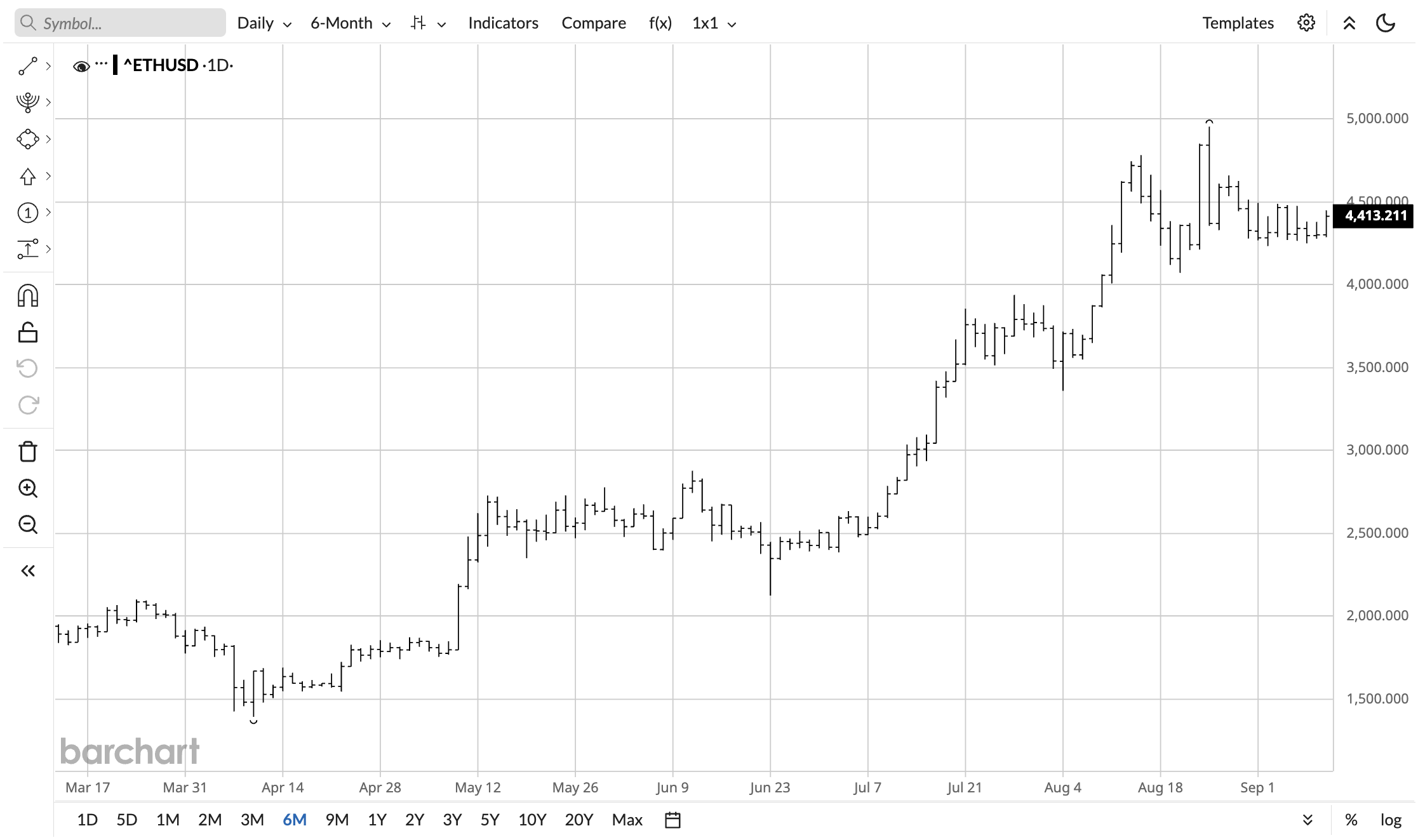

Ethereum (ETHUSD) has been lagging Bitcoin (BTCUSD) for quite some time, a historically peculiar phenomenon since ETH has outperformed BTC in every bull cycle since inception. It has only recently started closing the gap as Bitcoin plateaued and Ethereum more than doubled (up 117%) in the past six months.

Analysts now think the outperformance is just starting, and there are convincing clues.

For the first time, its exchange flux balance has turned negative. This metric tracks the cumulative net flow of ETH across all exchanges. This means more ETH tokens are leaving exchanges instead of entering them. At first glance, this looks bearish, but it is very bullish since it shows investors are moving ETH to their personal wallets as core long-term holdings.

This can lead to a supply crunch, as exchanges are the first place people go to exchange their fiat for crypto.

Exchange Reserves Drop Significantly

Exchange reserves have dropped to 15.72 million ETH. This is the lowest level since July 2016. Whales have withdrawn over 3.8 million ETH from exchanges in July 2025 alone, and large holders control 22% of the circulating supply.

Institutional investors are among the most aggressive, with ETFs increasingly scooping up supply. BitMine alone targets 5% of Ethereum's circulating supply.

The current circulating supply of Ethereum is 120.7 million. This means around 13% is on exchanges, which is significantly lower than the historical norm of 20-30%. Not only that, the pace of withdrawals has been accelerating. Around 1.2 million ETH has been leaving exchanges monthly, with Binance reporting that 500,000 ETH were withdrawn from trading platforms in just the final week of August.

Staking to Accelerate More

Interest rate cuts could supercharge current trends. The Federal Reserve is expected to cut rates this month, and this will bring the risk-free rate lower.

Ethereum staking yields get you 3-6%, and ~30% of the supply is already staked for the long term. As the interest rate falls, more investors will choose to lock up their holdings and stake them for the long term. The Beacon deposit contract alone holds 68.64 million ETH. This is ~56.8% of the supply.

Where Ethereum Could Go From Here

ETH has been consolidating and trading sideways at ~$4,300, with a recent breakout above $4,400. The long-term trend is overwhelmingly bullish if you consider the prospect of a strong altseason combined with the impending supply crunch.

The ETH to BTC ratio is a good indicator of how high ETH can go. From mid-2021 to mid-2023, 1 ETH could buy roughly 0.07 BTC. Today, 1 ETH gets you 0.038 BTC. Ethereum would have to nearly double to reach those levels.

Previous cycles have shown that Ethereum significantly outperforms Bitcoin due to its lower market cap. The recent one could be an outlier, but it can also be true that this bull cycle is more drawn-out and that Ethereum is just starting to catch up. I believe the latter is more likely.

If we look at technicals, Ethereum looks quite bullish, too. It has broken above its 20-day moving average.

A break above $4,500 could open the way to a sharp move towards $5,000.

My year-end price target is $5,500.