/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

For most of 2025, Confluent (CFLT) stock has witnessed significant volatility. The stock traded at highs of $37.90 in the second week of February. With cloud growth concerns, the stock plunged to 52-week lows of $15.60 in August.

There has, however, been a renewed rally in the stock, with reports indicating that Confluent is exploring sale after attracting “acquisition interest.” While the process is in early stages, the price action has been significantly positive as the demand for data infrastructure companies remains high.

About CFLT Stock

Confluent is a provider of data streaming platforms in the United States and internationally. The company’s platform has use cases across industries that include retail, healthcare, finance, transportation, and more. Confluent believes that its total addressable market (TAM) as of 2025 is $100 billion.

For Q2 2025, Confluent reported subscription revenue of $271 million, which was higher by 21% on a year-on-year (YoY) basis. For the same period, cloud revenue increased by 28%. A relative slowdown in cloud revenue triggered a sharp correction in CFLT stock.

Amidst volatility, CFLT stock has declined by 18.7% year-to-date (YTD). With news related to a potential acquisition, it might be a good time to consider exposure to CFLT stock.

Positives and Concerns for Confluent

As of Q2 2025, Confluent reported subscription revenue of $270.8 million. The subscription revenue has continued to trend higher on a year-on-year basis. However, the growth rate was the lowest in Q2 2025 as compared to the last eight quarters. Similarly, the quarterly cloud revenue has continued to inch higher, but the growth momentum has waned on a relative basis. This is one concern that has impacted stock sentiment.

It's also worth noting that for the first six months of 2025, Confluent reported an operating-level loss of $198 million. While operating losses have narrowed on a relative basis, valuations are likely to be impacted considering the cash burn.

In terms of long-term positives, a key factor is a big addressable market. For FY 2023, Confluent reported 60% of revenue from the United States and 40% from international markets. In Q2 2025, revenue contribution from the U.S. was 58%.

It’s likely that international revenue growth will support value creation in the coming years. This view is backed by the point that tailwinds are significant for the cloud, data, and AI sectors.

Further, specific to the company, streaming opportunities and the data streaming platform can be key drivers for growth. For Q2 2025, Flink ARR increased by 3x as compared to the last two quarters. This strengthens the view that the data streaming platform can be a key growth catalyst.

What Analysts Say About CFLT Stock

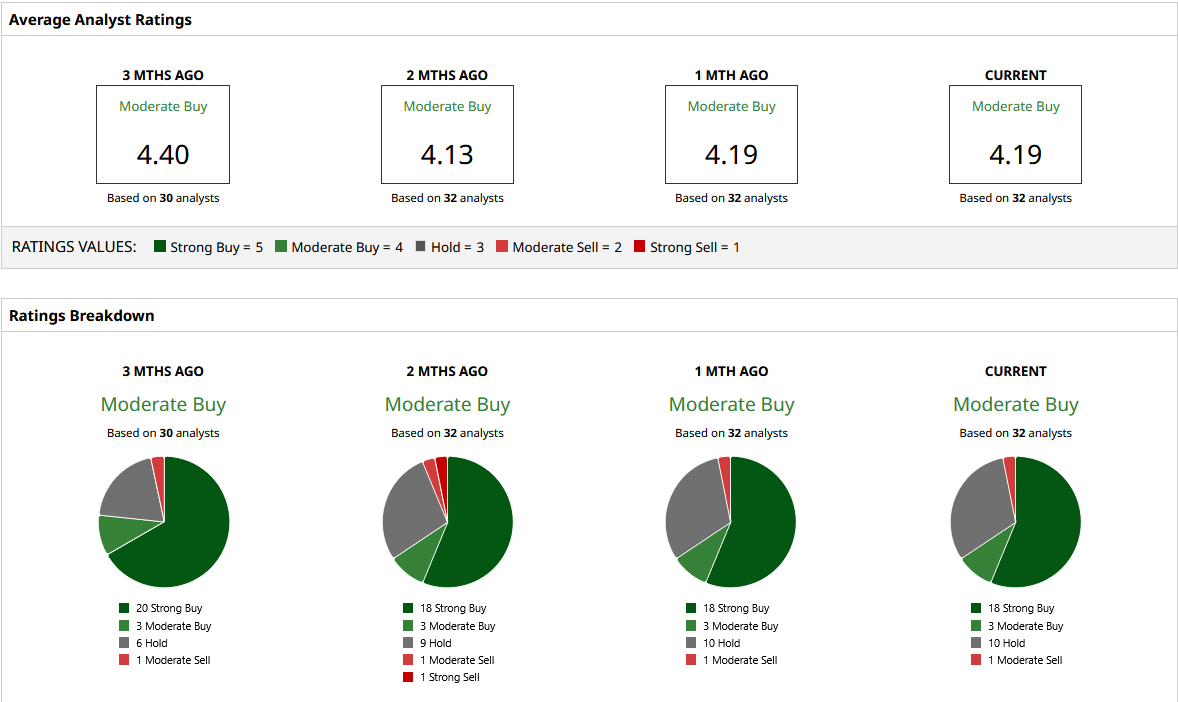

Based on the view of 32 analysts, CFLT stock is a consensus “Moderate Buy.” Of those analyst ratings, there are 18 recommendations of a “Strong Buy,” three for “Moderate Buy,” and 10 for “Hold.” Only one analyst gives it a “Moderate Sell” rating.

Further, the mean price target based on analyst ratings is $25.14, and it implies an upside potential of 10% from current levels. However, the most bullish price target of $36 implies an upside potential of 57%.

The relatively moderate upside potential is on the back of slow growth in the cloud business. As a matter of fact, growth in this segment fell below 30% for the first time in company history. It’s also worth noting that analysts expect earnings growth for FY 2025 at 34%. However, for FY 2026, earnings growth is expected to moderate to 6.3%.

Overall, it makes sense to be cautiously optimistic about CFLT stock. Renewed growth acceleration or an attractive acquisition offer can be potential triggers for rerating.