/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

Autonomous mobility business Pony AI (PONY) announced that it has been granted a permit by Dubai’s Roads and Transport Authority (RTA), which permits it to conduct autonomous driving trials. This news builds upon a partnership forged with RTA earlier this year.

This news marks a significant win for the company, which aims to strengthen its position in the Middle East, as it is expected to pave the way for commercial deployment. The company has begun pilot testing in select areas, and the service is scheduled for commercial launch in 2026, eliminating the need for a driver.

PONY stock has been on an uptrend recently, and the permit news is expected to support it further. With this possible catalyst, should you consider investing in shares now?

About Pony AI Stock

Pony AI is a leading company specializing in the development of advanced autonomous driving technologies for various applications, including passenger vehicles and logistics. Since its founding in 2016, it has created a comprehensive AI-powered system that supports fully driverless robotaxi and robotruck services, as well as solutions for personally owned vehicles.

The company has achieved large-scale real-world deployments in multiple cities across China, demonstrating reliable autonomous mobility. Pony AI’s vision centers on making autonomous driving accessible for daily travel and commercial use. The company has a market capitalization of $7.7 billion.

Pony AI had a successful debut on the Nasdaq following its initial public offering (IPO) in late 2024. The company's depositary shares opened at $15 in their debut, higher than the IPO price of $13.

With robust investor enthusiasm and analyst sentiments, Pony AI’s stock has been surging this year. PONY stock is up 56% year-to-date (YTD), and it has increased by 50% over the past month. The stock reached a high of $24.92 on Oct. 2, but is now down 16% from that high.

PONY stock currently trades at an eye-watering valuation. Its price-to-sales (P/S) ratio sits at 109 times, which is considerably higher than the industry average.

Pony AI’s Robotaxi Revenues More Than Doubled In Q2

On Aug. 12, Pony AI reported significant strides in its operations for the second quarter of fiscal 2025. The company reported that since mass production started, over 200 Gen-7 robotaxi vehicles have been rolled out. Pony AI posits that this puts it on track to achieve its year-end target of rolling out 1,000 vehicles.

The company’s overall topline increased 76% year-over-year (YOY) to $21.46 million. This was based upon its robotaxi revenues growing by 158% from the prior-year period to $1.5 million due to increasing adoption among users, expanding demand in Tier 1 cities, and heightened robotaxi deployment. Moreover, Pony AI’s licensing and application revenues were $10.4 million, reflecting a considerable 900%-plus YOY increase.

Pony AI’s net loss has also deepened during this period. Net loss grew from $30.9 million in Q2 2024 to $53.3 million in Q2 2025. On a non-GAAP basis, net loss grew from $30.3 million to $46.1 million over the same period.

The company also highlighted its growing presence in the Middle East and South Korea, as well as its ongoing progress in Luxembourg. For the current year, Wall Street analysts are optimistic about Pony AI’s ability to reduce its losses. Loss per share is expected to decline by 77% YOY to $0.57 in fiscal 2025.

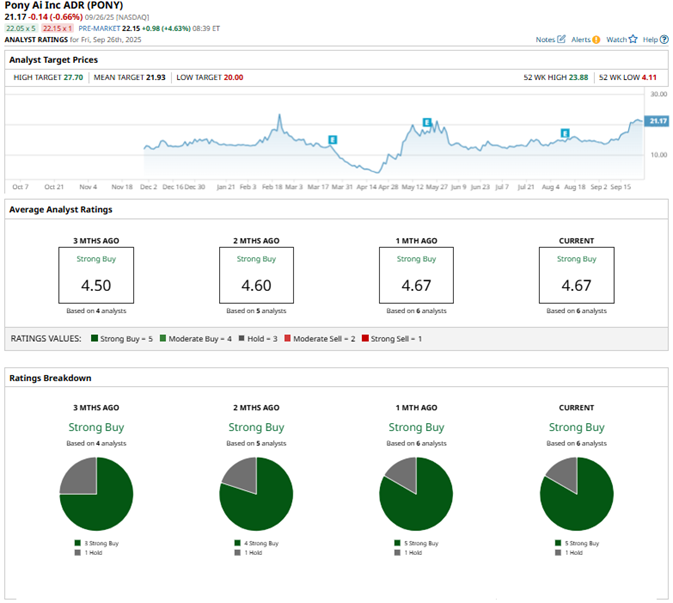

What Do Analysts Think About Pony AI’s Stock?

A plethora of Wall Street analysts have initiated coverage on Pony AI with bullish ratings. Recently, Citi analyst Jeff Chung initiated coverage with a “Buy” rating and $29 price target. Citi believes that the robotaxi sector is at an “inflection point,” with penetration expectedly to grow from 0.1% in 2025 to 9% in 2030 and 30% in 2035 in China.

In August, UBS also initiated coverage on Pony AI with a “Buy” rating and $20 price target. Analysts noted that the company is the only robotaxi firm to have started commercial fee-charging and driverless robotaxi operations in all four Tier 1 cities in China.

Wall Street analysts are robustly bullish on PONY stock, with a consensus “Strong Buy” rating overall. Of the seven analysts rating the stock, six give a “Strong Buy” rating while one analyst gives a “Hold” rating. The consensus price target of $24.06 represents 15% potential upside from current levels. Meanwhile, the Street-high price target of $31.30 indicates 50% potential upside from current levels.

Key Takeaways

Wall Street analysts are highly optimistic about Pony AI’s prospects. The company is venturing into new markets, and the commercial rollout of its robotaxis seems to be well on track. Therefore, with persistent bullish sentiments, it may be wise to consider buying PONY stock.