/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

Cathie Wood, the CEO of Ark Invest, is an unabashed fan of Tesla (TSLA). The electric vehicle (EV) company is investing heavily in robotaxis and currently is the single-largest holding in the company’s Ark Innovation ETF (ARKK), with a market value of $1.2 billion.

But it doesn’t stop there. Tesla is also Ark Invest’s top holding in two other ETFs, although with smaller positions. In all, Ark Invest holds $1.56 billion in Tesla stock, with most in the ARKK ETF.

| ETF | Weighting | Market Value |

| Ark Innovation ETF | 11.32% | $1,216,850,607 |

| Ark Next Generation ETF (ARKW) | 8.92% | $196,016,583 |

| Ark Autonomous Technology and Robotics ETF (ARKQ) | 11.83% | $156,279,180 |

| Total | $1,569,146,370 |

Wood recently celebrated a study showing that Tesla’s Robotaxi app had the 10th-most downloads on its debut in the Apple (AAPL) iOS store, beating Lyft’s (LYFT) debut and being on par with Uber’s (UBER) Apple store launch.

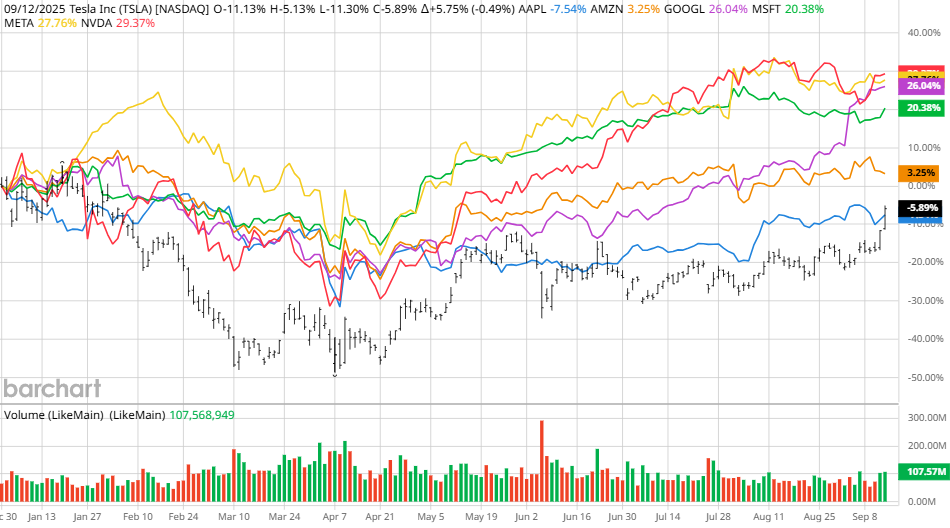

Wood refers to Tesla as the world’s “largest AI project” and predicts that the global potential market for autonomous taxi networks could reach $8 trillion to $10 trillion within a decade. But TSLA stock itself has been choppy so far this year and is struggling compared to the other “Magnificent Seven” stocks.

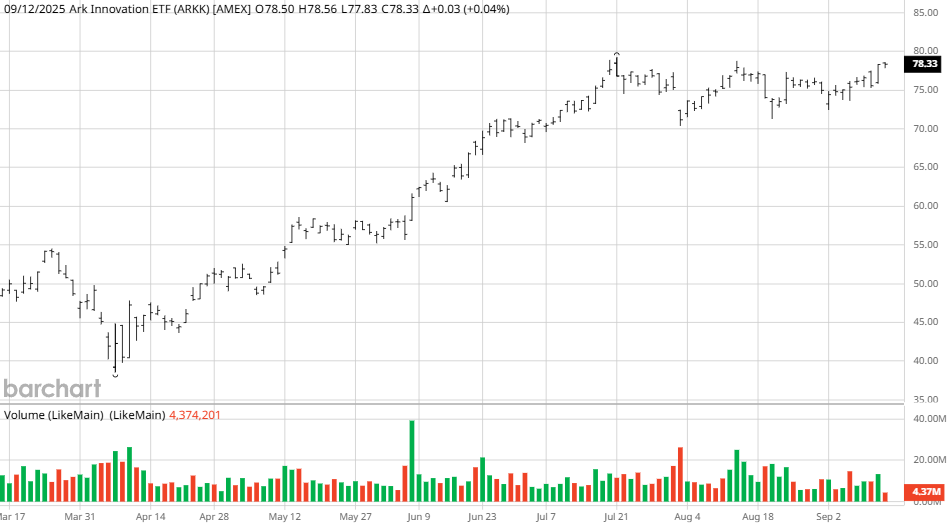

Meanwhile, the ARKK ETF is up 38% so far this year, by far outpacing TSLA stock. So, is it reasonable to use the ARKK ETF and invest in Cathie Wood stocks in general as a proxy for betting on the more volatile TSLA?

About the ARKK ETF

The ARKK ETF is managed by Ark Invest, which is headquartered in Florida. The company is helmed by Wood, who launched Ark Invest after more than 30 years combined at AllianceBernstein (AB) and Tupelo Capital Management.

The company focuses on disruptive companies and technologies, so its holdings are often technology-based and can experience volatility. The company’s ETFs include funds that are geared specifically to fintech, space exploration, 3D printing, Bitcoin (BTCUSD) and Ethereum (ETHUSD) futures, and blockchain.

The ARKK ETF is an actively managed ETF with an expense ratio of 0.75%, or $75 annually per $10,000 invested. Holdings include companies that are involved in “disruptive innovation”—which it describes as “the introduction of a technologically enabled new product or service that potentially changes the way the world works.”

The fund invests in companies that work with intelligent devices, autonomous networks, next-generation cloud products, digital wallets and assets, neural networks, and more.

The ARKK ETF is up 38% so far this year, outperforming not only TSLA but also the tech-heavy Nasdaq Composite’s ($NASX) 14% gain and the 12% gain of the S&P 500 ($SPX).

Which Stocks Does the ARKK ETF Hold?

Of course, Tesla is the top holding. Wood continues to accumulate TSLA stock for the ARKK ETF, buying $86 million in shares since July 27. But ARKK also holds 44 other stocks, with the top 10 holdings comprising a hefty 57.9% of the fund.

| Company | Weighting in ARKK |

| Tesla | 11.32 |

| Coinbase Global (COIN) | 6.28% |

| Roku (ROKU) | 6.26% |

| Tempus AI (TEM) | 6.16% |

| Roblox (RBLX) | 5.78% |

| Shopify (SHOP) | 5.02% |

| Crispr Therapeutics (CRSP) | 4.90% |

| Robinhood Markets (HOOD) | 4.60% |

| Palantir Technologies (PLTR) | 4.26% |

| Advanced Micro Devices (AMD) | 3.32% |

Should You Invest in the ARKK ETF?

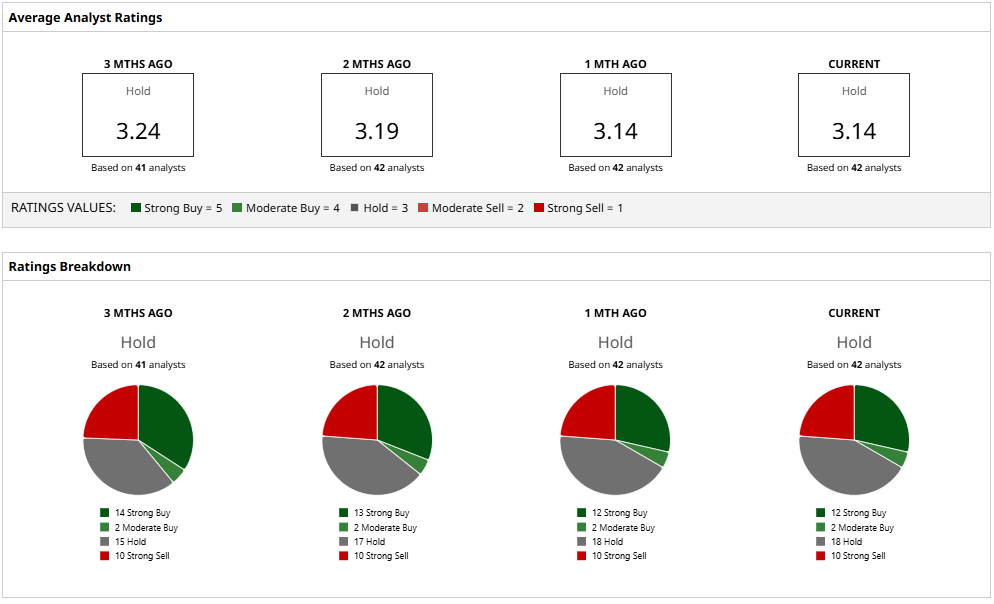

There’s no doubt that Elon Musk and Tesla have their supporters. But analysts are split down the middle on TSLA stock. Of the 42 who cover TSLA, 14 call it a “Strong Buy” or “Moderate Buy,” while 10 call it a “Strong Sell,” and 18 others are at “Hold.”

Analysts have a consensus price target of $299.28 on TSLA stock, which is nearly $100 less than it’s trading now.

While Tesla may very well become a dominant force in the robotaxi space, investors who want to hedge their bets would do well to consider the ARKK ETF. That way, you get plenty of exposure and upside for Tesla, but also the opportunity to profit from other innovative technologies identified by Wood and her team.