/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

C3.ai (AI) is a leading provider of enterprise artificial intelligence (AI) software, enabling global organizations to accelerate their digital transformation through advanced AI solutions. The company offers a robust platform and over 130 turnkey AI applications tailored for industries such as manufacturing, energy, financial services, defense, and government. C3.ai empowers clients, including Fortune 500 firms and federal agencies, to optimize operations, anticipate challenges, and unlock actionable insights at scale.

Founded in 2009, it is headquartered in Redwood City, California.

C3.ai Weakens in 2025

C3.ai shares rose 6% over the last five days but have been breakeven in the past month and have slid a steep 32% over the last three months. Its 52-week performance marks a 23% decline, with AI stock now hovering near its yearly lows. In sharp contrast, the Russell 2000 benchmark saw comparatively modest moves: up 1.8% in five days, up 9.3% in a month, and up 15% in a 52-week timeframe.

C3.ai’s steeper losses, driven by weak earnings and management turnover, highlight persistent operational and sentiment challenges relative to the broader small-cap market.

C3.ai Reports Q3 Results

C3.ai recently reported a quarterly loss per share of $0.37, slightly better than analyst expectations of a $0.38 loss. Quarterly revenue totaled $70.3 million, which missed consensus estimates of $94.5 million and represented a 19% year-over-year (YoY) decline.

Analysts revised their annual forecasts sharply downward after this miss, projecting FY2026 revenue of $323 million—a considerable reduction from the previous $420 million estimate—and expecting full-year losses of $3.20 per share, indicating greater challenges ahead.

Diving deeper, C3.ai’s key financial metrics reveal ongoing profitability hurdles. For the last fiscal year, the firm posted total revenue of $310.8 million, with gross profit at $192.9 million. However, operating expenses climbed to $460.3 million, leading to an operating loss of $267.4 million and a net loss of $268.3 million. Despite these headwinds, C3.ai maintains a robust cash position, reporting $743 million in reserves and no debt as of April 2025. This substantial cash runway positions the company to invest in growth and weather current losses.

Regarding guidance, management recently withdrew its previous financial projections, reflecting market uncertainty and company restructuring. The firm now aims to prioritize partner network expansion and enhance its AI platform, with new strategic initiatives, but no quantitative forward-looking guidance is provided.

Big Bets on Robotics

On Tuesday, C3.ai introduced its next generation of robotic process automation (RPA), powered by the C3 Agentic AI Platform. This new solution transforms traditional RPA by leveraging autonomous AI agents, allowing organizations to automate both business and operational workflows with advanced reasoning capabilities.

Processes such as customer service, invoice processing, and supply chain operations can now be executed more intelligently. Users benefit from a no-code, interactive natural language interface, making it easy for any employee to author and launch scalable AI-driven processes in minutes, significantly reducing the barrier to enterprise-wide automation.

Should You Bet on AI Stock?

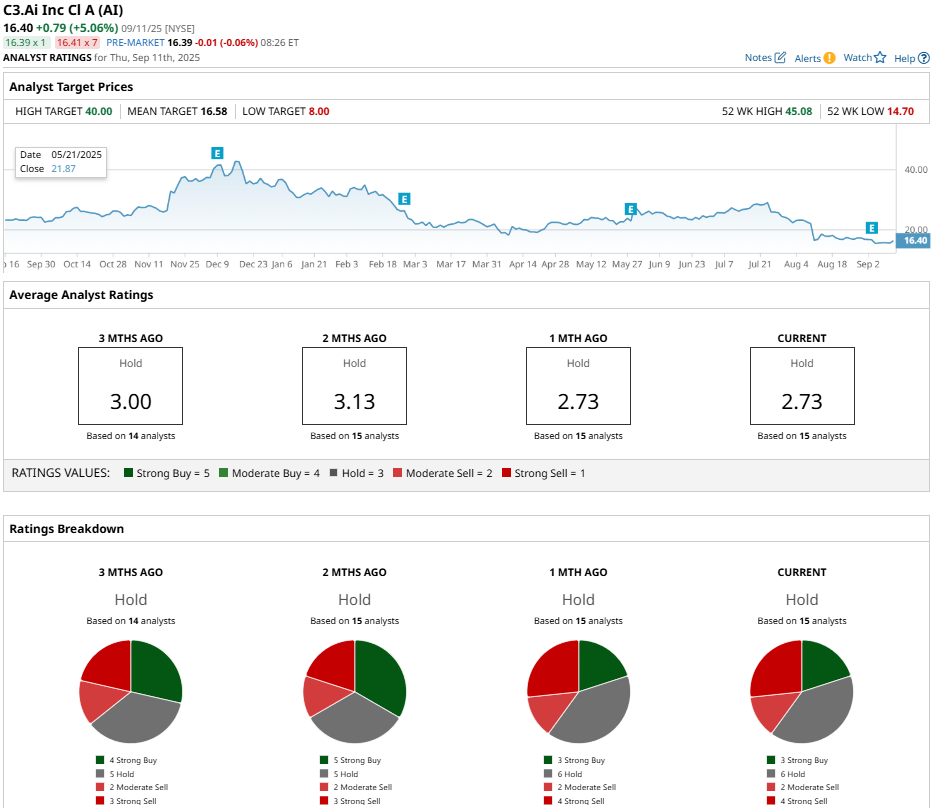

Analyst confidence in C3.ai remains low with a consensus “Hold” rating and a mean price target of $16.58, which remains at par with the current market rate.

AI stock is covered by 15 analysts while receiving three “Strong Buy” ratings, six “Hold” ratings, two “Moderate Sell” ratings, and four “Strong Sell” ratings from Wall Street.