/Engineer%20in%20Sterile%20Coverall%20Holds%20Microchip%20with%20Gloves%20and%20Examines%20it%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

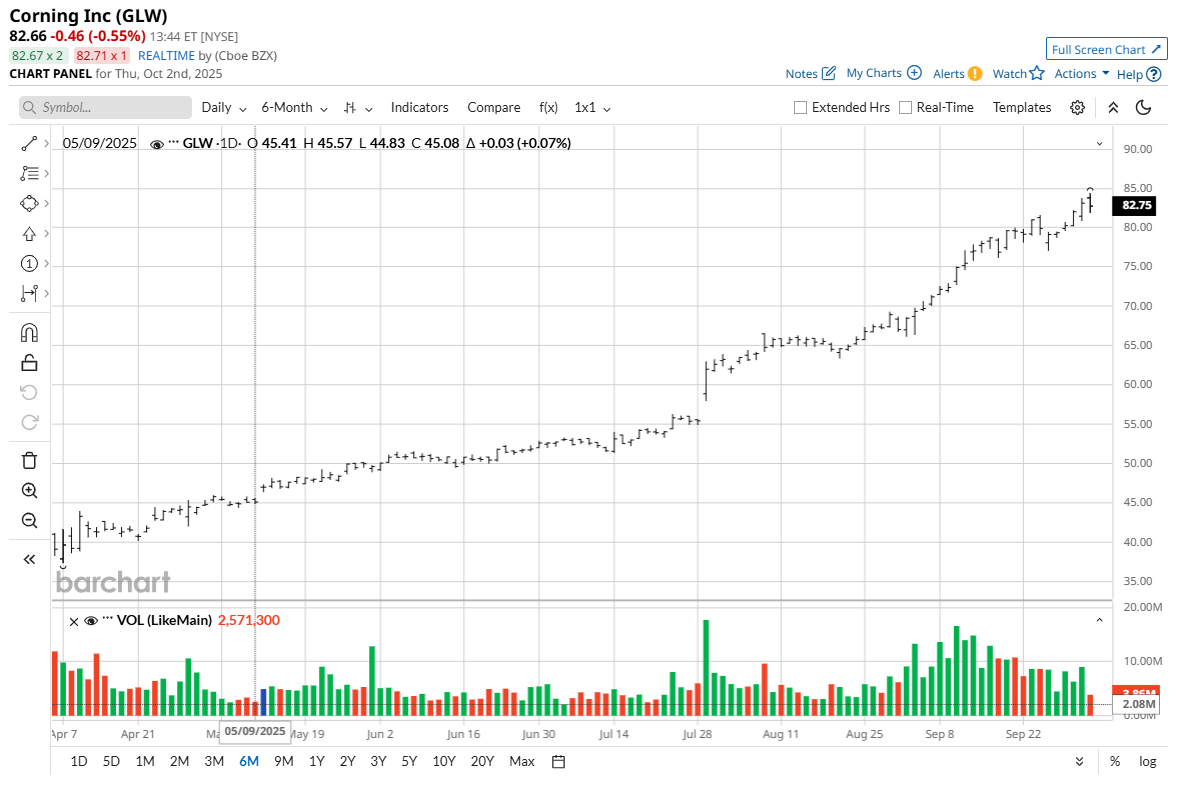

Corning (GLW) stock has been in the thick of the trading action in 2025 with a sustained rally, and shares are up more than 70% in the year to date so far. As the market continues to focus on attractive AI-related stories, Corning will benefit from AI-driven fiber growth. Further, other emerging business makes Corning among the hottest picks-and-shovels bets on artificial intelligence. As an example, the company expects its solar business to deliver $2.5 billion in revenue by 2028.

The optimistic outlook is backed by industry partnerships that are likely to support growth. Most recently, Corning has signed a deal with QuantumScape (QS) to develop ceramic separator manufacturing capabilities for the latter’s solid-state lithium metal batteries. Other recent partnerships include one with GlobalFoundries (GFS) for detachable fiber connector solutions and with T1 Energy (TE) for solar panels.

About Corning Stock

Headquartered in Corning, New York, GLW operates in the optical communications, display technologies, specialty materials, semiconductor, automotive, and life sciences businesses. With 34 advanced manufacturing facilities across 15 states, Corning seems well positioned to benefit from the focus to boost domestic manufacturing.

Further, with strong demand for the company’s new Gen AI products, GLW stock has surged by 70% in the year to date. The rally has been backed by strong fundamental developments.

From a valuation perspective, GLW stock trades at a current price-earnings ratio of 33.24x and a PEG ratio of 1.83x. Given the industry tailwinds and focus on innovation, GLW can still be considered attractive at these traditionally high levels.

Is Corning a Good Stock to Buy Now?

The strong rally in GLW stock has been backed by fundamental factors that position the company for sustained growth. Recently, Corning and QuantumScape announced an agreement for the development of ceramic separator manufacturing capabilities for QS solid-state batteries.

Further, the company has entered into an agreement to develop detachable fiber connector solutions for the GlobalFoundries silicon photonics platform.

It’s worth noting that Corning is already partnering with Apple (AAPL) to manufacture 100% of iPhone and Apple watch cover glass in Kentucky. Besides providing revenue visibility, these collaborations underscore the company’s focus on innovation-driven growth.

For Q2 2025, Corning exceeded its guidance with year-over-year core sales growth of 12%. This growth was associated with operating margin expansion by 160 basis points coupled and higher free cash flows.

For the third quarter, Corning has guided for double-digit sales and earnings growth on a year-over-year basis. Additionally, with positive industry tailwinds like generative AI and U.S.-made solar products, Corning expects to add $4 billion to its annualized sales by the end of 2026. At the same time, the company has guided for stronger free cash flow. This will ensure flexibility to invest in innovation as Corning continues to focus on “organic growth opportunities.”

With focus on multiple industries, innovation, and partnerships, Corning seems well positioned to achieve its growth target. It’s therefore likely that the GLW stock price will remain in an uptrend.

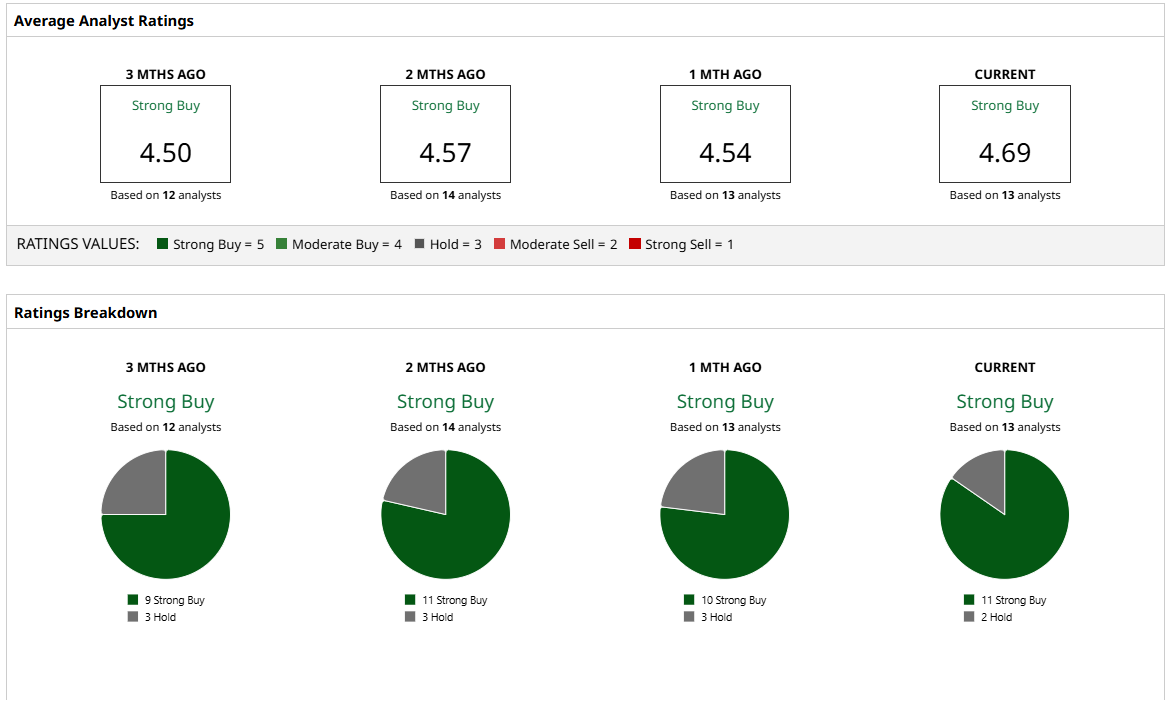

What Do Analysts Expect for Corning Stock?

Even after a rally of more than 70% year-to-date, analysts have maintained a “Strong Buy” rating for GLW stock. Among 13 analysts, a “Strong Buy” recommendation comes from 11 analysts and two call for a “Hold” rating.

Analysts tracking GLW stock expect earnings growth of 26% on a year-over-year basis for FY 2025. Corning has also guided for a healthy operating margin of 20% by the end of 2026. Given these growth expectations, Corning’s valuations don’t look stretched.

However, it’s worth noting that GLW stock trades above the mean analyst price target of $77.15. Having said that, the Street-high target of $93 implies potential upside of 13% from current levels.