Citigroup (C) stock is up 38% for the year and has more than doubled over the last two years, outperforming both the broader market and the financial sector during this period. The recent outperformance is a welcome relief for investors, as Citi has been a long-term underperformer, with its 10-year returns trailing those of its peers by a significant margin.

Moreover, the stock trades at less than a fifth of its 2007 highs. Citigroup has had its own share of issues, which is reflected in its long-term price action. However, the company has been trying to address these issues as part of the transformation under CEO Jane Fraser. These measures have paid off well and are reflected in Citi’s earnings and return metrics.

The company has also been sharing the fruits with investors in the form of dividends and share buybacks. While Citi’s dividend yield has come down over the last two years, thanks to the sharp rise in its stock, which has risen faster than the dividend, at 2.5%, it is still above many of its large-cap banking peers. In this article, we’ll look at Citi’s forecast and examine whether the stock is still a buy.

Citi’s Dividend Policy

To begin with, let’s look at Citi’s recent dividend history. Like its banking peers, Citi is generous with shareholder payouts. During Q2, the company returned nearly $3.1 billion to shareholders, representing a payout ratio of 82%. Of this total, $2 billion went toward share repurchases, while the remaining was for dividends.

The company increased its Q3 quarterly dividend by 7.1% to $0.60, after the Federal Reserve’s annual stress testing. After the annual stress test, Citi's preliminary Standardized Common Equity Tier 1 (CET1) capital ratio regulatory requirement fell to 11.6%, versus the 12.1% that it previously stood at. Notably, the banking sector is heavily regulated, and among others, the Fed can influence shareholder payouts as it did during the COVID-19 pandemic in 2020 by blocking dividend hikes.

Citi’s quarterly payout was static at $0.51 per share for nearly four years before it was hiked to $0.53 in mid-2023. Goldman Sachs expects the bank to grow its dividend at a CAGR of 19% between 2024 and 2026. The forecast looks achievable, looking at the strong earnings growth that Citi has been reporting in recent quarters.

The Investment Case for C Stock

The investment case for Citi has been built on the turnaround and its impact on the valuations. There has been a valuation disconnect between Citi and other large-cap U.S. banks amid the former’s poor return ratios and recurring regulatory woes.

During Q2, Citi’s book value increased 7% YoY to $106.94 while the tangible book value rose 8% to $94.16. While C stock traded below its tangible book value over the last few years, it now trades above that level. However, it still trades considerably below its book value, which is a sign of undervaluation in banking stocks. Citi’s U.S. banking peers trade above their book value, and while C stock has inched towards its book value as markets give a thumbs up to its transformation measures, it still has some catching up to do.

The company has shown progress in its turnaround and reported a return on total capital employed (ROTCE) of 8.7% in Q2, which it expects to rise to between 10%-11% by 2026. I believe that while some re-rating has already happened, Citi stock still has room to run higher if the company can continue to show signs of progress in its transformation, even as investors should temper down their expectations, and the returns over the next couple of years should be a lot lower than what we saw in the preceding two years. Overall, even as the margin of safety is a lot less than it had been in the last two years, I expect Citi shares to outperform peers over the next couple of years, while rewarding shareholders with some of the best payouts among its peers.

Citi Stock Forecast

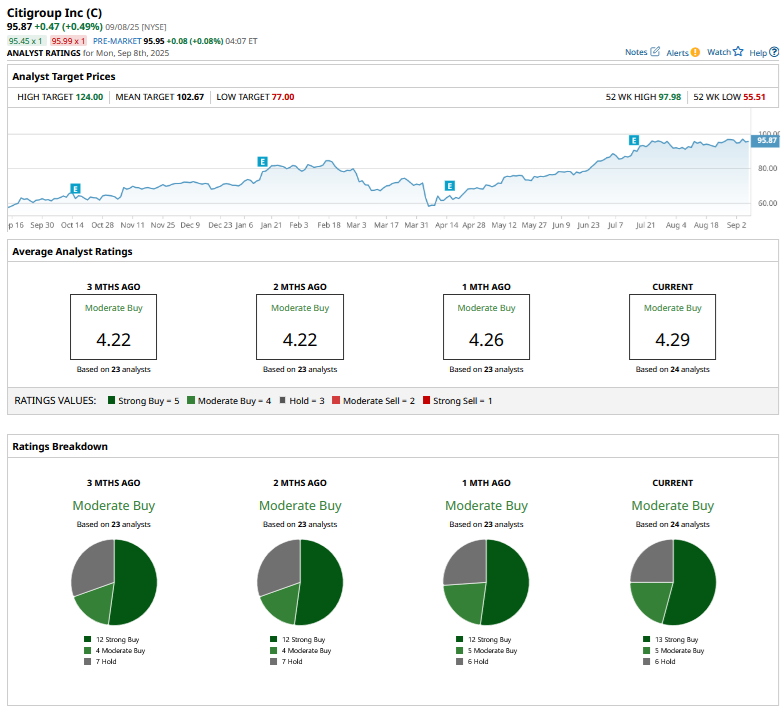

Of the 24 analysts covering Citi, 13 have a “Strong Buy” rating while 5 rate the stock as a “Moderate Buy.” The remaining 6 analysts rate C as a “Hold” or some equivalent, and its mean target price of $102.67 is 7.1% higher than the Sept. 8 closing price.