While the S&P 500 Index ($SPX) has been hitting record highs in a frenzy, some sections of the market haven’t yet recovered from the tariff tantrum. HP Inc (HPQ), for instance, is down 21% this year. The stock, however, boasts a fat dividend yield of almost 4.5%. In this article, we’ll discuss whether the HP is a buy after its frustrating underperformance.

To begin with, let’s understand what’s been going wrong with HP stock. The company was affected by the tariffs, which ultimately increased costs and put pressure on its margins. Moreover, the unsupportive macro environment is negatively impacting PC demand and has hampered companies’ ability to raise prices despite the tariff headwind.

HP Stock Forecast

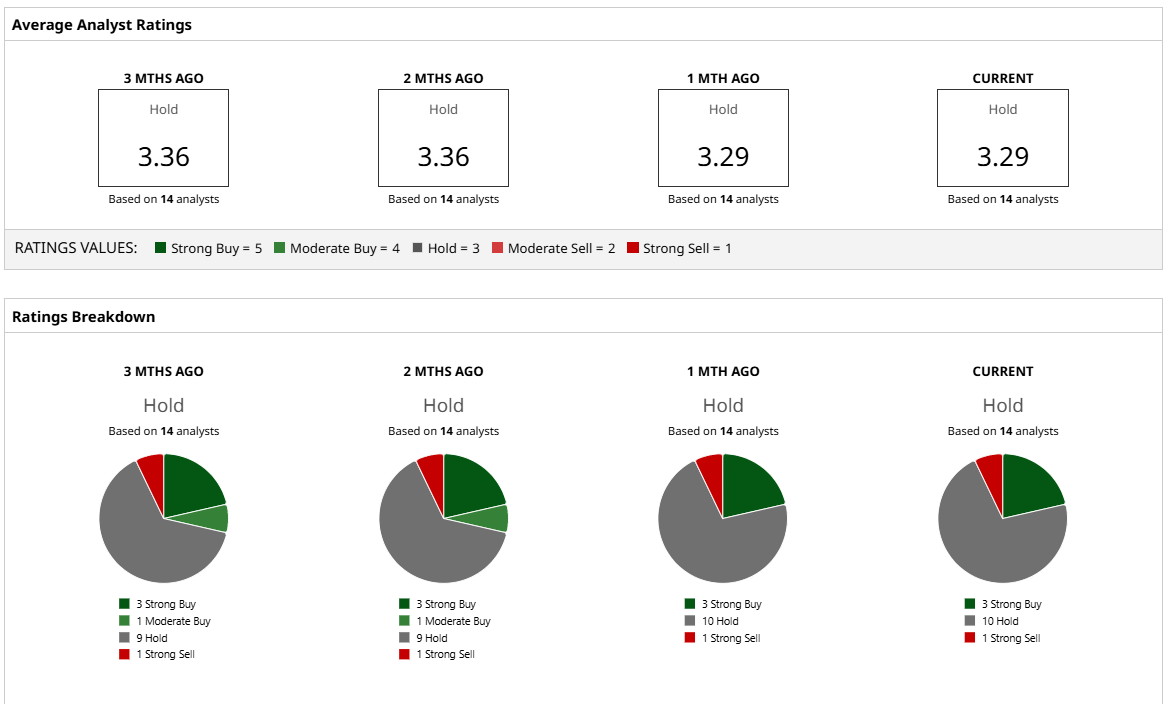

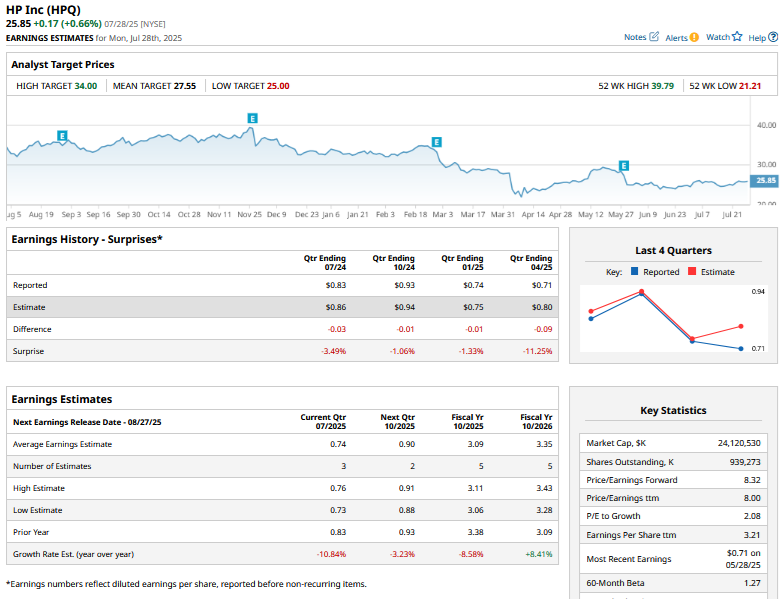

Of the 14 analysts covering HPQ, only three rate it as a “Strong Buy,” while 10 rate the stock as a “Hold.” One analyst rates HP as a “Strong Sell.” HP trades slightly above its Street-low target price of $22, while its mean target price of $27.27 is approximately 6% higher than its current price.

Analysts have been getting incrementally bearish on the stock this year, particularly after the company’s fiscal Q2 2025 earnings report in May.

Multiple brokerages, including Bank of America, Citigroup, Morgan Stanley, JPMorgan Chase, and TD Cowen, slashed HPQ’s target price following the company’s fiscal Q2 earnings report, in which it not only missed estimates, but gave dismal guidance, blaming the tariffs.

HP expects its adjusted earnings per share (EPS) in the current fiscal year to be between $3 and $3.30, which would imply a year-over-year fall in earnings even at the top end. Analysts, however, expect the company’s earnings to rise by high single digits in the next fiscal year.

How is HP Responding to the Tariffs?

To mitigate the impact of tariffs, HP increased sourcing from India, Vietnam, Mexico, Thailand, and the U.S. and said that by the end of June, nearly all the products it would sell in North America would be made outside of China.

While the supply chain tweak helped HP evade the steeper tariffs on China, it has its share of pitfalls. Firstly, as recent trade deals show, tariffs are not going away, with countries facing base tariffs of 10% or higher. Vietnam, for instance, is subject to a 20% tariff.

Secondly, companies shifted production to China for a reason, which was its low-cost advantage and impeccable manufacturing ecosystem. Shifting production to other countries will invariably mean higher costs, including investment in the manufacturing ecosystem. It is also putting pressure on cash flows in the short term due to an increase in working capital.

HPQ’s Dividend Policy Is Quite Generous

HP’s dividend policy is quite generous, which is not surprising, given the mature nature of its business. The company is committed to returning all of its free cash flows to investors through dividends and buybacks as long as its gross debt to earnings before interest, tax, depreciation, and amortization (EBITDA) multiple is below 2x, and it does not see other opportunities that promise a higher return on investment.

While HP has been a free cash flow powerhouse, the tariffs have taken a hit on the metric with the company lowering its fiscal year 2025 free cash flow guidance to between $2.6 billion and $3 billion versus the previous forecast of between $3.2 billion and $3.6 billion.

At the midpoint of that guidance, we get a price-free cash-flow multiple of 8.6x, which still looks attractive – so does the forward price-earnings (P/E) multiple of 8.32x.

What Could Drive Growth for HP?

While the near-term outlook looks quite hazy for HP given the tariff uncertainty, there are several factors that could drive growth over the next couple of years. For instance, the Windows 11 refresh cycle and the aging of the current installed base of PCs are two key drivers for PC industry growth. Moreover, sales of artificial intelligence (AI) PCs are picking up, and while they might not be driving incremental volumes, they are helping drive an uptick in average selling prices.

Is HP a Good Stock to Buy?

HP might not fit into the portfolios of some investors, especially those looking for high-growth names. However, unlike many other high dividend payers, HP’s business is not in a terminal decline. I believe HP stock would appeal to investors who are looking for high dividends and are comfortable with overall gains near 10% over the medium term.

HP’s risk-reward looks quite reasonable at these levels, and as we move to a more stable tariff regime, the stock can deliver returns (including dividends) in line with or slightly higher than the broader markets over the next couple of years.