/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

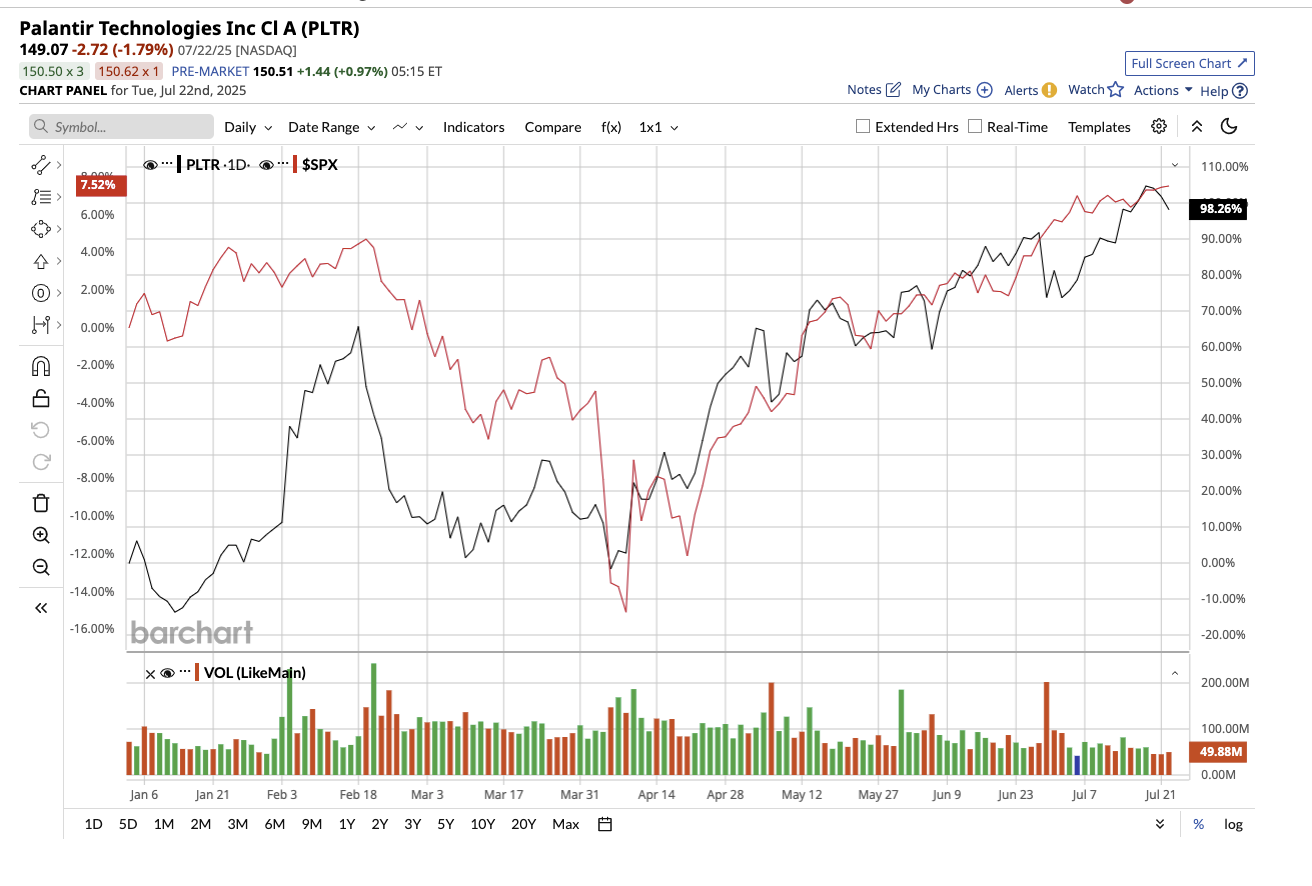

Artificial intelligence (AI) is the new arms race, with investors constantly looking for the next Nvidia (NVDA). Nvidia’s meteoric rise, fueled by its dominance in AI-powered GPUs, has made it the poster child for the AI boom. Valued at $351.8 billion, Palantir Technologies (PLTR) is one such contender quietly making big moves by transforming how enterprises and governments deploy AI at scale. However, it has received a mixed response in the market. Some praise its rapid growth and close ties with the government, while others question its complex business model and its durability. Nonetheless, Palantir stock is up an impressive 100% year-to-date, outperforming the broader market.

Despite Palantir’s impressive growth over the last few quarters, most analysts remain bearish on the stock. Let us see if the stock is still a buy regardless of the skepticism.

Q1 Signaled a Turning Point

Palantir develops software that enables organizations to make better data-driven decisions. Its platforms Gotham and Foundry combine and analyze large amounts of complex data to reveal insights. CEO Alex Karp described the company’s Q1 results as an “earnings adventure,” proving that it is no longer the misunderstood outsider in the AI and software space. Surging demand for its Artificial Intelligence Platform (AIP), a suite of tools that enables enterprises to deploy AI agents safely and effectively at scale, drove a 39% increase in revenue to $884 million in the first quarter. The company also reported a profit of $0.08 per share.

Palantir’s U.S. commercial business exceeded $1 billion in annual run rate for the first time, with 71% year-over-year (YoY) growth and 19% sequential growth. For years, critics claimed Palantir could not expand beyond government contracts or enter the commercial mainstream. However, the company has proven everyone wrong. In the first quarter alone, U.S. commercial total contract value (TCV) bookings reached $810 million, up 183% YoY.

While commercial success is growing, Palantir has not lost sight of its long-standing dominance in the defense and public sectors. Q1 government revenue grew 45% YoY to $487 million, including U.S. government revenue of $373 million, up 45% YoY, and International government revenue of $114 million, also up 45% YoY. These gains were fueled by ongoing initiatives and significant new contracts. Notably, Palantir has expanded its work in healthcare and defense in the U.K., as well as formed a new partnership with NATO. The company also successfully delivered TITAN vehicles to the U.S. Army on time and within budget.

Despite speculation that the U.S. government may reduce defense spending, Palantir is seeing a surge in demand for its Maven Smart System, an AI command platform, and other core programs. NATO member state have also now implemented the Maven systems. Karp emphasized, “We are seeing rapid expansion and very significant demand for Maven both in America and outside of America.” Palantir’s net dollar retention rate increased to 124% in the quarter, indicating that existing customers are significantly increasing their usage over time, an important metric for recurring revenue. Adjusted free cash flow reached $370 million in the quarter, with a target of $1.6 billion to $1.8 billion for the year. Palantir also held $5.4 billion in cash, cash equivalents, and short-term U.S. Treasury securities.

Palantir is not just growing. It is highly profitable, generating actual cash and reinvesting in AI development. The company will release its second-quarter earnings on Aug. 4. Analysts expect Palantir’s revenue to be $939.3 million, slightly higher than the company’s estimates and representing a 38% year-over-year increase. GAAP EPS could rise by 33%, reaching $0.08 per share. Analysts predict that the company’s earnings will climb by 41.9% in 2025 and another 26.8% in 2026. This growth is reflected in its premium valuation of 256 times forward 2025 estimated earnings. However, risk-averse investors may wish to wait for a better entry point to invest with a margin of safety.

What Is Wall Street Saying About Palantir Stock?

Much of analysts’ bearish outlook for Palantir stock stems from its overvaluation and overreliance on government contracts. Despite the company’s rapid expansion in the commercial segment, William Blair analyst Louie DiPalma remains cautious. DiPalma believes Palantir’s projected government-related annual recurring revenue (ARR) will exceed $150 million in the near term but cautions that a heavy reliance on government contracts and a competitive landscape create uncertainty.

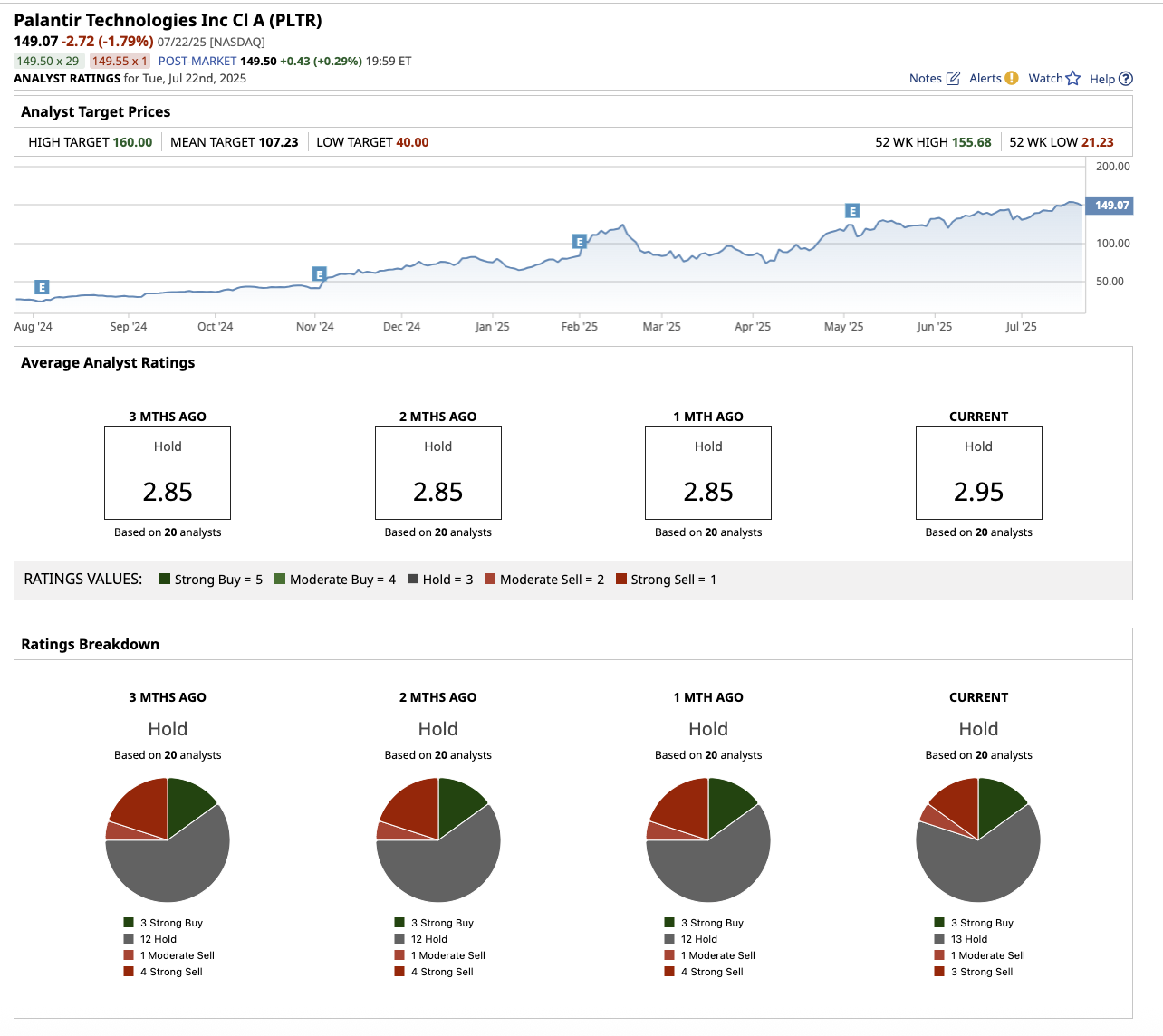

Overall, on Wall Street, PLTR stock is a “Hold.” Of the 20 analysts covering the stock, three recommend a “Strong Buy,” 13 suggest holding, one says it is a “Moderate Sell,” and three have given it a “Strong Sell” rating. The stock is way over its average target price of $107.23. However, the high price estimate of $160 suggests a rally of over 7.3% from current levels.

The Bottom Line on PLTR Stock

Palantir has everything it needs to thrive in the coming years, including strong government contracts, accelerating commercial momentum, disciplined cost management, and a game-changing AIP platform. Patient investors who can ignore the short-term noise may discover a long-term compounder in the making.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.