When Warren Buffett speaks, Wall Street listens. And when one of his portfolio companies makes a headline-grabbing move, investors can’t help but take notice. That’s precisely what happened last week when Kraft Heinz (KHC) shocked the market with a bold plan to split into two separate companies.

The move didn’t just surprise investors—it also drew a rare public expression of dissatisfaction from none other than Buffett himself. The legendary investor, whose Berkshire Hathaway (BRK.A) (BRK.B) owns more than a 27% stake in Kraft Heinz and remains its largest shareholder, admitted he was “disappointed” with management’s decision to pursue the breakup, arguing that it will be costly, disruptive, and ultimately not the right course for shareholders. However, while Buffett’s critique pushed KHC stock down about 7% in a single session, the announcement has reignited a broader conversation about whether Kraft Heinz could be at an inflection point.

So, is Kraft Heinz’s surprise split a red flag—or a rare chance to grab a Buffett-backed dividend stock on the cheap? Let’s dive deeper into the story and weigh the potential risks and rewards for investors today.

About Kraft Heinz Stock

With a market cap of $32.3 billion, Kraft Heinz is a global food and beverage powerhouse. The company produces and sells a broad range of products, including condiments, sauces, cheese, meals, meats, and beverages, under well-known brands such as Kraft, Oscar Mayer, Heinz, Philadelphia, and Lunchables. It distributes its products through multiple channels, including supermarkets, convenience stores, and e-commerce platforms, with a substantial share of revenue generated from key customers such as Walmart.

Shares of the food company have dropped 12.8% on a year-to-date (YTD) basis, with much of the decline driven by Warren Buffett’s expression of “disappointment” over Kraft Heinz’s recent decision to split. Zooming out, KHC stock has been on a downtrend over the past year amid sluggish sales impacted by changing consumer behavior and economic uncertainty.

Kraft Heinz Shakes Up the Market with Its Breakup Plan

Last Tuesday, Kraft Heinz announced plans to split into two companies, effectively undoing much of the $46 billion merger from a decade ago that had created one of the world’s largest food firms. Warren Buffett, the legendary investor whose Berkshire Hathaway is Kraft Heinz’s largest shareholder, told CNBC that he was disappointed with the move. The company’s shares ended the trading session down roughly 7% after Buffett’s comments.

Under the split, one global company would sell sauces, spreads, and seasonings, while the other would focus on grocery staples in North America. Kraft Heinz CEO Carlos Abrams-Rivera will lead the $10 billion North American grocery business, which will encompass brands like Oscar Mayer, Kraft Singles, and Lunchables. The other business, generating about $15 billion in annual sales, will have a global focus on “taste elevation,” featuring brands such as Heinz ketchup, Philadelphia cream cheese, and Kraft Mac & Cheese, according to the company.

Kraft Heinz stated that the move is intended to establish more focused, less complex businesses, further reinforcing a shift away from the food industry’s longstanding strategy of pursuing scale through mergers and acquisitions. “Scale by itself is not the answer, but having scale along with focus creates opportunities,” said CEO Abrams-Rivera. The split is anticipated to be completed in the second half of 2026.

In recent years, Kraft Heinz has faced challenges as demand has weakened for several of its core products, including Lunchables, Capri Sun, macaroni and cheese, and mayonnaise. Abrams-Rivera also noted that Kraft Heinz’s complexity has been a hurdle, as its nearly 200 brands spanning around 55 categories and 150 countries have made it difficult to invest fully in each one. That said, he believes the split will allow executives of the North American staples business to focus on a narrower market and pursue growth in channels such as convenience stores that have not yet been a priority.

However, Mr. Buffett, who, together with Brazilian private equity firm 3G Capital Partners, orchestrated the merger of Kraft and Heinz in 2015, believes the split is not the right decision. In an interview with the Wall Street Journal, the Oracle of Omaha said that Kraft Heinz’s breakup plan would be both costly and disruptive, adding that shareholders should have gotten a vote. He noted that Greg Abel, who is set to succeed him as CEO in January, recently told Kraft Heinz representatives that Berkshire Hathaway does not support the split. “It doesn’t create value, and it involves lots of expenses,” Buffett said.

Meanwhile, Buffett’s Berkshire Hathaway holds a stake of over 27% in Kraft Heinz, making it the company’s largest shareholder. Berkshire hasn’t made any changes to its stake since the 2015 merger. Mr. Buffett told the WSJ that he doesn’t know what the future holds for that stake. “Ten years ago, we said great things were going to happen because you put the two together. If you’re honest about it, what’s happened has not been impressive,” he said.

It’s also worth noting that such breakups are not new to the food and beverage industry, as more major food companies pursue divisions to shed slower-growth categories and regain investor confidence. In August, Keurig Dr Pepper (KDP) revealed plans to unwind the 2018 merger that combined a coffee company with the owner of 7UP. And two years ago, Kellogg separated its snacks division into Kellanova (K) and rebranded itself as WK Kellogg (KLG).

TD Cowen analyst Robert Moskow said that food megamergers have generally seen low success rates. The analyst noted that the skills and investments needed to succeed across various areas of the grocery store often differ, and companies with more focused portfolios tend to have better long-term success than highly diversified ones. However, he acknowledged that dividing Kraft Heinz into two separate companies could be complicated.

Kraft Heinz Sales Fall Again in Q2

As noted earlier, Kraft Heinz has struggled recently from weakening demand for some of its core products, a trend clearly reflected in its latest earnings report. The company reported a 1.9% year-over-year (YoY) decline in net sales to $6.35 billion and a 2.0% drop in organic net sales to $6.33 billion. The decline was mainly driven by an unfavorable volume/mix that outweighed the benefit of higher pricing. With that, the core issue facing Kraft Heinz is that many of its mature brands have reached saturation in most of the company’s key markets. And this is arguably the very issue that the recent push to split the company aims to tackle.

Kraft Heinz has been reshuffling its portfolio and directing investments toward healthier products that better align with shifting consumer preferences. Also, to drive sales, the company has recently introduced initiatives such as offering a larger box of macaroni and cheese designed to serve a family of five for under $2 and upgrading the quality of cookies and crackers in Lunchables. In July, KHC stated that it anticipates costs to increase by 5% to 7% this year, though only part of that rise is being passed on to consumers.

Meanwhile, Kraft Heinz reported a GAAP loss of $6.60 per share for the quarter, weighed down by a $9.3 billion noncash impairment charge, which the company attributed mainly to a prolonged decline in its share price and market capitalization.

Looking ahead, management reaffirmed its downbeat full-year guidance, projecting adjusted EPS of $2.51 to $2.67, a YoY decline of 13% to 18%, and organic net sales to fall between 1.5% and 3.5% compared to the previous year.

KHC Analysts’ Estimates, Valuation, and Dividend Yield

Analysts tracking the company predict a 15.04% YoY drop in its adjusted EPS to $2.60 for fiscal 2025. Also, Wall Street expects KHC’s revenue to fall 2.46% YoY to $25.21 billion in FY25.

In terms of valuation, priced at 10.50 times forward adjusted earnings, the stock trades at a discount compared to the sector’s median of 16.77x and its own five-year average of 12.75x. I believe the stock is cheap at its current levels, even when factoring in its declining top and bottom lines. With that, the potential for further downside in its share price seems relatively limited.

KHC stock could even be seen as an appealing option for income-focused investors, given its high yield. Kraft Heinz’s annualized dividend of $1.60 per share translates into a dividend yield of 5.86%, which is well above the sector median of 3%.

What Do Analysts Expect for KHC Stock?

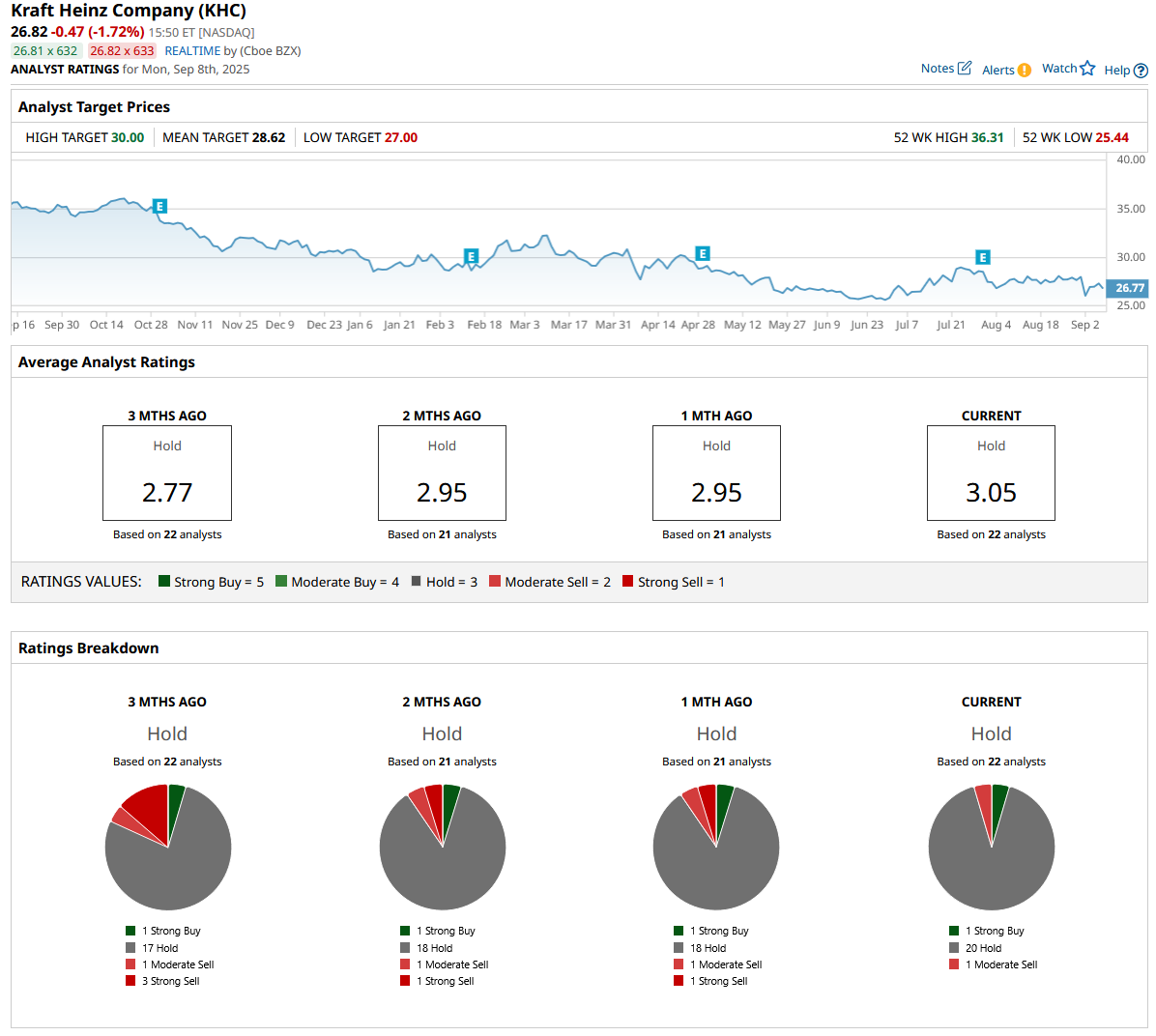

Wall Street analysts maintain a cautious stance on KHC stock, as evidenced by its consensus “Hold” rating. Of the 22 analysts covering the stock, 20 recommend holding, while one rates it a “Strong Buy” and another a “Moderate Sell.” Notably, KHC stock currently trades near its average price target of $28.62.

It’s also worth noting that analysts had mixed reactions to the company’s plan to split. Last Wednesday, Morgan Stanley’s Megan Alexander upgraded the stock to “Equal Weight,” noting that the sharp decline in Kraft Heinz’s share price has brought the food giant to a “reasonable” valuation as it moves closer to splitting into two separate companies. At the same time, analysts from Wells Fargo, Stifel, BofA, and UBS lowered their price targets on the stock following the news.

The Bottom Line on KHC Stock

Putting it all together, I believe Kraft Heinz’s split could ultimately be a positive development. It seems logical to me to have one company focused on a global reach while the other concentrates on the North American market, given the differences in culinary preferences across regions. With that, if a North American company can curb sales declines through greater concentration on its home market, while a globally oriented company targets international growth opportunities, investors could benefit over the long run. And the current valuation leads me to believe that KHC stock is “too cheap to ignore,” particularly when factoring in its solid dividend yield.