/Quantum%20Computing/A%20concept%20image%20showing%20a%20ray%20of%20light%20passing%20through%20cyberspace_%20Image%20by%20metamorworks%20via%20Shutterstock_.jpg)

IonQ (IONQ) has again caught investors off guard by breaking a quantum performance record, reaching an algorithmic qubit (#AQ) metric of 64 on the company's Tempo platform. This advancement exponentially increases the computational capabilities available for tackling real-world issues such as drug discovery, supply chain optimization, and next-generation cybersecurity. It occurs as IonQ stock, arguably the most followed name among quantum computing stocks, trades around the higher part of the stock's 52-week range after recent volatility.

Quantum computing is now a big-budget race, as tech titans such as IBM (IBM), Alphabet (GOOG) (GOOGL), and Microsoft (MSFT) spend billions on research. It stands as significant that IonQ’s milestone is notable because it represents a commercially significant step forward, putting the company ahead of abstract potential use cases instead of promises. In the face of rising AI data center spending as well as increasing enterprise interest in computational innovations, the milestone achieved by IonQ may change the nature of investments.

About IonQ Stock

IonQ is based in College Park, Maryland, and builds quantum computing platforms based on trapped-ion methodologies as the industry pioneer in quantum networking. IonQ has a market value of approximately $19 billion, making it among the largest-cap, publicly traded quantum computing companies.

IONQ shares have been very volatile, rising over 700% in the last year as hopes about quantum tech among investors spiked. In the last 52 weeks, the stock has swung between $7.99 and $76.13, lately trading around $64.21. That showing blows past the S&P 500 Index ($SPX), up less than 20% during the same time.

Valuation is still the point of contention among investors. IonQ has a price-to-sales ratio north of over 470x and a price-to-book (P/B) multiple of 17.5x, which indicate through-the-roof growth expectations rather than current profitability. As the company is still highly unprofitable, with negative returns on equity (-67.1%) as well as assets (-57.9%), investors are essentially paying IonQ’s premium for technological leadership as well as long-term growth potential instead of next-quarter earnings strength.

Worth mentioning, IonQ has no dividend payment, as is fitting with its reinvestment-rich approach to achieving size and widening the technology moat.

IonQ Beats on Earnings

IonQ announced second-quarter results that surpassed Wall Street forecasts, surpassing the high end of the revenue guidance by 15%. The company also announced that it proposes to acquire Oxford Ionics in a deal valued at $1.075 billion, where the acquisition is geared to advance the roadmap to scalable quantum breakthroughs. More acquisitions of quantum networking companies, such as those of Lightsynq, continued to build the IonQ quantum networking footprint.Management reconfirmed an aggressive roadmap: achieving 800 logical qubits by 2027 and 80,000 by 2030, making IonQ poised to gain quantum advantage across numerous sectors. Notably, the company completed a $1 billion equity raise, taking pro forma cash and investments to $1.6 billion—attracting runway to support its aggressive R&D as well as acquisition plan.

On the business side, IonQ has already shown some concrete applications. Working together, AstraZeneca (AZN), Amazon's (AMZN) AWS, and Nvidia (NVDA) announced a 20x acceleration of drug development pipelines based on the company's quantum systems. Management also pointed to the wider uses of #AQ 64, indicating some computations would need as many as 1 billion GPUs without it, also indicating cost as well as energy efficiency benefits.

As IonQ is still not profitable, its growing partnerships, acquisitions, and roadmap advancement, meanwhile, cause investors to look ahead to scalability and commercialization instead of short-term margins.

What Do Analysts Expect for IONQ Stock?

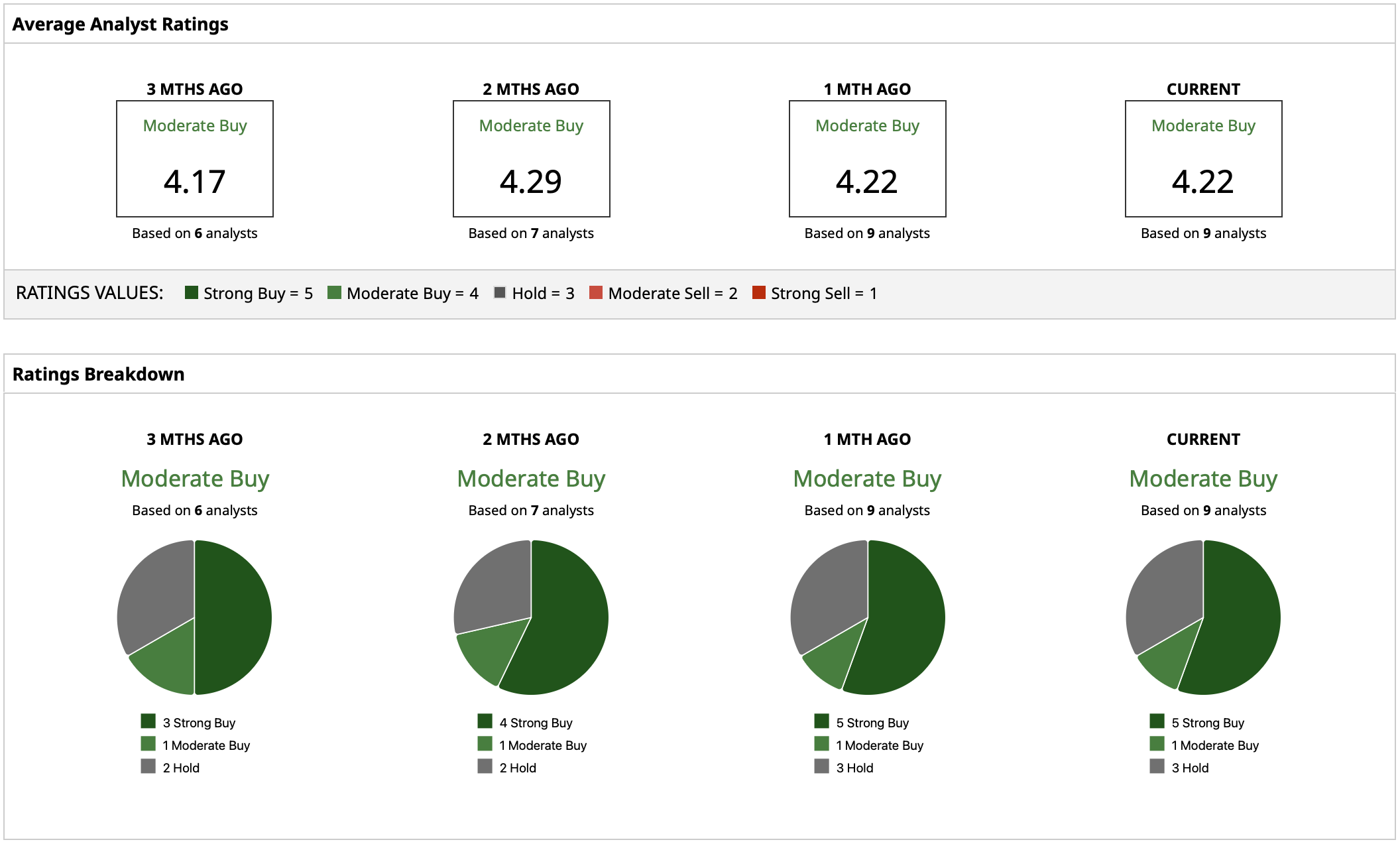

Analyst sentiment around IONQ is blended but cautiously optimistic. Analysts assign a “Moderate Buy” rating consensus for the stock with target prices ranging all the way from a price target as low as $32 up to a price target as high as $100. Its median target price of $64.62 implies 0.6% potential upside based on the current closing price of $64.21, indicating a stock already valued close to consensus fair value.