One of Nvidia Corp.’s (NASDAQ:NVDA) key manufacturing partners, responsible for producing much of the chipmaker's highly sought-after GPUs, is losing steam.

After fueling a multi-year rally, the supplier's momentum is now fading, reflected in a sharp drop in its Growth score within Benzinga's Edge Stock Rankings.

TSM is gathering positive momentum. See what the experts say here.

A Steep Decline In The Growth Score

The Growth score in Benzinga’s Edge Rankings is calculated based on a company’s historic growth profile, that is, the pace at which earnings and revenues have grown, with equal importance given to both long-term and immediate trends, such as the latest quarterly earnings report.

See Also: Micron Unveils New Memory Tech For AI Data Centers, Nvidia Team Up

The stock in question with the big drop in Growth scores is Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE:TSM), a pure-play foundry company that manufactures the vast majority of NVIDIA’s high-performance GPUs.

Taiwan Semiconductor Manufacturing Co. Ltd.

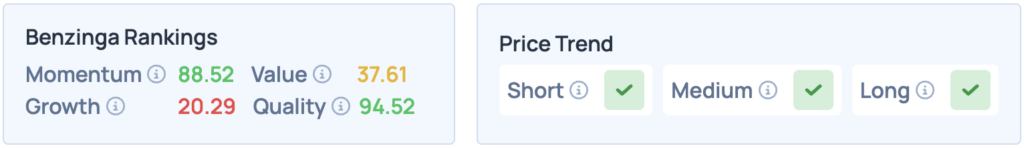

The Taiwan-based company has seen its Growth score drop from 89.4 to 20.17 within the span of a week, hinting at a slowdown in the pace at which the company has grown in recent years.

Being one of the few global mega-cap companies that reports its revenues every month, TSMC’s September figures showed a 31.4% year-over-year growth in sales, driven by growing orders from Apple Inc. (NASDAQ:AAPL) and NVIDIA.

However, the company also marked a 1.4% month-over-month decline in sales compared to August, which is what likely led to the decline in its Growth score in Benzinga’s Edge Rankings. Riding on the coattails of NVIDIA and the AI frenzy, the stock is up 227% over the past five years, with this momentum now beginning to fade.

The stock continues to score high on Momentum and Quality, but is now doing poorly in-terms of Growth in Benzinga’s Edge Stock Rankings. It, however, still has a favorable price trend in the short, medium and long terms. Click here for deeper insights on the stock, its peers and competitors.

Read More:

Photo courtesy: Jack Hong via Shutterstock