/AI%20(artificial%20intelligence)/AI%20Infrastructure%20by%20FOTOGRIN%20via%20Shutterstock.jpg)

When people think about artificial intelligence (AI) stocks, a 175-year-old materials science company usually isn’t the first name that pops up. But Corning Incorporated (GLW) is proving that even an old-school industrial giant can become a key player in the AI revolution. Historically known for manufacturing specialty glass and ceramics, Corning’s most well-known product is Gorilla Glass, the ultra-tough screen glass used in smartphones worldwide.

Now, however, the company has reinvented itself as a critical supplier to the world’s largest AI data centers. At the heart of this transformation is Corning’s optical communications segment, which provides end-to-end fiber-optic technology. It has become the company’s largest and fastest-growing business, riding the explosive demand for data infrastructure fueled by AI. And investors have certainly taken notice, sending the stock soaring more than 100% over the past year.

The company counts major tech heavyweights like Nvidia (NVDA) and Apple (AAPL) among its customers and has been a clear beneficiary of the AI boom. In fact, the company’s shares received another massive boost recently after Corning announced that Meta (META) will pay the company up to $6 billion through 2030 for fiber-optic cable to support its AI data centers. So, given Corning’s expanding role in the AI race, should investors be loading up on GLW shares?

About Corning Stock

Corning is a global leader in materials science, with 175 years of breakthrough innovations that have helped shape the modern world. The New York-based company blends deep expertise in glass and ceramic science with optical physics, along with advanced manufacturing and engineering skills, to create game-changing products that transform industries and enhance everyday life.

Today, Corning operates across a diverse set of fast-growing markets, including optical communications, mobile consumer electronics, display technologies, automotive, solar energy, semiconductors, and life sciences. Corning’s shares have climbed sharply as the company has become a vital supplier to the world’s largest AI data centers, and its latest deal with Meta highlights just how important its role has become.

On Jan. 27, GLW stock surged more than 15% after the materials science giant announced a blockbuster $6 billion agreement with Meta. As part of the deal, Corning will supply its most advanced optical fiber, cable, and connectivity products. The two companies will also collaborate to accelerate the buildout of AI data centers, as Meta races to keep pace with its rivals in the AI arms race.

To keep up with booming AI-driven demand, Corning plans to expand its manufacturing operations in North Carolina. Meta will serve as the anchor customer for a major capacity expansion at Corning’s optical cable facility in Hickory. Once construction is complete, Corning’s CEO, Wendell Weeks, says the plant will be the largest of its kind.

With a market capitalization of roughly $89.4 billion, Corning has quietly become one of the market’s bigger winners. Shares have skyrocketed about 106% over the past year, making the S&P 500 Index’s ($SPX) 15% gain in 2025 look tame by comparison. And the rally is still going. GLW is already up 17% in 2026, while the broader market has inched ahead just 2%.

Corning’s Q4 Earnings Snapshot

Right on the heels of its Meta deal, Corning delivered another big headline. On Jan. 28, the company reported its fiscal 2025 fourth-quarter results, which came in ahead of Wall Street’s expectations for both revenue and earnings. The specialty glass maker posted adjusted sales of about $4.41 billion, marking a 14% year-over-year (YoY) increase and topping analysts’ forecasts of $4.32 billion.

Profit growth was even stronger. Adjusted earnings per share climbed 26% from a year ago to $0.72, beating the Street’s consensus estimate of $0.70. A large share of that revenue growth came from Corning’s Optical Communications segment, which stood out as the clear star of the quarter. Revenue in the division jumped 24% YoY to $1.7 billion, fueled by rising demand for AI-related data infrastructure.

Meanwhile, Display segment revenue slipped 2% to $955 million compared to the prior-year period, while Specialty Materials revenue rose 6% YoY to $544 million. Looking at the full year, Corning’s momentum was just as impressive. The company reported core sales of $16.41 billion for 2025, up 13% YoY, while core earnings per share surged 29% to $2.52.

Management also shared an ambitious update to its long-term growth strategy. Corning raised the target for its upgraded “Springboard Plan,” now aiming to deliver $11 billion in incremental annualized sales by the end of 2028, up from its original $8 billion goal. For 2026, the company increased its internal sales growth target to $6.5 billion, up from the previous $6 billion target, signaling continued confidence in strong demand ahead.

How Are Analysts Viewing GLW Stock?

Oppenheimer recently raised its price target on GLW stock to $120 from $100 and maintained its “Outperform” rating on the stock. The higher target comes right after the company delivered better-than-expected fourth-quarter results.

The investment firm believes Corning’s updated outlook may actually be conservative, since it does not factor in potential revenue from scaling optical opportunities. Oppenheimer also pointed out that profit margins in the Optical segment are expected to improve in the years ahead, adding another potential tailwind to the story.

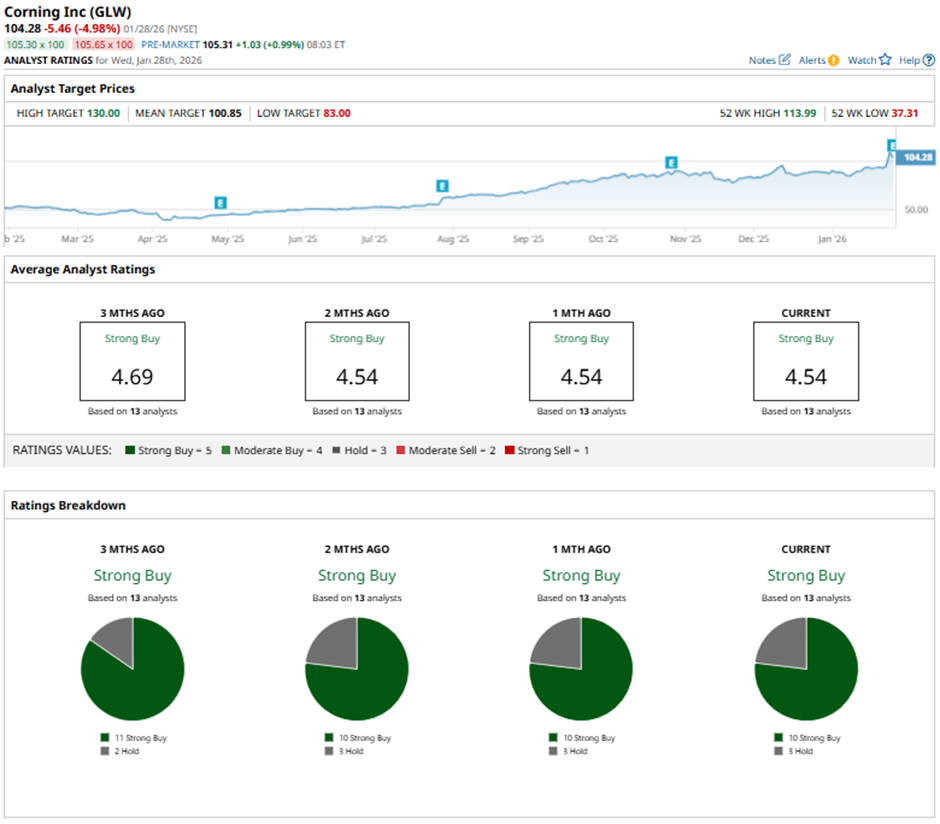

Overall, Wall Street is feeling optimistic about Corning’s outlook, and that confidence shows in the stock’s consensus “Strong Buy” rating. Out of 13 analysts covering GLW, 10 are firmly in the “Strong Buy” camp, while the remaining three are taking a more cautious stance with “Hold” ratings.

Even after its big run, analysts still see room for gains. While the stock is already trading above the average price target of $100.85, the Street-high target of $130 suggests there could still be about 25% upside from current levels, a sign that many believe Corning’s AI-driven growth story is far from over.