Shares of NioCorp (NB) and other U.S. rare earth miners continue to gain momentum as the Trump administration doubles down on building a domestic supply chain independent from China. Analysts remain bullish, with some rare earth stocks trading well below their price targets as government support intensifies. The sector jumped after Trump and Australian Prime Minister Anthony Albanese signed an agreement to invest in joint ventures for critical minerals and rare earths.

Treasury Secretary Scott Bessent announced the administration will set price floors for rare earths to combat alleged Chinese market manipulation, similar to the unprecedented deal struck with MP Materials (MP) in July that included an equity stake, price floor, and offtake agreement.

China's recent export restrictions have accelerated Washington's urgency. Beijing now requires licenses to export products containing just 0.1% rare earths and imposed controls on extraction technology and equipment. The restrictions expand to five additional rare earth elements, which provides China enormous leverage in trade negotiations.

Investors are betting the administration will replicate the MP Materials playbook with additional miners. William Blair initiated coverage on USA Rare Earth (USAR) with an “Outperform” rating, expecting Trump could take a material stake soon. The White House has already invested in Lithium Americas (LAC) and Trilogy Metals (TMQ), fueling speculation about which company comes next.

J.P. Morgan Chase (JPM) also committed up to $10 billion in critical minerals investments through direct equity stakes and venture capital. CEO Jamie Dimon warned the U.S. has become dangerously reliant on unreliable sources for materials essential to national security. The Defense Department is rushing to stockpile $1 billion worth of critical minerals.

Is NB a Good Stock to Buy Right Now?

NioCorp is positioning itself as a critical player in America's push to break free from Chinese dominance in rare earths and strategic minerals. The Nebraska-based company is racing toward construction of its fully permitted Elk Creek facility, which would produce niobium, scandium, titanium, and magnetic rare earth oxides, including the crucial heavy rare earths dysprosium and terbium. The U.S. currently produces none of these materials domestically.

The Trump administration's aggressive stance on critical minerals has created powerful tailwinds for NioCorp. CEO Mark Smith reports that critical strategic minerals are now the top priority across the White House, Congress, and federal agencies.

NioCorp raised $212.5 million in 2025 and maintains zero debt on its balance sheet. The company is working through final requirements for a $780 million loan from the U.S. Export-Import Bank, including upgrading reserves from probable to proven status through ongoing drilling programs. The U.K. Export Finance group offered up to $200 million in loan guarantees, and Germany's program could add another $200 million. These would reduce EXIM's exposure while keeping total debt at $780 million.

NioCorp requires $420 million in equity financing to complete the $1.2 billion project. Smith confirms discussions with major institutional funds are progressing, though the company is pursuing multiple financing paths simultaneously. A $10 million Defense Department grant remains pending after DOGE audits delayed final approval.

NioCorp's demonstration plant achieved exceptional recovery rates for all minerals using an integrated hydrometallurgical process. The miner is finishing feasibility study updates, including the rare earths, and expects results before year's end.

China's April export ban on heavy rare earths has intensified urgency, with European manufacturers already shutting down production lines. NioCorp's three-year construction timeline positions it to start production by the decade's end.

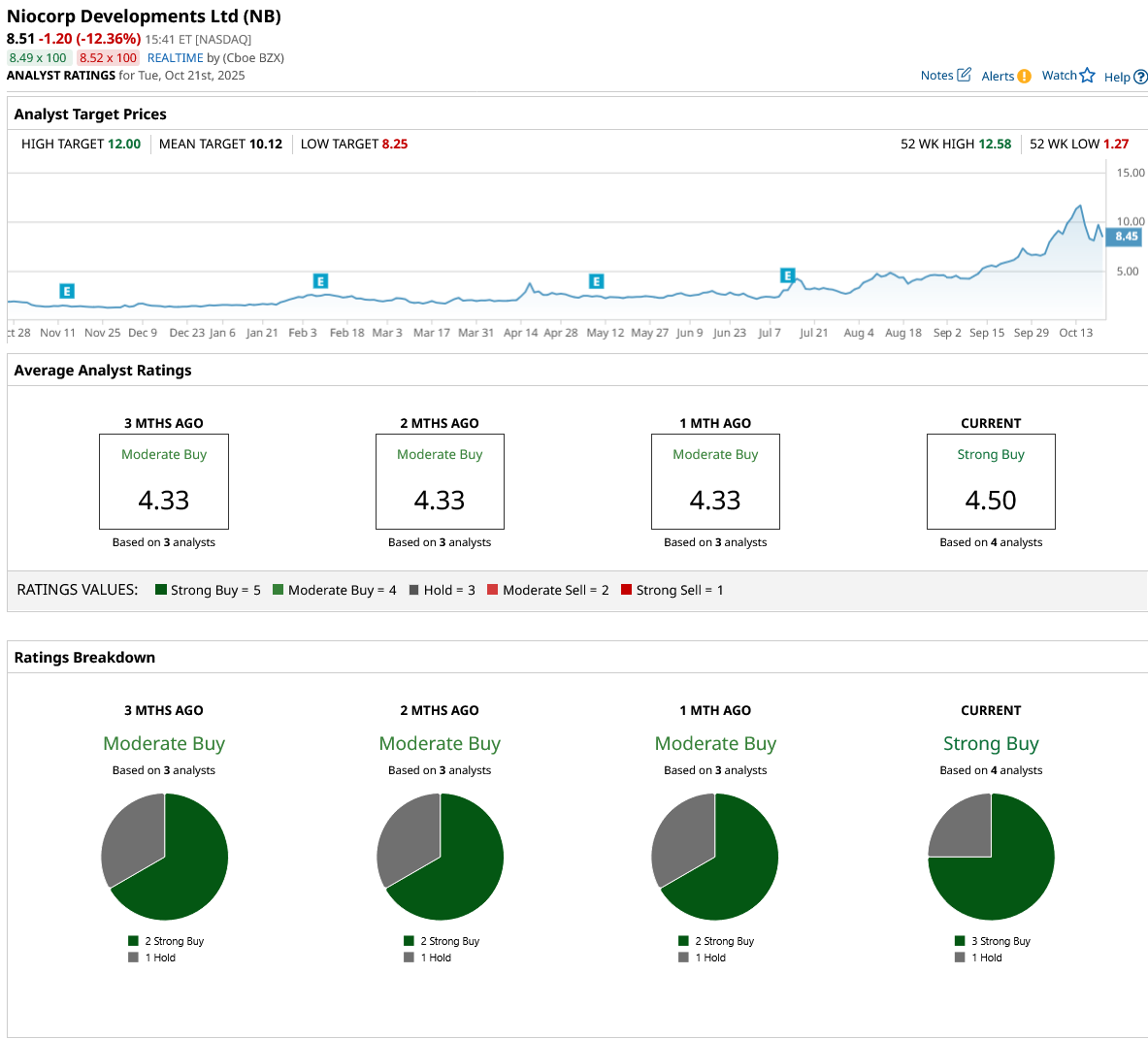

Analysts Take on NB Stock

NioCorp shares surged nearly 20% in recent sessions but dipped 12% today, while analysts believe the stock offers roughly 20% upside from current levels as government backing materializes. Out of the four analysts covering NB stock, three recommend “Strong Buy,” and one recommends “Hold.” The average NB stock price target is $10.12 above the current price of $8.51. The high target of $12 suggests it could gain as much as 40% from here.