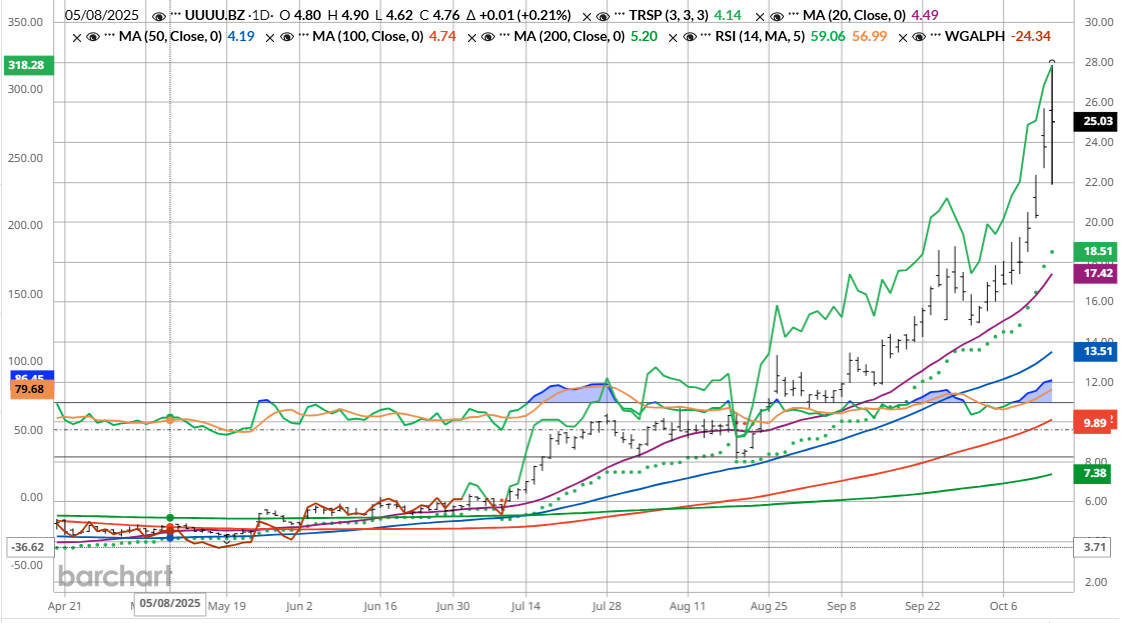

- Energy Fuels (UUUU) just hit new all-time highs amid escalating U.S.-China trade tensions.

- The stock has a 100% “Buy” opinion from Barchart and is trading above key moving averages.

- The stock is up 334% over the past 52 weeks and 487% over the past six months.

- However, UUUU is volatile, and projected to report widening losses in 2025.

Today’s Featured Stock

Energy Fuels (UUUU), valued at $5.5 billion, is yet another stock soaring on rare earth mineral hopes as U.S.-China trade tensions stay hot.

The company has primarily been involved in mining, processing, and developing uranium and vanadium in the U.S., and says it supplies uranium for nuclear power facilities. This industry alone has been hot, thanks to artificial intelligence driving up energy demand and turning investor attention to the untapped world of nuclear energy.

But nothing has been hotter than rare earth minerals. Energy Fuels announced in April that it could use its existing infrastructure to produce six rare earth oxides, including samarium, gadolinium, and yttrium.

China continues to dominate the rare earth industry, so the U.S. has been desperate to improve its supply chain of the critical minerals. Denver-based Energy Fuels wants to position itself at the center of this opportunity.

After China ramped up restrictions on U.S. exports of its rare earth minerals, investor frenzy is only growing. The hope is that President Donald Trump’s administration will invest in more U.S.-based companies, and investors are betting Energy Fuels could be on the short list.

What I’m Watching

I found today’s Chart of the Day by sorting through Barchart’s list of stocks at new 52-week highs for those with the highest technical buy signals; superior current momentum in both strength and direction; and a Trend Seeker “Buy” signal. UUUU checks those boxes. Since the Trend Seeker signaled a new “Buy” on Aug. 22, the stock has gained 132%.

Barchart Technical Indicators for Energy Fuels

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

UUUU hit an all-time high of $26.08 in morning trading on Oct. 14.

- UUUU has a Weighted Alpha of +318.28.

- Energy Fuels has a 100% “Buy” opinion from Barchart.

- The stock has gained 334.98% over the past year.

- UUUU has its Trend Seeker “Buy” signal intact.

- Energy Fuels has made 13 new highs and is up 109.29% in the last month.

- Relative Strength Index (RSI) is at 86.59.

- There’s a technical support level at $22.42.

Don’t Forget the Fundamentals

- $5.5 billion market capitalization.

- 60.1x price-sales ratio.

- Revenue is expected to decrease by nearly 44% this year before surging by 306% in 2026.

- Losses per share are also expected to widen in 2025, before flipping to a profit per share of $0.12 in 2026.

Analyst and Investor Sentiment on Energy Fuels

As Jim Van Meerten, our regular Chart of the Day columnist, always says, “I don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping stock, it’s hard to make money swimming against the tide.”

Energy Fuels has limited analyst coverage, but it seems that those who do follow the stock are moderately positive on it.

- The analysts tracked by Barchart give it 3 “Strong Buy” ratings and 2 “Hold” ratings.

- Their price targets are between $7.25-$22. Investors should note that Energy Fuels has surpassed even the high price target of $22.

The Bottom Line on Energy Fuels

Energy Fuels, like so many other rare earth stocks, has been on a tear higher in 2025, and rightfully so. The U.S. government has already taken stakes in MP Materials (MP) and Trilogy Metals (TMQ), and has expressed interest in other mining projects. It’s understandable why investors expect that Energy Fuels could receive similar interest.

However, this is not a guarantee, and disappointment could send Energy Fuels shares plunging. Plus, its price-sales ratio is steep compared to an industry median of 1.3x. Huge projected revenue growth in 2026 could make its valuation more compelling, but the U.S. rare earth supply chain remains unproven.

Investors should be mindful of volatility and proceed with caution.

Today’s Chart of the Day was written by Sarah Holzmann. Read previous editions of the daily newsletter here.

Additional disclosure: The Barchart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.