Constellation Brands (STZ) is a leading international producer and marketer of beer, wine, and spirits. Renowned for its premium portfolio, the company owns iconic brand names such as Corona, Modelo, Robert Mondavi Winery, and Casa Noble Tequila. As one of the fastest-growing consumer packaged goods companies in the U.S., Constellation focuses on innovation, premiumization, and strong engagement with evolving consumer tastes.

So far this year, however, STZ stock is down. Should investors consider buying shares of this legacy name on the dip? Let's take a closer look.

About Constellation Brands Stock

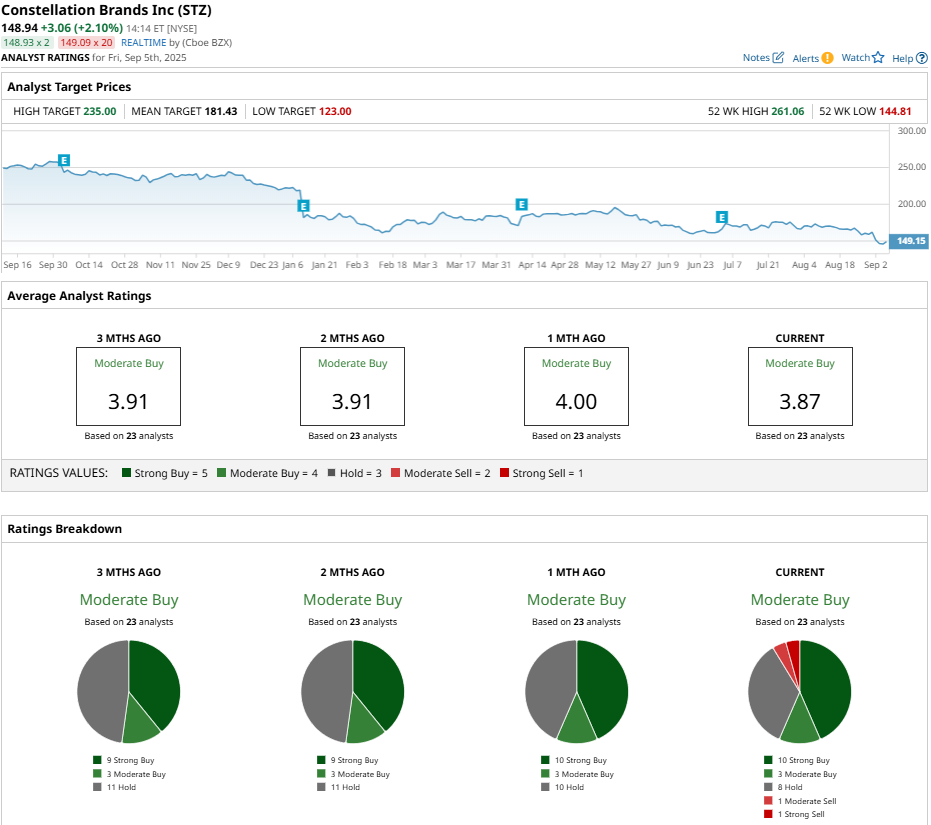

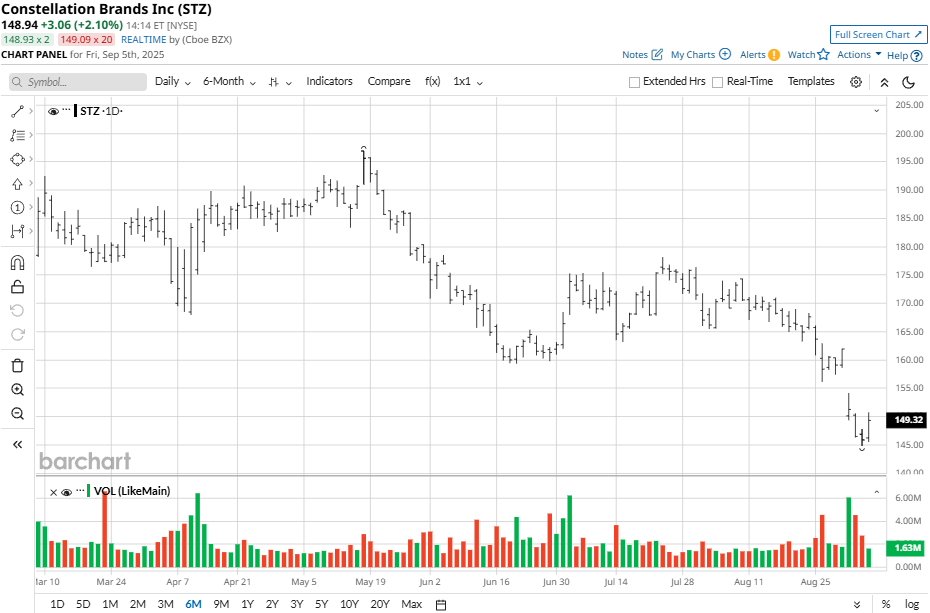

Constellation Brands stock has experienced a steep decline of late, falling about 8% in the last five days, 13% over the last one month, and 20% in the past six months. Year-to-date (YTD), STZ stock has retreated roughly 33%, while its 52-week performance shows a 40% loss, currently trading near its yearly low.

In stark contrast, the S&P 500 ($SPX) has posted double-digit gains in 2025, driven by the strength of the tech sector and positive market sentiment. This divergence highlights underperformance by STZ stock relative to the broader index, indicating investor caution around the company despite generally bullish conditions in the equity market.

Constellation Brands’ Q1 Results

Constellation Brands finished its first quarter of fiscal 2025 with EPS of $3.22 and total revenue reaching $2.52 billion, coming in below analyst expectations for EPS of $3.31 and $2.55 billion in revenue. Both results also declined compared to the same period last year, indicating sustained headwinds for its beer, wine, and spirits lines.

Breaking apart segment performance, beer net sales declined 1.7% to $2.23 billion, falling short of projected figures, while wine and spirits showed a sharper 28% drop to $280.5 million. Operating income from beer came in at $873.4 million, also below consensus estimates, while losses continued for wine and spirits.

That said, the company’s free cash flow remained strong at $444 million, alongside $637 million of operating cash flow and stable net leverage of 3.0X. In Q1, Constellation Brands repurchased $306 million in shares and issued $182 million in dividends.

Constellation Brands Lowered Guidance

STZ stock declined following a downward revision of the company's fiscal 2026 financial outlook, driven by weaker consumer demand. The company lowered its EPS forecast to a range of $10.77 to $11.07 from an earlier estimate of $12.07 to $12.37. Meanwhile, comparable EPS was adjusted to $11.30 to $11.60, down from $12.60 to $12.90. This contrasts with the consensus EPS estimate of $12.65 for the fiscal year.

The updated guidance also reflects a new expectation for enterprise organic net sales growth to fall between a decline of 6% and growth of 4%. That's compared to the prior outlook of a 2% decline to 1% growth. For the beer segment specifically, net sales are now anticipated to decrease by 4% to 2%, reversing earlier projections anticipating as much as 3% growth.

CEO Bill Newlands attributed the revisions to ongoing macroeconomic challenges that have suppressed consumer spending and increased purchasing volatility. CFO Garth Hankinson also pointed to distributor-level inventory rebalancing as a sign of softer consumer trends, projecting shipment volumes to lag depletion rates in Q2.

Should You Buy Constellation Brands Stock?

Despite the present downward market sentiment, STZ stock has a fairly positive view among Wall Street experts with a consensus “Moderate Buy” rating and a mean price target of $181.43, reflecting potential upside of 25% from current levels. Out of the 23 analysts with coverage, 10 analysts give STZ stock a “Strong Buy” rating, three provide a “Moderate Buy” rating, eight have a “Hold," one analyst has a “Moderate Sell,” and one analyst has a “Strong Sell” rating.