Centrus Energy (LEU) disclosed a massive catalyst that could reshape America's nuclear energy landscape. The uranium enrichment specialist announced plans for a multi-billion-dollar expansion of its Ohio facility, the most significant domestic uranium enrichment investment in decades.

The Piketon plant expansion promises to create 1,300 jobs while boosting production of both standard Low-Enriched Uranium (LEU) and the specialized High-Assay, Low-Enriched Uranium (HALEU) needed for next-generation reactors.

The timing of the plan is notable as the U.S. seeks energy independence and nuclear power experiences a renaissance. Moreover, Centrus is the only American company that uses domestic technology and manufacturing for uranium enrichment.

The company has already secured over $2 billion in customer commitments and raised $1.2 billion in funding over the past year, which indicates strong market demand. With federal backing on the horizon through funding from the Department of Energy, Centrus is well poised to capitalize on America's nuclear resurgence.

However, the expansion's success hinges on securing federal support, making this a high-stakes bet on government policy and the future of nuclear energy.

Is LEU Stock a Good Buy Right Now?

Centrus Energy continues to strengthen its position as America's only domestic uranium enricher through strategic international partnerships and robust financial performance. The company's recent memorandum of understanding with Korea Hydro & Nuclear Power (KHNP) and POSCO International signals growing international confidence in its expansion plans.

In Q2 of 2025, Centrus reported revenue of $154.5 million with a gross margin of 35%, up from 19% in the year-ago period. It ended Q2 with a cash position of $833 million, providing the company with enough liquidity to support its expansion plans.

The expanded partnership with KHNP demonstrates real market demand for American-made enriched uranium. Korea is one of the largest export markets, with KHNP operating 26 reactors and constructing four more. The increased supply volume commitment under their February 2025 contract, contingent on federal funding, validates Centrus' commercial viability and competitive positioning.

Centrus successfully achieved its 900-kilogram HALEU production milestone under its DOE contract, with the department exercising an option to extend operations through June 2026. As the only Western producer of virgin HALEU and the sole American enricher using domestic technology, Centrus holds a unique competitive moat in the nuclear fuel market.

Centrus is a compelling investment in 2025. However, investors should note the company’s dependence on federal funding decisions for large-scale expansion. The $60 million manufacturing readiness investment demonstrates proactive preparation, but the timeline for DOE awards remains uncertain.

With nuclear energy experiencing renewed support from both the government and the private sector, Centrus appears well-positioned to capitalize on America's nuclear renaissance, provided federal funding materializes as expected.

What Is the Target Price for LEU Stock?

Analysts tracking LEU stock forecast revenue to increase from $442 million in 2024 to $850 million in 2029. In this period, adjusted earnings are forecast to expand from $4.47 per share to $11.50 per share. If the nuclear energy stock is priced at 40x forward earnings, which is not too steep given its growth rates, it should trade around $460 in early 2029, indicating an upside potential of over 50% from current levels.

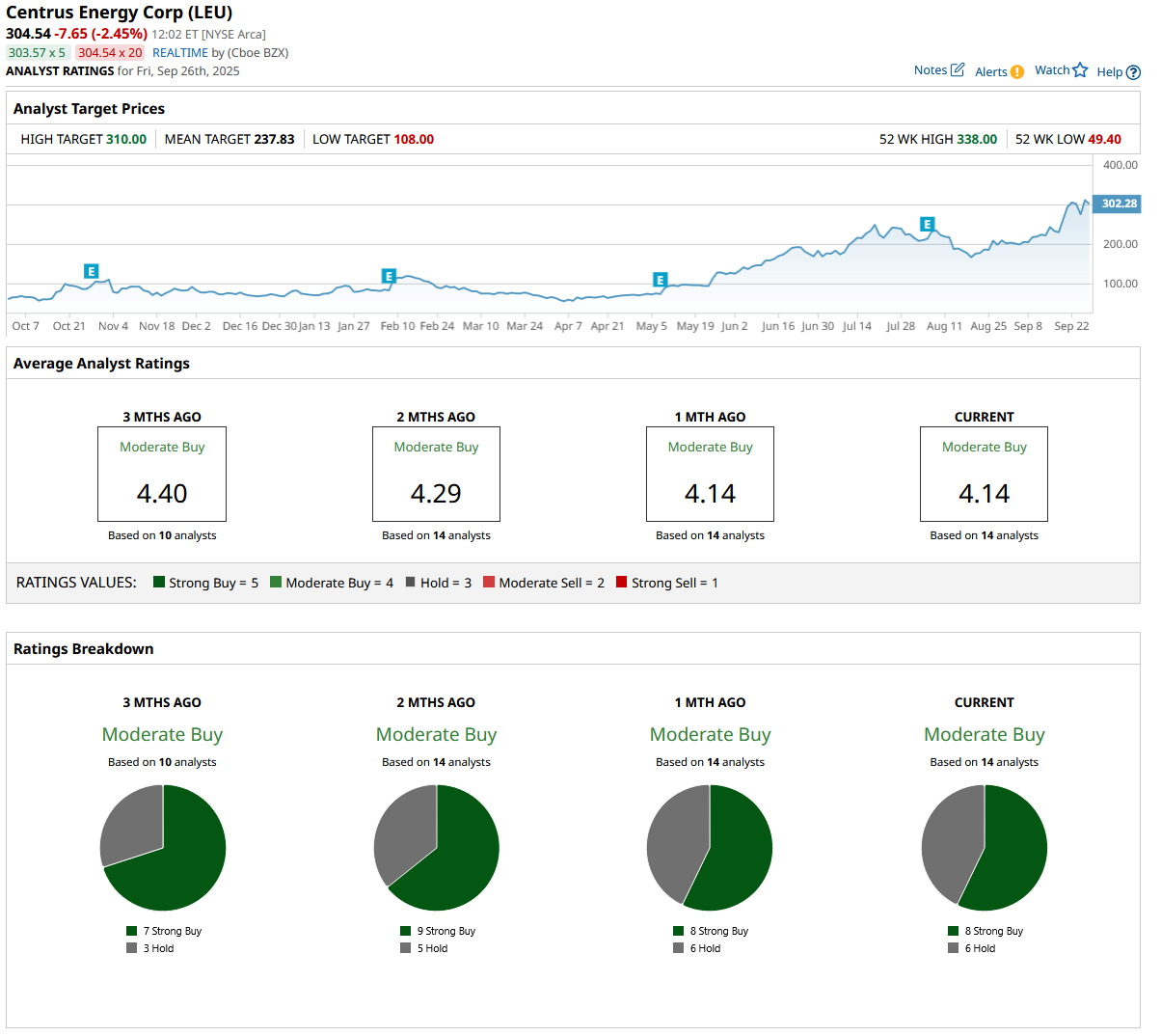

Out of the 14 analysts covering LEU stock, eight recommend “Strong Buy” and six recommend “Hold.” The average LEU stock price target is $238, below the current price of $304.54.