The Nasdaq 100's monster rally from April's tariff-induced panic has entered rarefied territory, with one technical streak not seen since the heart of the dot-com boom in 1999 now lighting up—and history suggests it may have more room to run.

After plunging in April under the weight of renewed trade war fears, the Invesco QQQ Trust (NASDAQ:QQQ)—which tracks the Nasdaq 100—has stormed back with a stunning 38% gain through July 22.

That alone is impressive. But under the surface, technical analysts are buzzing about something even more remarkable: the index has now traded above its 20-day moving average for 61 consecutive sessions, a bullish streak not seen since 1999.

That's right—this kind of strength has only occurred during some of the most powerful tech bull runs in history.

Only 1999 Beats This Tech Momentum Run

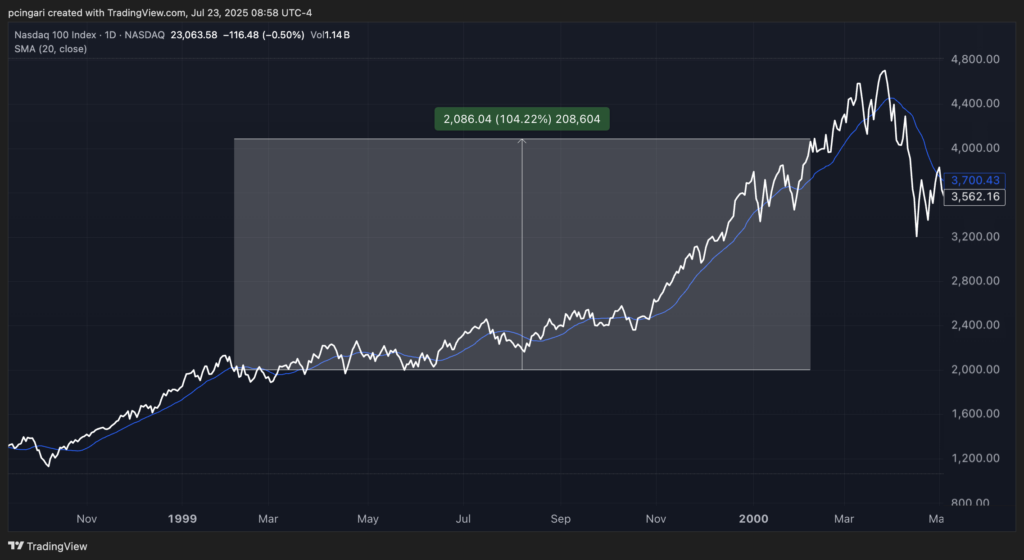

To find a longer stretch of daily closes above the 20-day moving average, you have to go back to late 1998 into early 1999. That run lasted 76 trading sessions, from mid-October 1998 to early February 1999.

And what came next?

Between Feb. 5, 1999 and Feb. 8, 2000, the Nasdaq 100 skyrocketed 104%, delivering one of its biggest rolling-year gains ever.

The NASDAQ Composite, heavily weighted with tech and internet stocks, peaked at 5,048.62 on March 10, 2000, before plunging nearly 80% by October 2002. The broader market, including the S&P 500, also declined during this period, though less severely.

Golden Cross: Another Bullish Boost

In late June, the Nasdaq 100 also triggered a golden cross, a classic bullish signal in technical analysis where the 50-day moving average rises above the 200-day moving average.

According to a backtest using the Technology Select Sector SPDR Fund (NYSE:XLK), a buy-on-golden-cross, sell-on-death-cross strategy has posted strong results since 2009.

Out of nine trades, eight were profitable, most delivering double-digit returns. That makes the golden cross a historically consistent bullish indicator during strong uptrends, such as the one we're seeing now.

Read Also: Nvidia, Palantir Fuel Historic Tech Rally — And It’s Far From Done

What Happens Next? Look To Momentum—And History

While nothing is guaranteed, this type of sustained momentum—combined with bullish technical signals—often lays the groundwork for further upside, especially in a market driven by mega-cap tech and AI optimism.

Even if today's rally doesn't mirror the full scale of the late-90s boom, it's hard to ignore that similar conditions are stacking up: rapid price gains, strong breadth, and powerful trend signals.

History suggests the bulls remain firmly in control.

Now Read

Image: Shutterstock