Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

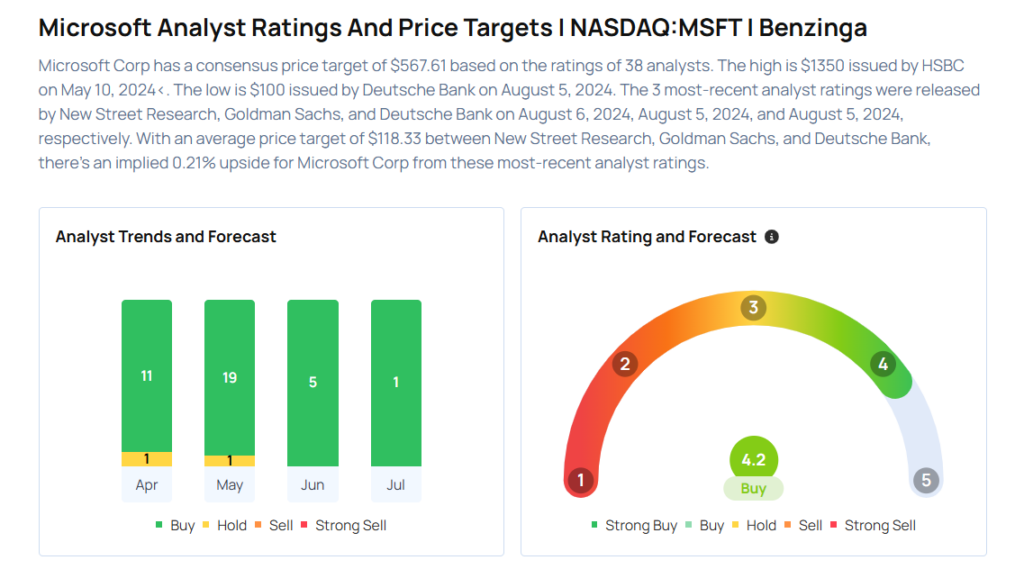

- Oppenheimer analyst Brian Schwartz upgraded the rating for Microsoft Corporation (NASDAQ:MSFT) from Perform to Outperform and announced a $600 price target. Microsoft shares closed at $496.62 on Tuesday. See how other analysts view this stock.

- Wolfe Research analyst Peter Supino upgraded Fox Corporation (NASDAQ:FOXA) from Underperform to Peer Perform. Fox shares closed at $55.09 on Tuesday. See how other analysts view this stock.

- Evercore ISI Group analyst Elizabeth Anderson upgraded the rating for Doximity, Inc. (NYSE:DOCS) from In-Line to Outperform and raised the price target from $50 to $70. Doximity shares closed at $61.47 on Tuesday. See how other analysts view this stock.

- JP Morgan analyst Mark Strouse upgraded Bloom Energy Corporation (NYSE:BE) from Neutral to Overweight and boosted the price target from $18 to $33. Bloom Energy shares closed at $24.32 on Tuesday. See how other analysts view this stock.

- Citigroup analyst Patrick Donnelly upgraded the rating for Charles River Laboratories International, Inc. (NYSE:CRL) from Neutral to Buy and raised the price target from $150 to $200. Charles River shares closed at $158.44 on Tuesday. See how other analysts view this stock.

Considering buying MSFT stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock