Molson Coors (TAP) is back in focus after it revealed a broad-based restructuring plan that would cut hundreds of jobs and remake its Americas unit. The announcement comes on the heels of last month's hiring of Rahul Goyal as chief executive of the brewer, which was its latest signal that it was turning emphatically to bigger-margin, more-rapidly growing markets. Investors are scrutinizing whether such efforts would help stir up growth again or simply highlight traditional brewers' structural decline.

About Molson Coors Stock

Molson Coors is a leading brewer of the globe with brands such as Coors Light, Miller Lite, Blue Moon, and Madri under its belt. With its main offices in Golden, Colorado, as well as Montreal, it controls a market capitalization of approximately $9.2 billion and is present in the Americas, Europe, and Asia-Pacific regions. In recent years, Molson Coors was moving on from being a purely beer company to becoming a more diversification-oriented beverage company with added Fast Start drinks, ready-to-pour drinks, and alcohol-free beverages.

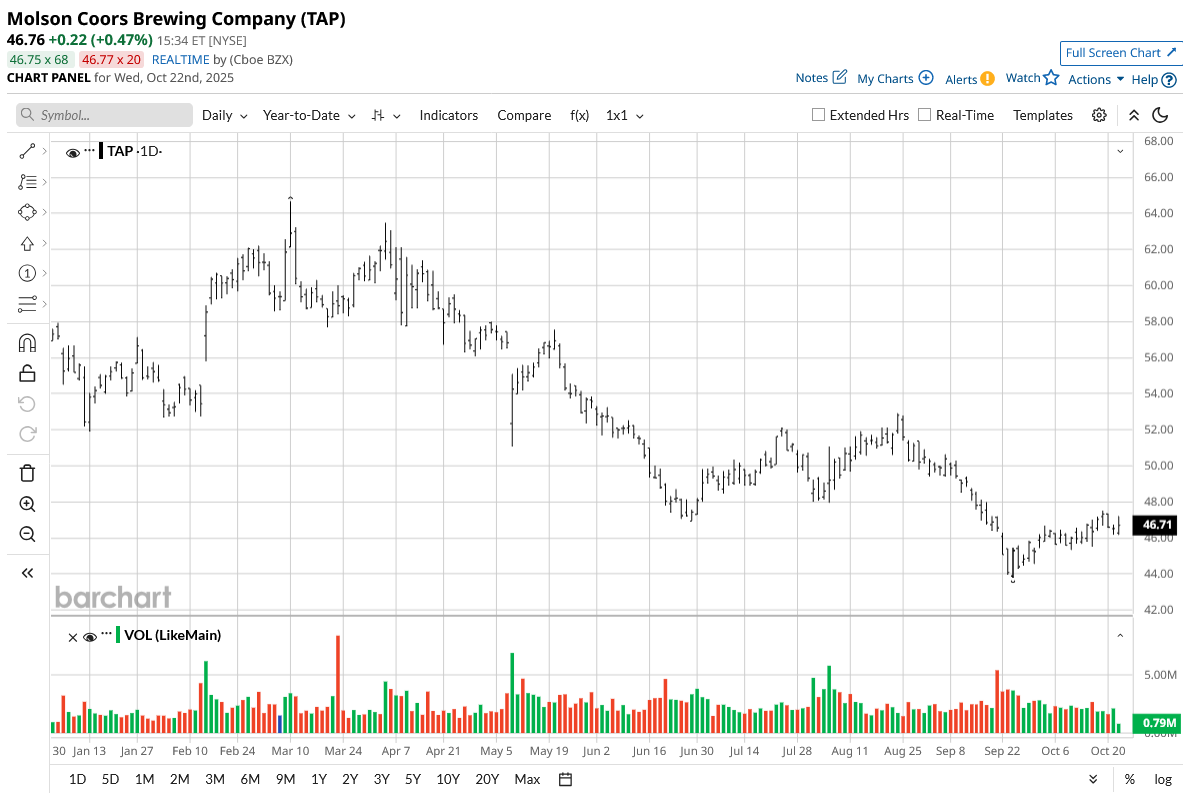

Molson Coors shares are down 16% over the last 12 months, behind the S&P 500's ($SPX) 14% rise. The selloff is reflective of weak U.S. beer demand as well as losses of market share to peers such as Anheuser Busch (BUD) and Constellation Brands (STZ). Boston Beer (SAM), for comparison, is off 24% in that time due to wide-ranging headwinds in its category. The stock in TAP is now trading at $46.76, in a 52-week range of $43.80 to $64.66, which puts it close to multi-month bottoms.

From a valuation perspective, Molson Coors looks cheap. It is only 8.38x trailing earnings as well as 8.65x forward earnings, significantly lower than its long-term average and the consumer staples industry average of 18x. Its 0.68 price-to-sales (P/S) as well as 0.69 price-to-book (P/B) indicate that it's deep in discount on book value, suggesting that investors are still doubtful regarding its future prospects of growth. But with a 0.46 debt/equity as well as healthy interest coverage of 6.3x, Molson Coors is still well-positioned in terms of finances to ride through short-term gyrations.

Molson Coors also yields a decent dividend yield of close to 4%, underpinned by strong free cash flow generation. In 2025's half, the company paid back $500 million to shareholders in dividends and share buy-backs. Management has reconfirmed its intention to continue the payout, so TAP is compelling to income-seeking investors who want reliability in a cushy consumer backdrop.

Molson Coors Restructures Amid Weak Beer Trends

As part of its bid to “change even faster” and accelerate with “urgency” towards sustainability-driven growth, Molson Coors revealed a broad-based restructuring of its Americas operations. The makeover is centered on shifting resources to its leading brands while reducing overhead, with plans to cut approximately 400 salaried jobs—9% of its Americas workforce—by the end of the year.

This restructuring comes on the heels of a leadership change, with Rahul Goyal replacing long-time CEO Gavin Hattersley last month. Goyal comes on board with a company under pressure from changing consumer tastes and increased pressure from craft beers, seltzers, and hard seltzer-like non-alcohol offerings. Analysts view the restructuring as a means of cleaning up operations for redirecting resources to receive more margin-rich, fast-growing categories in beverages.

The restructuring will take a $35–$50 million figure, primarily regarding severance and post-employment benefits, with total impact in Q4 2025. Although margins in the near term may compress, management's view is that it prepares Molson Coors for further 2026 and subsequent growth. The brewer is also growing its footprint in mixers within the premium mix, energy drinks, as well as its zero-proof beverage offerings, with a view to filling gaps in traditional beer softness.

Molson Coors Underperformed on Revenue But Surpassed on EPS

In the second quarter of 2025, Molson Coors saw its net sales decrease 1.6% (-2.6% constant currency) with U.S. GAAP net income of $428.7 million, which was $2.13 per diluted share. In an adjusted sense, underlying EPS was up 6.8% to $2.05, good enough to top Street expectations, although revenue was light due to softer U.S. demand and contract brew lost volume post 2024.

Management revised its full-year outlook to reflect a 3–4% decline in net sales and a 7–10% drop in EPS, citing macroeconomic headwinds, share losses in the U.S., and higher aluminum costs linked to the Midwest Premium. However, the company reaffirmed its $1.3 billion free cash flow target, aided by favorable working-capital dynamics and cash tax benefits.

CEO Gavin Hattersley framed the weakness of the beer category as “cyclical rather than structural,” highlighting that Molson Coors has preserved much of the share gains from the last three years in its core U.S. big brands—Coors Light, Miller Lite, and Coors Banquet. CFO Tracey Joubert supplemented that robust cash generation makes continued reinvestment in growth possible while rewarding shareholders with dividends and buybacks.

The next significant earnings release is due in early February 2026, when investors will seek reassurance that cost-saving efforts and portfolio growth are starting to stabilize profitability.

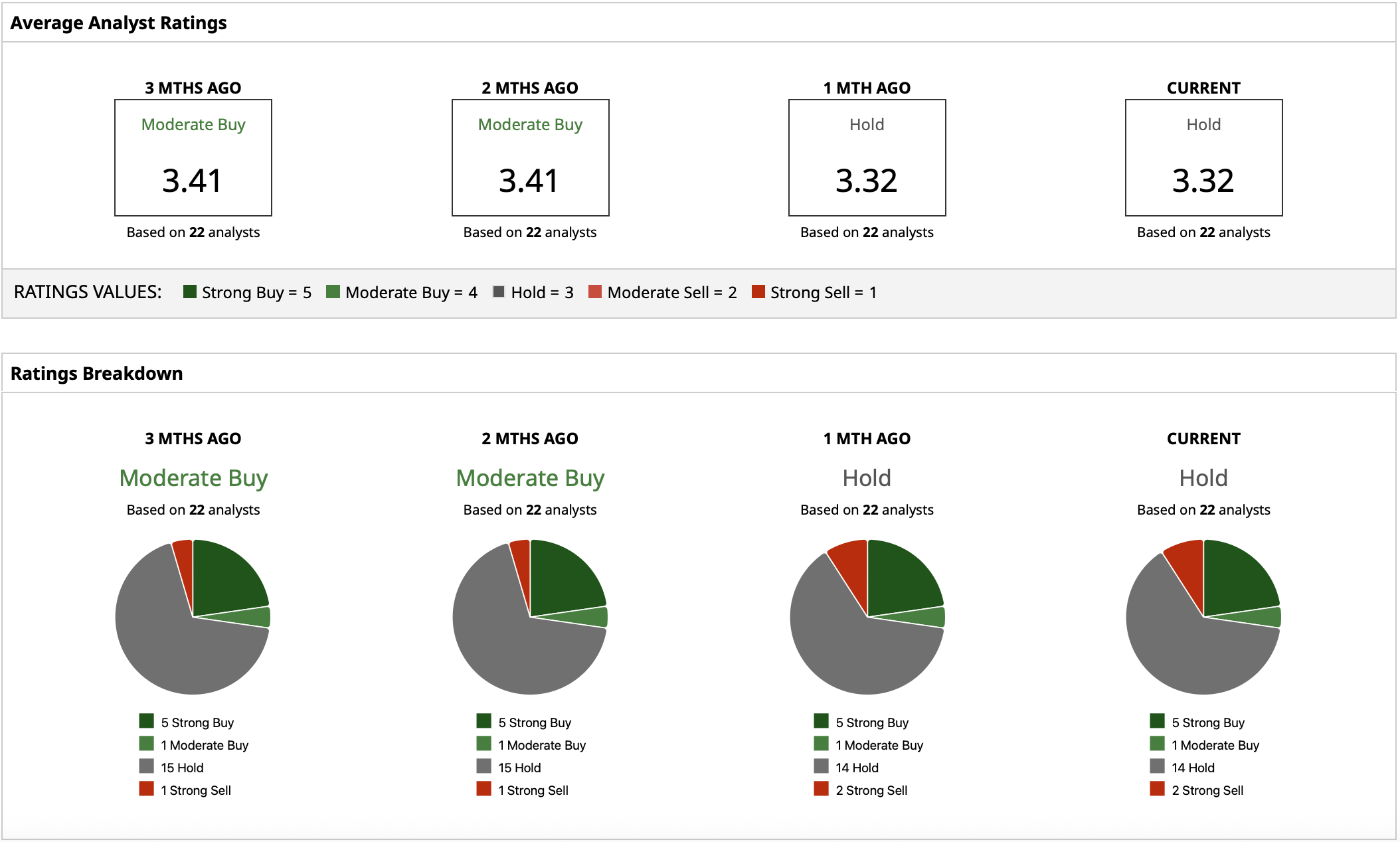

What Do Analysts Expect for TAP Stock?

TAP stock has a “Hold” rating consensus with a price target of $53.14, would equate to approximately 14% upside from here, with a high estimate of $72 and a low of $42. This range reflects concern that near-term returns from restructuring are weak but moderates upside with better execution under new leadership.