Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

- BTIG analyst Marie Thibault downgraded the rating for TrueCar, Inc. (NASDAQ:TRUE) from Buy to Neutral. TrueCar shares closed at $2.45 on Friday. See how other analysts view this stock.

- Wolfe Research analyst Andrew Rosivach downgraded Rexford Industrial Realty, Inc. (NYSE:REXR) from Outperform to Peer Perform. Rexford Industrial Realty shares closed at $43.76 on Friday. See how other analysts view this stock.

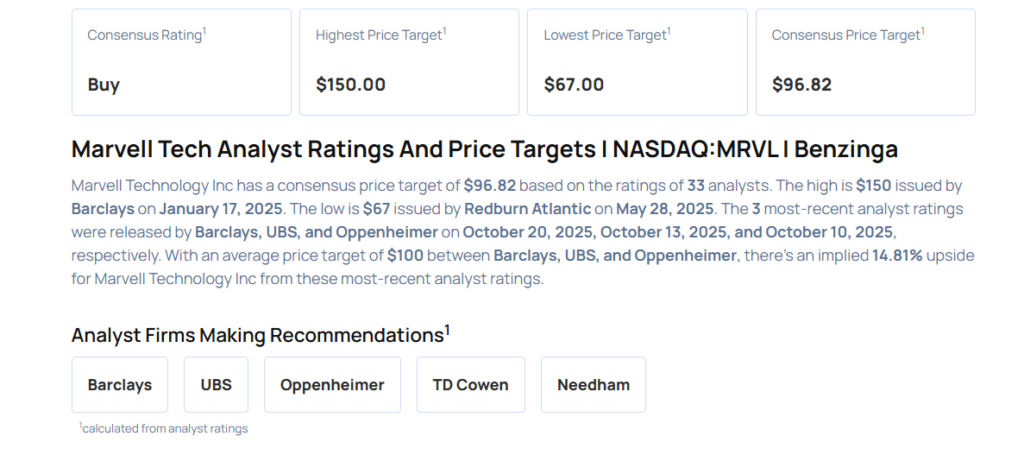

- Barclays analyst Thomas O’Malley downgraded Marvell Technology, Inc. (NASDAQ:MRVL) from Overweight to Equal-Weight and maintained the price target of $80. Marvell Tech shares closed at $87.95 on Friday. See how other analysts view this stock.

- Citigroup analyst Paul Lejuez downgraded Gildan Activewear Inc. (NYSE:GIL) from Buy to Neutral and raised the price target from $60 to $63. Gildan Activewear closed at $60.74 on Friday. See how other analysts view this stock.

- Rosenblatt analyst Kevin Cassidy downgraded Navitas Semiconductor Corporation (NASDAQ:NVTS) from Buy to Neutral and raised the price target from $4 to $12. Navitas Semiconductor shares closed at $14.66 on Friday. See how other analysts view this stock.

Considering buying MRVL stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock