A Republican lawmaker is facing scrutiny after selling shares in Medicaid provider Centene Corp. (NYSE:CNC) just days before voting to advance legislation that included significant cuts to Medicaid.

Check out the current price of CNC stock here.

What Happened: On Thursday, popular X account, Nancy Pelosi Stock Tracker, which tracks the stock market trades of political leaders, shared a snippet of a recent episode of The Joe Rogan Experience, featuring Democratic Texas Rep. James Talarico.

In the episode, Talarico calls out insider trading by politicians, citing the recent example of a Congressman who sold his entire stake in a medicaid company, right before the “Big, Beautiful Bill” passed.

See Also: Healthcare’s 2025 Stock Crash Could Be A 2030 Windfall

According to the post, the Congressman in question is Rep. Rob Bresnahan (R-PA), who sold his stake in Centene on 14 May. “A couple [of] days after he sold, he then voted to advance the ‘Big, Beautiful Bill,’ which included cuts to Medicaid,” it says.

The timing of the sale has reignited concerns over lawmakers trading stocks in industries directly impacted by their votes. “So a sitting Politician sells stock in a Medicaid company just a couple [of] days before voting on a bill where he may have known it would crater Medicaid stocks. Unreal,” the post says.

In the video, Joe Rogan states that while former Speaker Nancy Pelosi is used as a poster child for insider trading, elected representatives on both sides of the aisle actively indulge in it.

Why It Matters: Since Bresnahan sold his stake in the company, Centene’s shares have cratered by over 55%, plunging 40% in a single day in early July after pulling its guidance citing an unfavorable actuarial report.

Economist Justin Wolfers calls it “simply absurd” that representatives are allowed to trade stocks while receiving “top-secret briefings” and information all the time.

Benzinga has reached out to Rep. Bresnahan for a statement. The story will be updated after we receive a response.

As Rogan says, while Pelosi’s investments have outperformed several leading hedge funds, with gains of 65% in 2023 and 54% in 2024, they still pale in comparison to her colleagues, who’ve returned anywhere between 70% and 149% over the past year.

Price Action: Centene shares were down 9.04% on Thursday, trading at $26.76, but are up 0.88% after hours.

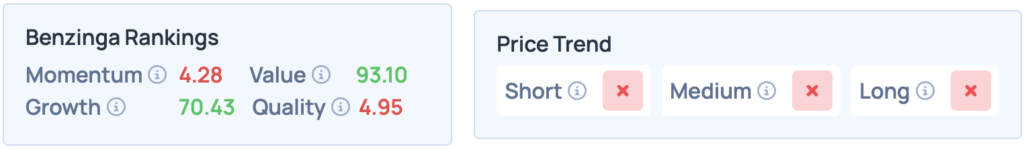

According to Benzinga’s Edge Stock Rankings, Centene scores high on Growth and Value, but has an unfavorable price trend in the short, medium and long term. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: JHVEPhoto / Shutterstock.com