Penny stocks often swing on bold strategies, especially when companies tie their fortunes to high-risk, high-reward assets. For investors, that can mean either outsized gains or painful setbacks, depending on how the gamble plays out. One of the latest examples comes from CleanCore Solutions (ZONE), a cleaning products company that has suddenly surprised Wall Street with one of the most aggressive pivots in recent memory.

This week, CleanCore unveiled plans to raise $175 million through a private placement to build the first official Dogecoin (DOGEUSD) treasury, backed by the Dogecoin Foundation and House of Doge. The move represents an aggressive attempt to rebrand around digital assets and payments while leveraging the popularity of the meme coin.

With its stock plunging on the announcement, investors are now left asking. Is ZONE a visionary play or a risky bet? Let's find out.

About ZONE Stock

Headquartered in Omaha, CleanCore develops eco-friendly cleaning technologies using pure aqueous ozone. Its product line includes wall-mounted fill stations, portable caddies, laundry systems, ice treatment solutions, and GreenKlean sanitizing tablets. Serving janitorial, industrial, and residential markets, the company promotes sustainable, chemical-free cleaning alternatives.

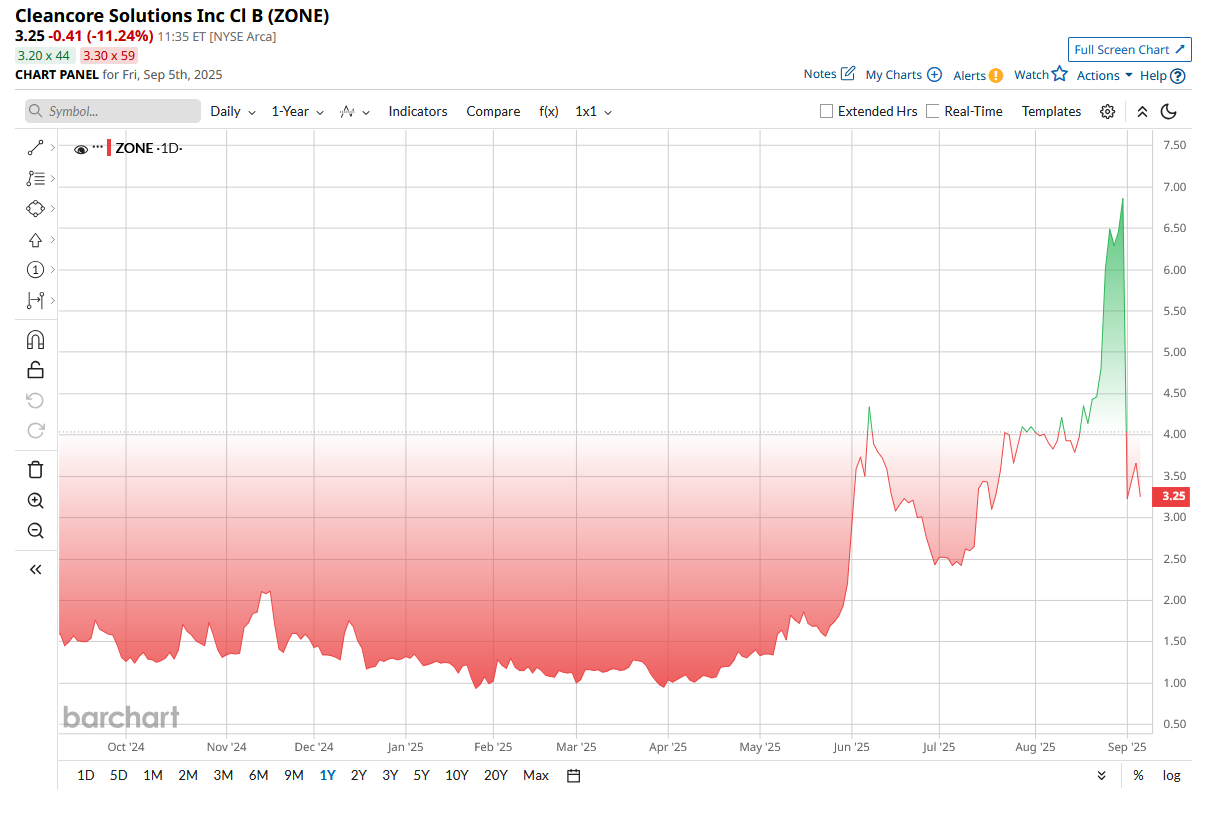

Valued at a tiny market cap of $35 million, shares of CleanCore have surged more than 145% year-to-date (YTD). However, investors have responded to the recent crypto pivot move with skepticism. ZONE shares plummeted nearly 60% on the day of the announcement, dropping from $6.86 to $2.69. The selloff mirrors declines seen in other Dogecoin-treasury plays like Spirit Blockchain Capital (SBLCF) and Dogecoin Cash (DOGP).

Fragile Fundamentals

CleanCore’s financials underscore why the pivot was necessary. Fiscal 2025 revenue came in at just $2.07 million, up 29% from last year but still far too small to cover expenses. Net losses widened to $6.74 million, driven partly by $3.2 million in stock-based compensation. Operating cash outflow reached $2.34 million, leaving only $1.46 million in cash and equivalents by June. In its latest filings, the company even raised “substantial doubt” about its ability to continue operations without fresh capital.

Executives are framing the Dogecoin initiative as a transformational moment. CEO Clayton Adams called it a “watershed” event for the company and the broader Dogecoin ecosystem. Marco Margiotta, CEO of House of Doge and now CleanCore’s Chief Investment Officer, emphasized the strategic alignment with crypto foundations. The board also added attorney Alex Spiro, who is known for representing Elon Musk, as chairman to guide the transition. The leadership team is clearly signaling that Dogecoin will define CleanCore’s future.

Is ZONE Stock a Buy?

The transformation of ZONE into a Dogecoin Treasury transforms the stock into a pure speculation and is no longer a classic value game. The company has very low revenue, records recurring losses, and is burning cash. The new capital raise is a kind of crypto bet that buys time and turns the balance sheet into a crypto bet: should Dogecoin go up, the treasury can increase equity; should it go down, CleanCore will have a depreciating asset and will still require new capital. Management does not provide any defined way to achieve long-term product revenue.

Until you are highly confident that Dogecoin will be adopted long-term, consider ZONE as high-risk and do not allocate it to your core portfolio today.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.