The growing demand for antimony is creating unprecedented opportunities for companies operating in the antimony industry. This growth is likely to persist for years to come, as antimony alloys have key applications in lead-acid batteries for military vehicles, as flame retardants in military uniforms, and in semiconductors for military equipment. According to one report, the antimony market is expected to reach $6.54 billion by 2029, growing at a compound annual growth rate (CAGR) of 6.9%.

Against this backdrop, small-cap natural resource company United States Antimony (UAMY) secured a five-year sole-source contract worth up to $245 million from the U.S. Defense Logistics Agency, further solidifying its growing partnership with the Department of Defense. UAMY stock surged more than 13% intraday on the news.

The first delivery of the orders is expected to occur this week, as the company’s two smelting facilities already have the capability to produce the required antimony metal ingots.

Should you buy UAMY shares now?

About UAMY Stock

United States Antimony is a fully integrated natural resource company that mines, processes, and produces antimony, as well as other metals, including cobalt, tungsten, precious metals, and zeolite. The company is a key U.S. producer of antimony products, including antimony oxide, which is used in flame retardants, catalysts, and for various industrial purposes.

UAMY owns and operates smelting and milling facilities, primarily located in Montana and Mexico, which gives it control over the entire supply chain, from raw materials to finished products. The company is headquartered in Dallas, Texas and has a market capitalization of $997 million.

UAMY stock has been on a strong upward trend recently, driven by robust financial performance. Over the past 52 weeks, the stock has gained 984%, while it is up by 366% year-to-date (YTD). The stock reached a 52-week high of $8.40 on Oct. 3 but is down by 6% from this high. Shares jumped 13.2% intraday on the same day on the news of the contract award, as well as nearly 22% intraday on Oct. 1.

As UAMY stock has skyrocketed, shares are trading at an eye-watering valuation. Its price-to-sales (P/S) ratio sits at 64.72 times, which is considerably higher than the industry average.

UAMY’s Strong Q2 Topline Growth

On Aug. 12, UAMY reported strong topline growth for the second quarter of fiscal 2025. Revenues increased 187% year-over-year (YOY) to $10.53 million. For the first six months of the fiscal year, revenues were $17.53 million, up 160% annually.

In turn, this led gross profit to grow by 127% from the prior year’s quarter to $2.84 million for Q2. Ffor the six months, gross profit grew 183% YOY to $5.21 million. For the first half of the year, the company reported a net income (available to common shareholders) of $724,329, representing a significant turnaround from the $123,726 net loss it reported a year prior. The company also reported a small net income per share of $0.01.

Chairman and CEO Gary Evans stated that, while the results were robust, they could have been better if not for two factors. First, the company experienced the supply of sub-optimum antimony ore from an Australian supplier as well as a Chinese embargo of its products. The firm's Thompson Falls antimony smelter also lacked operating personnel during the reporting period.

UAMY has significant inventories on its balance sheet. The company aims to double production at the Thompson Falls site, with expansion efforts expected to conclude by the end of this year. The company is also strengthening its antimony supply chain.

Wall Street analysts are highly optimistic about UAMY’s future earnings. They expect EPS to climb by 300% YOY to $0.02 for the current quarter. For the current fiscal year, EPS is projected to surge 350% annually to $0.05, followed by a 380% growth to $0.24 in the next fiscal year.

What Do Analysts Think About UAMY Stock?

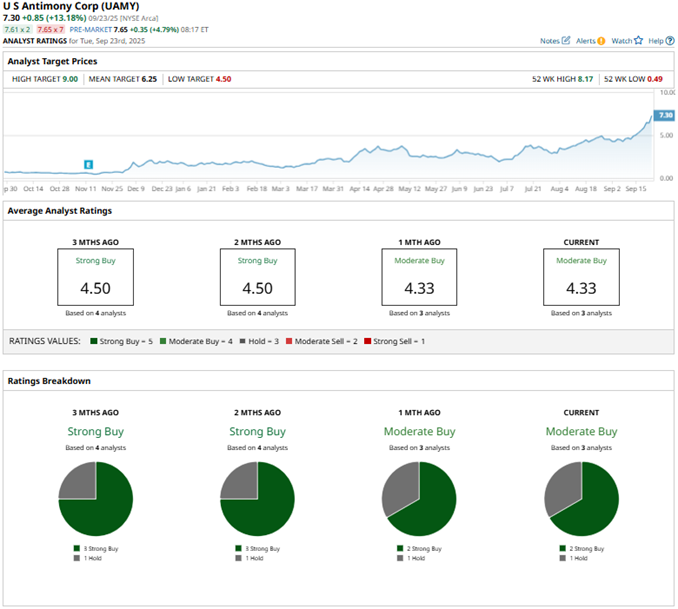

Wall Street analysts are reasonably bullish on UAMY stock. Last month, analysts at D. Boral Capital maintained a “Buy” rating on shares and a price target of $5, reflecting continued confidence in the company. In the same month, H.C. Wainwright reiterated a “Buy” rating on UAMY with a $4.50 price target, citing its financial performance and strong inventory position.

Wall Street analysts are soundly bullish on UAMY stock, with a consensus “Moderate Buy” rating overall. Of the three analysts rating the stock, two analysts give a “Strong Buy” rating while one analyst has a “Hold” rating. The consensus price target of $9.08 represents 15% upside from current levels. The Street-high price target of $9.75 points to 24% potential upside from current levels.

Key Takeaways

The antimony market’s hefty prospects and the lucrative government contract are expected to help United States Antimony stay profitable. Hence, as UAMY stock continues to surge, it might be wise to buy shares at prices below $10.