/Drone%20flying%20by%20Pexels%20via%20Pixabay.jpg)

AeroVironment (AVAV) is trading at a valuation considered steep, but that hasn’t tempered analysts’ enthusiasm. The company remains in favor largely because of its accelerating growth in unmanned systems, recent strategic acquisitions such as BlueHalo, and strong contract wins that expand its military and defense footprint.

Notably, Bank of America initiated coverage on AVAV stock and set a $300 price target, reflecting confidence that demand in drone, counter-drone, and autonomous systems markets will sustain the company's growth. Analysts see AeroVironment as well positioned to benefit from rising drone use in military operations, even as investors contend with premium valuations and limited margin for error.

About AeroVironment Stock

Based in Arlington, Virginia, AeroVironment is a prominent defense technology company known for its expertise in developing and producing unmanned aerial systems (UAS). With a market capitalization of roughly $14.4 billion, it holds a strong and influential position within the aerospace and defense industry.

Over the past 52 weeks, AeroVironment stock has delivered solid gains, rising 58% over that period. The stock closed the last session at $288.08, just around 3% below its 52-week high of $295.90, reached on June 30.

AVAV stock is also up by 87% on a year-to-date (YTD) basis, driven by defense tailwinds and heightened demand for unmanned aerial systems. Despite recent valuation concerns, this strong performance underscores the market’s bullish view of its future in the defense industry.

AVAV stock currently trades at a premium compared to the sector median as well as its own historical average, trading at 78.15 times forward earnings and 16.95 times forward sales.

AeroVironment's Steady Topline Performance

AeroVironment released its first-quarter fiscal 2026 results on Sept. 9, reporting revenue of $454.7 million, up 140% year-over-year (YOY), driven in large part by the contribution from its recently acquired BlueHalo business alongside solid performance in its Autonomous Systems (AxS) and Space, Cyber and Directed Energy (SCDE) segments. The acquisition of BlueHalo added $123.7 million to product revenue and $111.5 million to service revenue in the quarter.

The AxS segment contributed $285.3 million, while the company's SCDE segment accounted for $169.4 million. Funded backlog stood at a record $1.1 billion, as compared to $726.6 million as of April 30, 2025. Meanwhile, bookings during the quarter were $399 million.

However, profitability lagged as adjusted EPS came in at $0.32, missing analyst expectations, and down significantly from $0.89 for the same quarter last year.

On the guidance front, AeroVironment affirmed its full-year fiscal 2026 revenue forecast of $1.9 billion to $2 billion and adjusted EPS outlook of $3.60 to $3.70. The company also reiterated expectations for adjusted EBITDA in the range of $300 million to $320 million, signaling confidence in continued demand, its strong backlog, and improving margin trends.

Analysts predict EPS to be around $3.63 for fiscal 2026, up 11% YOY, before surging by another 25% annually to $4.53 in fiscal 2027.

What Do Analysts Expect for AeroVironment Stock?

Bank of America recently launched coverage of AeroVironment stock with a “Buy” rating and a $300 price target, citing strong growth prospects in military drone and counter-drone technologies. Analysts highlighted AeroVironment’s expanding portfolio, which includes autonomous systems, precision strike platforms, counter-UAS systems, and space-based systems, among other technologies. They see the company as a key beneficiary of the U.S. Department of War’s heightened focus on low-cost “attritable” drones.

On Sept. 10, Needham also reiterated a “Buy” rating on AeroVironment with a $300 price target. This reaffirmation follows the company's robust fiscal first-quarter performance.

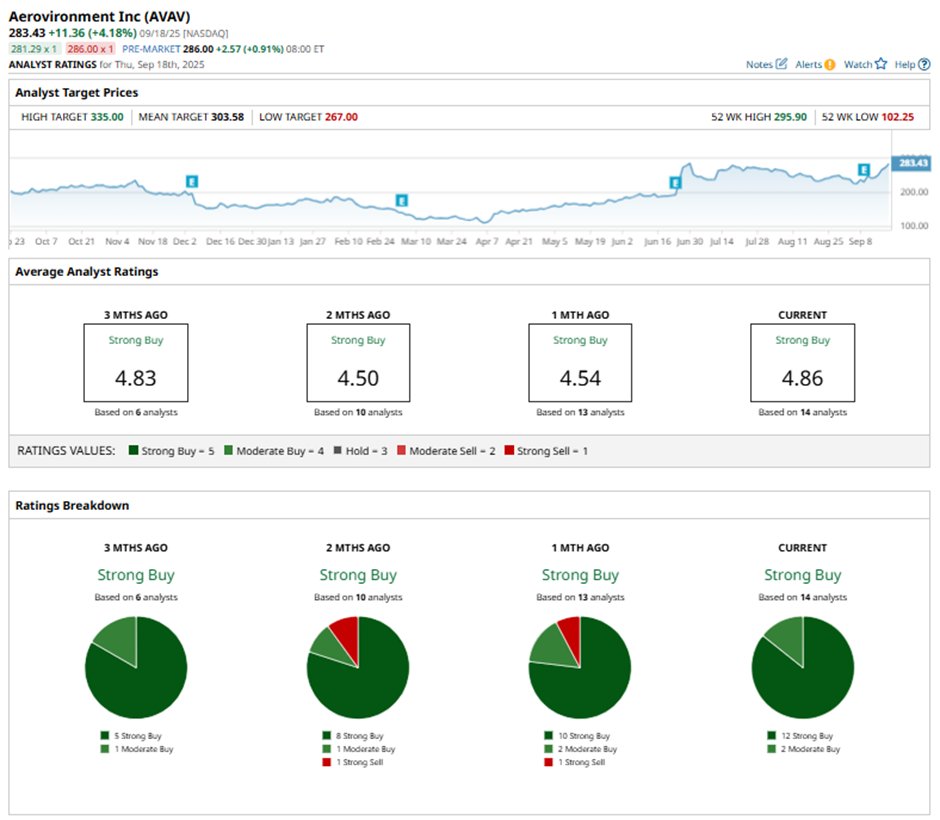

Wall Street is majorly bullish on AVAV stock. Overall, AVAV stock has a consensus “Strong Buy” rating. Of the 14 analysts covering the stock, 12 advise a “Strong Buy,” while two suggest a “Moderate Buy" rating.

The average analyst price target for AVAV stock is $303.31, indicating potential upside of 5%. The Street-high target price of $335 suggests that the stock could rally as much as 16% from current levels.