Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

- Keefe, Bruyette & Woods analyst Kelly Motta downgraded First Bancorp (NYSE:FBP) from Outperform to Market Perform and lowered the price target from $26 to $24. First BanCorp shares closed at $20.35 on Friday. See how other analysts view this stock.

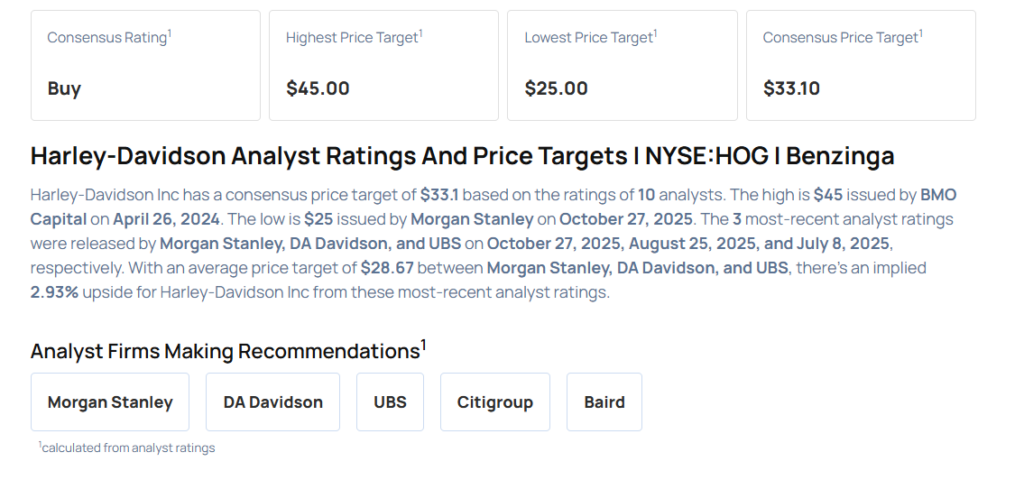

- Morgan Stanley analyst Adam Jonas downgraded Harley-Davidson Inc (NYSE:HOG) from Equal-Weight to Underweight and slashed the price target from $27 to $25. Harley-Davidson shares closed at $28.21 on Friday. See how other analysts view this stock.

- HC Wainwright & Co. analyst Ananda Ghosh downgraded Avidity Biosciences Inc (NASDAQ:RNA) from Buy to Neutral and cut the price target from $87 to $72. Avidity Biosciences shares closed at $49.15 on Friday. See how other analysts view this stock.

- Loop Capital analyst Chris Dankert downgraded MRC Global Inc (NYSE:MRC) from Buy to Hold and maintained the price target of $16. MRC Global closed at $14.47 on Friday. See how other analysts view this stock.

- Jefferies analyst Julien Dumoulin-Smith downgraded TXNM Energy Inc (NYSE:TXNM) from Buy to Hold but raised the price target from $58 to $61.25. TXNM Energy shares closed at $56.80 on Friday. See how other analysts view this stock.