/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)

Valued at a market cap of $27 million, Rail Vision (RVSN) develops and sells railway detection systems that enhance operational safety, efficiency, and predictive maintenance. It uses specialized cameras and onboard computers to monitor train operations, prevent collisions, and reduce downtime. Rail Vision also offers cloud-based data services, maintenance solutions, and geographic mapping systems to railway operators worldwide.

Last week, Rail Vision made an unusual move into quantum computing by signing a term sheet to acquire 51% of Quantum Transportation, a startup developing error correction technology for quantum systems.

The deal involves issuing shares worth approximately 5% of Rail Vision's capital to certain shareholders of Quantum Transportation. Rail Vision will also provide a convertible loan of up to $700,000 at 8% annual interest to fund operations.

Quantum Transportation has developed a patented machine learning decoder that addresses a significant challenge in quantum computing: noise in qubits, which hinders reliable scaling. The technology works across various hardware platforms and can help smaller quantum companies test error correction methods without the need to build specialized teams.

Rail Vision plans to utilize this IP for railway applications, such as predictive maintenance and autonomous operations.

How Did Rail Vision Perform in 2025?

Rail Vision reported mixed financial results for the first half of 2025 amid operational challenges. The railway safety technology company ended Q2 with $22.3 million in cash, up from $17.2 million in 2025, providing it with runway to execute its growth strategy.

In the first six months of 2025, its revenue decreased 69% year-over-year (YoY) to $237,000 from $761,000 in the same period last year. The decline was attributed to timing issues with revenue recognition rather than lost business. Most of the revenue came from additional MainLine system installations for Israel Railways and servicing existing customers.

The company’s research and development spending increased to $3.2 million from $2.5 million, driven by higher headcount, salary increases, and currency headwinds resulting from the weakening of the dollar against the Israeli shekel. General and administrative costs also rose to $2.5 million from $2.1 million due to one-time employee bonuses and stock-based compensation.

The company posted a GAAP net loss of $5.7 million, or $0.11 per share, a substantial improvement from the $24.3 million loss reported a year earlier. That earlier figure included significant non-cash charges related to a convertible loan facility. On a non-GAAP basis, the loss narrowed to $4.9 million from $5.4 million.

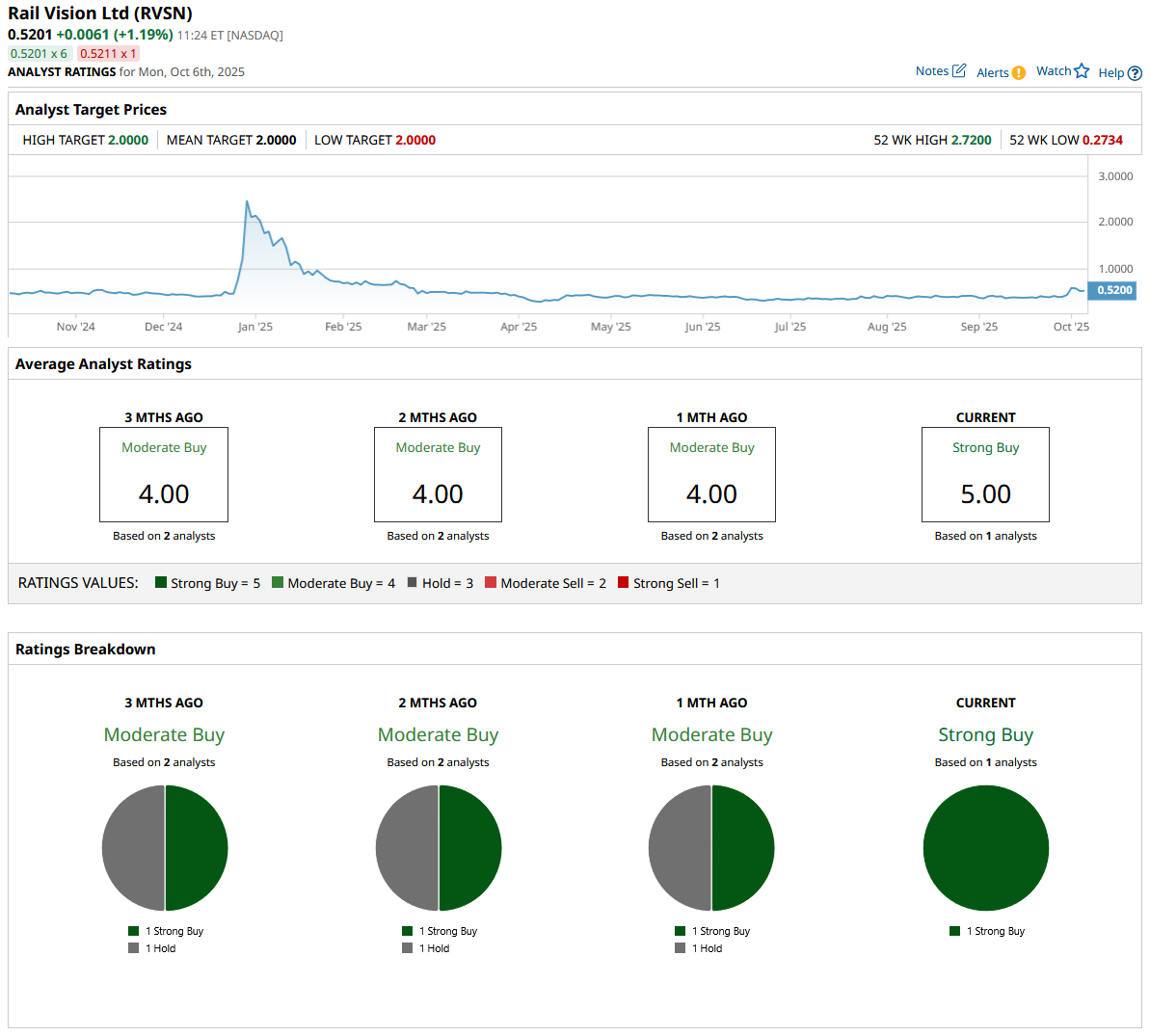

What Is the RVSN Stock Price Target?

Despite the financial challenges, Rail Vision made commercial headway. The company secured a $335,000 follow-on order from a Latin American mining operator and entered the Indian market through a partnership with Sujan Ventures.

Moreover, CEO David BenDavid expressed confidence in the company's technology and team, noting that the improved cash position provides flexibility to pursue growth while investing in innovation.

Analysts tracking RVSN stock forecast revenue to increase from $1.30 million in 2024 to $12 million in 2025. In this period, its net losses are expected to narrow from $30.71 million to $3.62 million.

A single analyst tracking RVSN stock has a “Strong Buy” rating with a price target of $2, indicating an upside potential of over 200% from current levels.