Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

- JP Morgan analyst Richard Shane upgraded Apollo Commercial Real Estate Finance, Inc. (NYSE:ARI) from Neutral to Overweight and raised the price target from $10 to $10.5. ARI shares closed at $9.98 on Friday. See how other analysts view this stock.

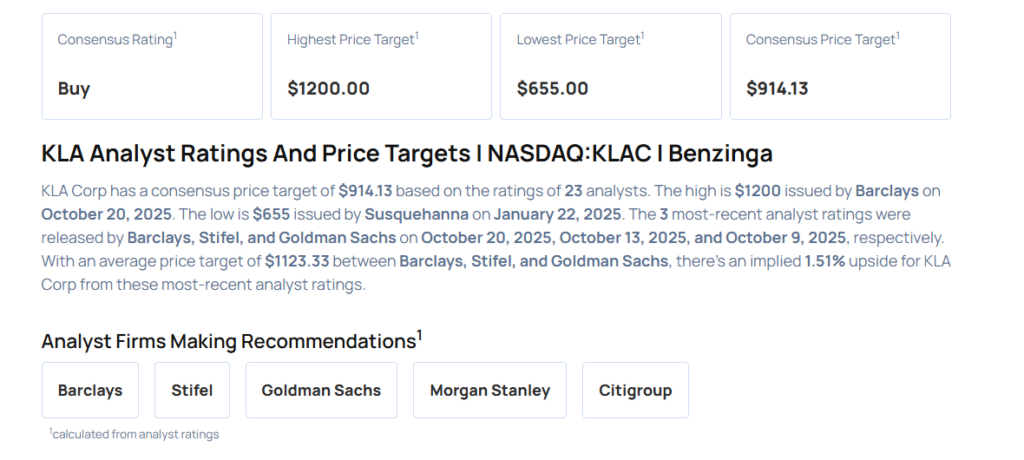

- Barclays analyst Tom O’Malley upgraded KLA Corporation (NASDAQ:KLAC) from Equal-Weight to Overweight and raised the price target from $750 to $1,200. KLA shares closed at $1,106.66 on Friday. See how other analysts view this stock.

- TD Cowen analyst Moshe Orenbuch upgraded Ally Financial Inc. (NYSE:ALLY) from Hold to Buy and raised the price target from $43 to $50. Ally Financial shares closed at $39.82 on Friday. See how other analysts view this stock.

- Barclays analyst Nicholas Campanella upgraded Sempra (NYSE:SRE) from Equal-Weight to Overweight and raised the price target from $80 to $101. Sempra closed at $91.29 on Friday. See how other analysts view this stock.

- BMO Capital analyst John Kim upgraded Prologis, Inc. (NYSE:PLD) from Underperform to Market Perform and announced a $119 price target. Prologis shares closed at $124.08 on Friday. See how other analysts view this stock.