Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

- Piper Sandler analyst Derek Podhaizer initiated coverage on Select Water Solutions, Inc. (NYSE:WTTR) with an Overweight rating and announced a price target of $15. Select Water Solutions shares closed at $9.28 on Monday. See how other analysts view this stock.

- JP Morgan analyst Adrian Huerta initiated coverage on Amrize Ltd (NYSE:AMRZ) with an Overweight rating and announced a price target of $57. Amrize shares closed at $50.57 on Monday. See how other analysts view this stock.

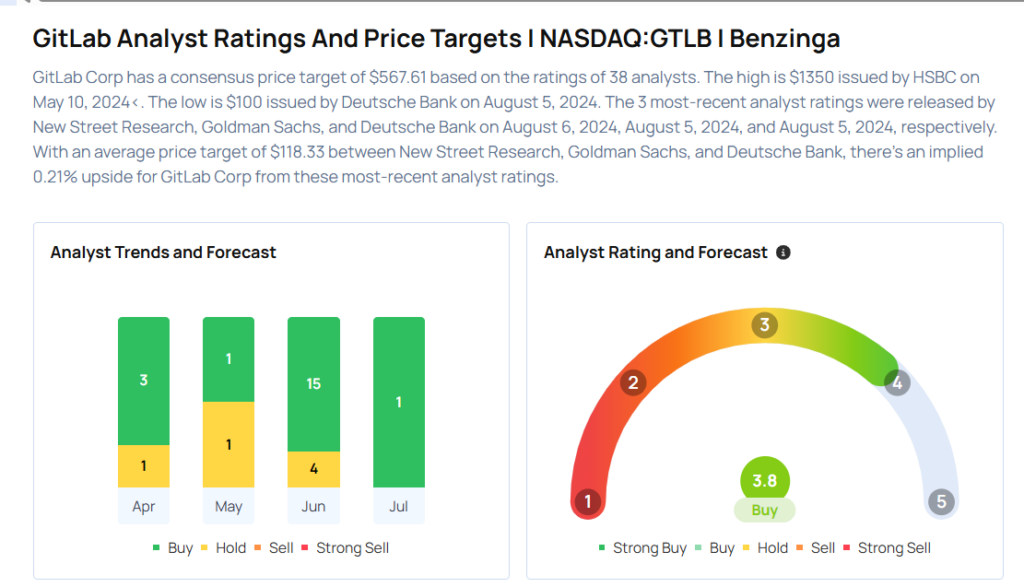

- Rosenblatt analyst Blair Abernethy initiated coverage on GitLab Inc. (NASDAQ:GTLB) with a Buy rating and announced a price target of $58. GitLab shares closed at $42.57 on Monday. See how other analysts view this stock.

- Barclays analyst Julian Mitchell initiated coverage on Ralliant Corporation (NYSE:RAL) with an Overweight rating and announced a price target of $60. Ralliant shares closed at $47.36 on Monday. See how other analysts view this stock.

- Goldman Sachs analyst Andrea Newkirk initiated coverage on Revolution Medicines, Inc. (NASDAQ:RVMD) with a Buy rating and announced a price target of $65. Revolution Medicines shares closed at $38.37 on Monday. See how other analysts view this stock.