The quantum computing market is seeing a strong increase in investments from both the government and private sectors, with significant money being poured into making the technology practical and expanding its real-world uses. Experts expect the market for quantum technology to reach about $4.24 billion by 2030, growing steadily at a rate of about 20.5% annually from 2025 to 2030.

This growth follows a series of important advancements in the field, from better qubit stability to new partnerships focused on building larger quantum networks. Leading pure-play quantum companies have experienced sharp rises in their stock prices as investors bet on when this technology will become widely commercial.

IonQ (IONQ) is a clear example of this trend. Over the last six months alone, IonQ’s stock price has climbed to about $70, marking a gain of over 170%. The company’s market value now tops $21.9 billion, showing growing confidence in its plan to increase qubit numbers and reduce errors.

B. Riley analysts have raised their 12-month price target on IONQ to a new high of $100, up from $75, reflecting strong belief in the company’s path to scalable quantum advantage. Will IONQ stock keep beating expectations and reach even higher levels? Let’s take a closer look.

Tracking the Numbers Behind IonQ’s Market Momentum

IonQ is a key player in quantum computing and networking, focusing on developing powerful quantum hardware and software that help businesses and governments tackle complex problems.

Over the past year, its stock price has soared an impressive 805%, showing strong investor interest and the company's steady progress. This year alone, the stock has advanced over 65%, making IONQ one of the top performers in the tech sector.

Even though the quantum computing field is still young, IonQ’s market value sits at about 22.3 billion dollars with nearly 297 million shares outstanding, reflecting big bets on its future potential despite recent losses.

The company reported $20.7 million in revenue for the second quarter, beating expectations by 15% and showing strong demand for its products. IonQ’s cash reserves grew to $656.8 million by mid-2025, and after a $1 billion funding round, the total jumped to $1.6 billion. Though the company posted a net loss of $177.5 million in the quarter and a $36.5 million adjusted EBITDA loss, these funds are fueling ongoing growth and innovation. With annual sales of $43 million but a net loss of $332 million, IonQ is clearly in growth mode, building the foundation for future breakthroughs that investors seem eager to support.

Quantum Advantage and the Engines Driving IonQ’s Growth

IonQ’s recent deal with the U.S. Department of Energy shows the company’s commitment to pushing quantum technology into new areas, especially space. They are set to design and run a test for secure quantum communications from orbit, making IonQ a key player in the growing Quantum in Space initiative. This work could lead to safer satellite communications and more precise quantum networks, important for both government and business users.

Adding to this momentum, IonQ’s purchase of Oxford Ionics brings in advanced trapped-ion tech and a strong team, helping speed up the rollout of better quantum computers and grow IonQ’s reach in Europe and Asia.

Their latest breakthrough with synthetic diamond materials, in partnership with Element Six, allows them to produce important quantum network parts using common chipmaking methods. This means they can scale up production more easily and bring quantum computing closer to industrial use.

Finally, acquiring Capella Space helps IonQ push ahead with its plan for secure quantum communications via satellites, combining Capella’s radar tech with IonQ’s quantum systems. This opens up huge opportunities in defense and intelligence. Together, these moves power IonQ’s growth and back their new high price target.

Why Analysts See More Room for IonQ to Run

IonQ expects its revenue for 2025 to be between $82 million and $100 million, with the third quarter forecasted to bring in $25 million to $29 million. This strong revenue outlook, along with an average earnings estimate of -$0.97 per share for 2025, an improvement from last year’s -$1.56, shows why analysts stay positive despite the company’s current investments and losses.

B. Riley Securities recently raised its 12-month price target from $75 to a new high of $100 and kept a “Buy” rating. Their confidence comes from IonQ’s growing commercial success and the Department of Energy's moving quantum systems toward commercial use rather than just research. Needham analyst N. Quinn Bolton also stays positive with a “Buy” rating and an $80 target, focusing on IonQ’s growing pipeline and cloud subscription revenue.

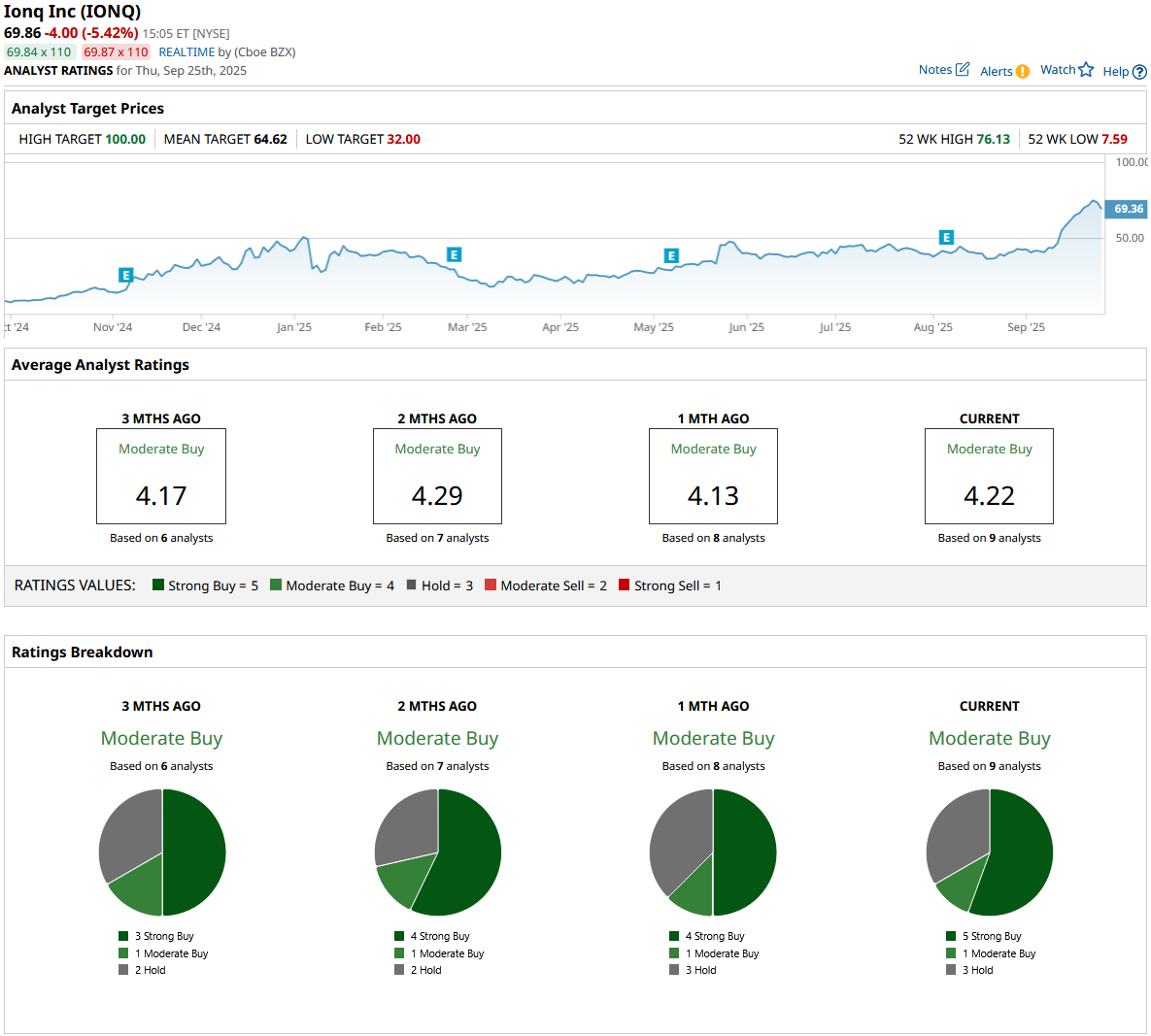

The nine analysts surveyed agree on a consensus "Moderate Buy" rating, with an average price target of $64.62, suggesting about a 7.5% drop from the current price.

Conclusion

Given the Street-high target and growing commercial traction, IonQ’s momentum isn’t slowing down any time soon. With B. Riley lifting its 12-month price target to $100 and a consensus “Moderate Buy” outlook still in place, the path ahead looks tilted toward upside. As quantum deployments pick up steam, particularly in space and enterprise cloud services, it seems likely shares will continue drifting higher, potentially testing that $100 mark within the next year. For investors, IonQ’s blend of ambitious partnerships, robust cash runway, and sustained analyst support suggests the stock is poised to climb rather than retrace.