Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

- HSBC analyst Samantha Hoh downgraded Bloom Energy Corp (NYSE:BE) from Buy to Hold but raised the price target from $44 to $100. Bloom Energy shares closed at $87.58 on Wednesday. See how other analysts view this stock.

- DA Davidson analyst Jeff Rulis downgraded QCR Holdings Inc (NASDAQ:QCRH) from Buy to Neutral and announced a price target of $83. QCR Hldgs shares closed at $74.87 on Wednesday. See how other analysts view this stock.

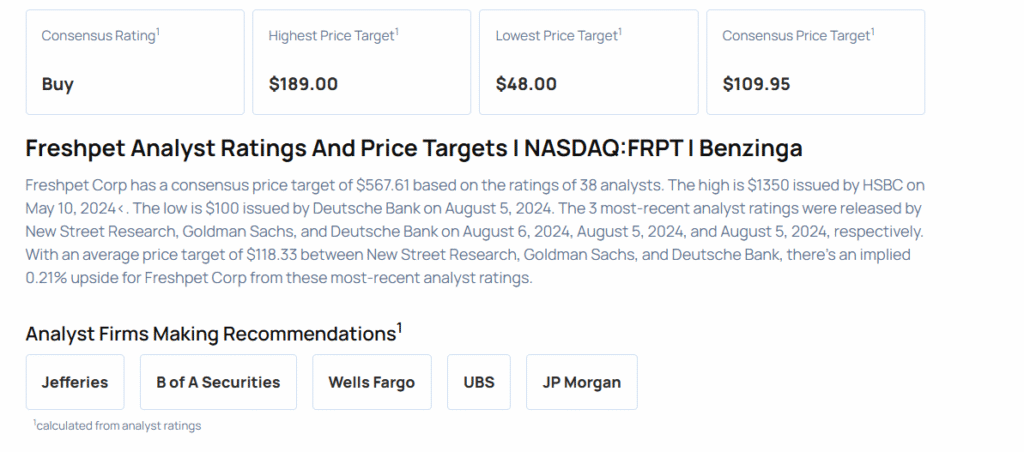

- Jefferies analyst Kaumil Gajrawala downgraded Freshpet Inc (NASDAQ:FRPT) from Buy to Hold and cut the price target from $97 to $53. Freshpet shares closed at $49.51 on Wednesday. See how other analysts view this stock.

- JP Morgan analyst Jimmy Bhullar downgraded Renaissancere Holdings Ltd (NYSE:RNR) from Overweight to Neutral and announced a $303 price target. RenaissanceRe shares closed at $262.15 on Wednesday. See how other analysts view this stock.

- Canaccord Genuity analyst Dalton Baretto downgraded the rating for Teck Resources (TSX:TECK) from Buy to Hold but raised the price target from C$62 to C$63. See how other analysts view this stock.