The price of Trade Desk (TTD) stock has recovered significantly since the April low and the company is due to report earnings on August 7th after the market close.

To take advantage of the volatility skew around earnings, I like to use a strategy called a diagonal put spread.

This option strategy is an advanced strategy because it utilizes options over different expiration periods and different strike prices.

The strategy involves selling an out-of-the-money put for a near term expiry and then buying a put for around the same price using a later expiry.

The idea with the trade is that the stock might fall a little bit more, but should stay above the short strike price.

Let’s look at an example using Trade Desk.

Trade Desk Diagonal Put Spread Example

The trade I’m looking at is selling a August 15th put with a strike price of $75 and buying an August 22nd put with a strike price of $74.

As of yesterday’s close, the August 15th put could be sold for around $1.45 and the August 22nd put could be bought for $1.40.

The net premium received for the trade would be $5 and that is the worst case scenario on the upside – a $5 gain.

The risk on the trade is on the downside with a potential maximum loss of $95. This is calculated by taking the difference in the spread (1) multiplied by 100 and subtracting the option premium (5).

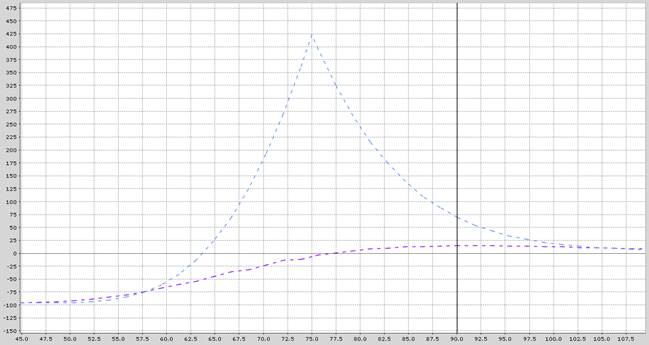

The maximum potential gain is around $425 which would occur if TTD closes right at $75 on August 15th.

The trade has a nice profit zone in between $65 and $100.

Aiming for a return of around 10-15% makes sense and I would set a similar stop loss.

The worst-case scenario is a sharp drop in TTD stock early in the trade. For this reason, if the stock drops below $75 in the next few days, I would also consider closing the trade early to minimize losses.

The initial trade set up has a delta of 1 meaning the position is roughly equivalent to owning 1 shares of TTD stock. Note that this delta number can change significantly as the stock starts to move.

Below is the payoff graph with the blue line representing the profit or loss at expiration and the purple line being the trade as of today.

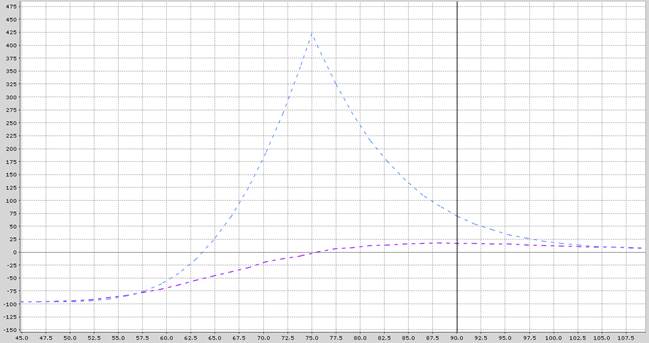

This is how the trade could look the day before earnings.

So, provided TTD stock stays above $75 in the next week, the trade should be ok. As the trade requires the stock to not drop too much, this would not be an appropriate strategy for bearish traders.

Trade Desk Company Details

The Barchart Technical Opinion rating is a 24% Buy with a Average short term outlook on maintaining the current direction.

The market is approaching overbought territory. Be watchful of a trend reversal.

The Trade Desk, Inc. is a provider of technology platform for advertising.

The company through self-service, cloud-based platform, ad buyers create, manage and optimize data-driven digital advertising campaigns which includes display, video, audio, native and social, on a multitude of devices, such as computers, mobile devices and connected TV.

It operates primarily in the United States, Europe and Asia.

The Trade Desk, Inc. is headquartered in Ventura, CA.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.