NYSE:DIA) posted $1.7 billion in redemptions, its largest since December 2020.

Even the Roundhill Magnificent Seven ETF (CBOE: MAGS), a relatively new fund focused on mega-cap tech names, saw $102 million in outflows—only the second monthly decline in assets since its debut in November 2023.

Why Are Investors Pulling Back Amid Record Highs?

Veteran Market strategist Ed Yardeni said investor sentiment remains cautious, despite easing geopolitical concerns and progress on trade policy under President Donald Trump.

"Though the stock market is back on record-high ground after a couple of big worries have dissipated, investors remain wary, sentiment readings show," Yardeni said in a note on Monday.

Yardeni highlighted the ceasefire in the 12-day conflict between Israel and Iran and improved outlooks regarding Trump’s proposed trade policies, yet noted that traditional sentiment indicators like the AAII Bull-Bear Ratio and Investor Intelligence surveys remain subdued.

"Stock investors always find something to worry about," Yardeni said.

In Yardeni's view, the disconnect between price action and sentiment could suggest that a large portion of the current rally is being driven by passive or algorithmic flows, rather than broad-based investor enthusiasm.

Technical Strength vs. Macro Uncertainty

On the technical front, Adam Turnquist, chief technical strategist at LPL Financial, recently indicated that historical patterns suggest momentum tends to continue after a market reaches new highs.

According to Turnquist’s analysis, after reaching new highs, the S&P 500 posted average and median 12-month returns of 9.7% and 8.6%, respectively. Notably, 74% of those occurrences led to positive performance over the following year.

Still, Turnquist flagged macro risks that could limit further gains.

"A lot of good news is arguably priced into the market," he said.

Further upside in equities, Turnquist added, will likely hinge on several variables aligning: upside earnings surprises, lower-than-expected tariff levels, passage of Trump's "Big Beautiful Bill" with limited market disruptions, and ideally, a moderation in interest rates on the longer end of the yield curve.

Read Next:

Photo: Shutterstock