In a world increasingly shifting to digital records, it can be tempting to toss paperwork as soon as it starts piling up. But before you feed the shredder or dump it all in a drawer, there’s a method to knowing what to keep – and for how long.

From everyday receipts to critical legal documents, understanding these timelines could save you from financial headaches, missed reimbursements, or even identity theft.

Read on for professional organizers' top decluttering tips on what paperwork is worth keeping, how long for and more on the only exception to the timeline, which is to always keep tax paperwork for at least seven years.

How long should you wait before getting rid of important paperwork?

1. One month

Everyday paperwork like grocery receipts, ATM withdrawal slips, and utility bills can usually be discarded after one month. These documents serve short-term purposes or relate to limited 30-day return windows.

Professional organizer and certified KonMari® consultant Amélie Saint-Jacques says, 'As a general rule, we keep too much paper. The first question to ask yourself is why you want to hold on to it.

'If it's a receipt to check against your bank statement, or because you might need to return an item, then you can usually get rid of it after one month. There is also paperwork such as invitations, school permission slips, event pamphlets etc. that can be tossed straight after the date of the event.'

Knowing how to organize paperwork starts with getting rid of unnecessary paper promptly. Keeping basic receipts more than a month is likely a key reason clutter keeps creeping back into your home. However, for receipts tied to warranties, expenses, or tax deductions, you may need to file them, or take a digital backup – snapping a quick photo or scanning into a labeled folder can prevent hassle later.

Home organization pro Amélie Saint-Jacques recommends this portable file system for on-the-go organization. The built-in handle and double-latch closure keep documents secure, plus file rails that hold up to 12 folders. Handily, the water-resistant exterior easily wipes clean with a disinfecting wipe.

2. Six months

Credit card statements, medical bills, and pay stubs deserve a bit more time. These items often help resolve billing disputes or serve as income verification, so six months is a reasonable window to keep them on file.

Karina Toner, operations manager at Spekless Cleaning, explains, 'Six months is a reasonable buffer for catching billing errors or disputes. After that, most records can be accessed online or requested if needed. Documents to ditch include credit card statements (unless used for tax deductions), medical bills and EOBs (Explanation of Benefits), plus monthly pay stubs (unless needed to prove income).

'To avoid being overwhelmed by clutter, the half-year mark is also a great moment to reduce paper clutter by digitizing remaining physical copies, then shredding originals. Free scanner apps like Adobe Scan or Microsoft Lens make it easy to convert paperwork into searchable PDFs you can organize and back up securely.'

A biannual review is also a good time to look into the costly mistakes driving up your bills, and make some changes.

Home organization pro Amélie Saint-Jacques recommends this portable Bonsaii home shredder, which can shred up to 6 sheets of paper at a time. It has a sizeable 3.4-gallon wastebasket, and also includes a manual-reverse function to protect the paper shredder from the frustration of paper jams.

3. One year

Bank statements, utility bills used for tax purposes, mortgage escrow summaries, and insurance renewals should be kept for a year. These documents help with financial planning, annual reviews, or tax filing. After twelve months, newer documents will typically replace the need for older versions.

Ben Soreff, professional organizer at House to Home Organizing, says, 'In terms of paper management, the first step is to not care where a piece of paper came from. I don't care if the paper is from the president or the pope – the only thing I'm concerned about is the action.

'The vast majority of paper is being kept just in case for tax purposes. This is fine, but it can be stored more remotely.'

A good filing system is one of the six easy steps to reducing overwhelm when organizing important documents. This is particularly important for tax record-keeping.

Audra George, owner of Oklahoma-based Pretty Neat, says, 'Annual membership statements and credit card statements can go after a year, no problem.

'However, anything to do with your personal taxes should be kept seven years after taxes were completed for IRS standards. Organize these papers year-by-year in case of an audit. This is very important and trumps all other rules.'

Our experts recommend this lockable, steel, three-drawer filing cabinet as a safe and reliable way to organize documents. The built-in sliding rail ensures easy and quiet opening and closing of the drawers, while its interlock system with dual keys, ensures your files and valuables remain safe.

4. Never

Certain documents should never be thrown in the trash. These include vital records like birth and death certificates, marriage licenses, and property deeds.

Toner says, 'Documents you need to keep forever include birth and death certificates, social security cards, marriage licenses and divorce decrees, wills, powers of attorney, legal documents, property deeds, adoption papers, and citizenship documents.

'Since they're so important, and many are very difficult or expensive to replace, I advise keeping originals in a fireproof, waterproof safe and storing digital backups in a secure cloud service like Google Drive with two-factor authentication enabled.'

Important documents like these are among the 15 things you should never store in your basement. While they needn't be kept forever, remember that tax returns and supporting records should be retained for at least seven years.

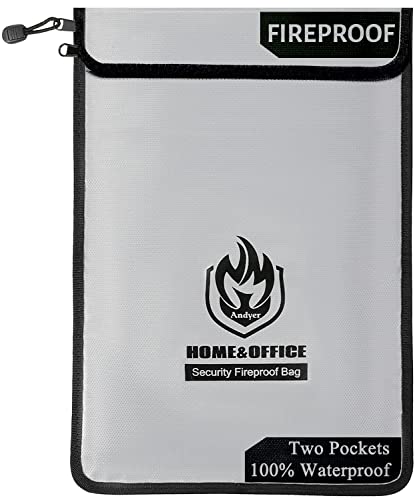

Cleaning and organization pro Karina Toner recommends this fireproof bag, which has two pockets, sealed zippers, and can withstand ultra-high temperatures. She says, 'This compact, water-resistant bag is ideal for storing irreplaceable documents safely in your home.'

Meet the experts

So there you have it – how long to keep important paperwork, the best ways to store it and the one exception to the rule.

When it comes to paperwork, timing is everything. Understanding what to keep and for how long isn’t just about staying organized – it’s about protecting your finances, identity, and peace of mind.

Use these timelines to declutter smartly and store safely, knowing you’ve kept only what truly matters.

Next, learn how to organize any space in six steps for maximum functionality.

.png?w=600)