Curaleaf (CURLF) has been one of the big beneficiaries of the latest cannabis fervor. CURLF stock has climbed roughly 80% year to date and up more than 230% over the past three months as traders price in a possible federal rescheduling tailwind and the company’s steady push to stabilize operations.

Curaleaf consistently stands out for investors tracking multi-state operators (MSOs). Its expansive U.S. retail footprint, broad product lineup, and growing international presence position it as a top pick when policy risks begin to ease and speculative capital flows back into the sector.

About CURLF Stock

Valued at $1.7 billion by market cap, Curaleaf runs one of the largest U.S. dispensary networks and sells a broad array of consumer-facing cannabis products, flower, vapes, edibles and hemp-derived beverages. The company has been working through what management calls a “domestic stabilization” plan: trimming overhead, focusing stores on profitability, and leaning into higher-margin branded products. That combination of scale and product reach is exactly what traders want to own if federal policy moves to reduce cannabis’ legal friction.

On paper, CURLF's valuation appears attractive. Its price/sales (P/S) ratio of 1.5 is notably below the sector median of 3.5, suggesting a more affordable stock compared to its peers.

Dispensaries Drive Growth

Curaleaf isn’t just riding headlines. It’s opening stores and expanding distribution for branded products. The company operates roughly 150+ U.S. dispensaries and has been rolling out consumer products into non-dispensary channels, notably placing hemp-derived seltzers and other items into mainstream retail.

Those distribution moves test whether Curaleaf can build CPG-like reach beyond the regulated dispensary channel, a potential multiplier if federal rules loosen. Internationally, Curaleaf is consolidating ownership in key markets and preparing for scaled launches abroad, which could add higher-margin revenue over time.

Curaleaf’s Tops Q2 Earnings Estimate

Earlier this month, Curaleaf reported its Q2 earnings, which came above expectations and showed signs of stabilization, but also reminded investors that the business isn’t out of the woods. Q2 revenue came in at $314.5 million, down about 8% year-over-year, but gross margin expanded to roughly 49% and adjusted EBITDA landed around $65–66 million on a 21% margin. Curaleaf has reported an increase in international cannabis sales, with a 74% rise year-over-year (YOY) in Q1 2025, highlighting robust growth in international markets like Germany and the UK.

On an adjusted basis, the company still reported a net loss of $0.06 or $50.6 million, so the road to consistent profitability continues.

Turning to the balance sheet, operating cash flow for the first half was positive about $51 million, but Curaleaf carries meaningful net debt, with cash of roughly $102 million against net debt north of $500 million.

So we can say that the margins are improving, cash flow is moving in the right direction, but leverage and GAAP losses keep risk elevated.

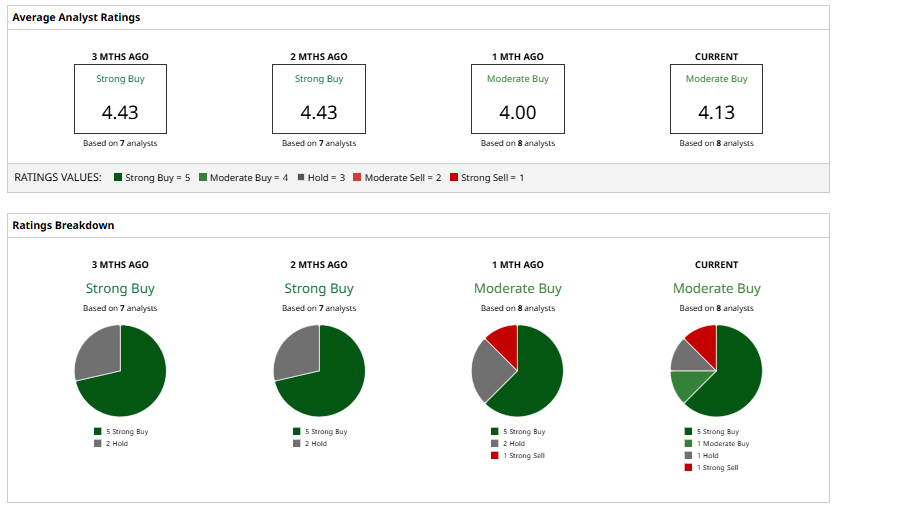

What Do Analysts Say About CURLF Stock

Turning to Wall Street, analysts seem fairly upbeat on CURLF stock, tagging it as a “Moderate Buy.” Of the eight analysts Barchart covered, five call it a “Strong Buy,” one echoes the “Moderate Buy” view, one recommends a “Hold,” and one flags a “Strong Sell.” With a 12‑month average target of $3, there’s still over 13% upside potential from current levels.