Stablecoins promise to transform finance by combining the stability of traditional fiat currencies with the speed of blockchain technology. Companies aligned with this trend are drawing investor interest, especially those adopting treasury strategies similar to those of early crypto pioneers like Strategy (MSTR).

TLGY Acquisition (TLGYF), a blank-check firm, is now jumping into this trend. On July 21, it announced a merger with StablecoinX Assets, a startup aiming to build a public company that will hold large amounts of Ethena’s ENA tokens.

Ethena is a decentralized finance (DeFi) platform that issues ENA, the Ethena governance token, and USDe, a synthetic dollar backed by crypto. After the merger, the new entity, StablecoinX, is expected to trade on the Nasdaq Exchange under the ticker USDE. The deal is expected to close some time in Q4 2025.

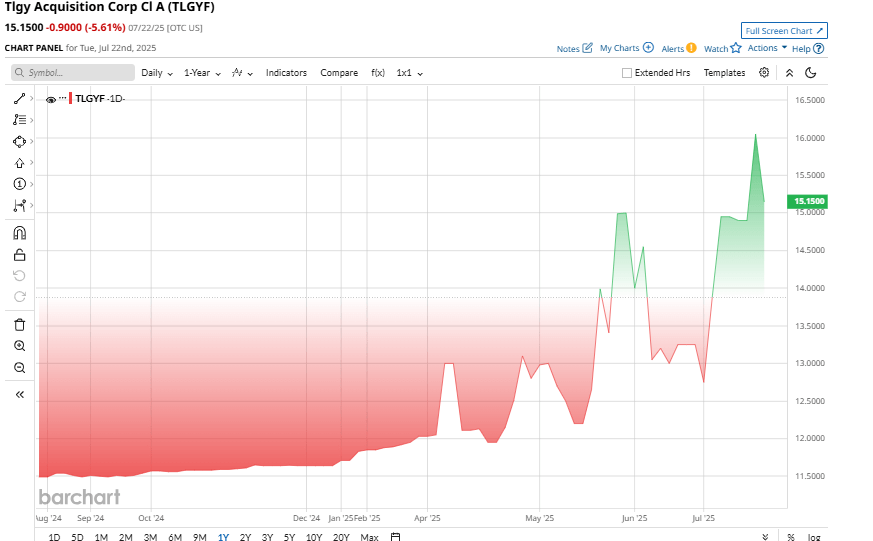

Investors initially cheered the news, sending TLGYF shares up about 50%, though the gains quickly faded. Still, the stock remains up 21% year-to-date.

TLGYF’s High-Stakes Pivot Into Crypto

TLGYF, soon to become StablecoinX pending shareholder and regulatory approval, is making a bold bet on Ethena’s rising stablecoin ecosystem. Ethena’s USDe, a “synthetic dollar” built on the Ethereum (ETHUSD) blockchain. It is “softly” pegged to the U.S. dollar and now holds a market capitalization of $6.75 billion. It is the 22nd-largest crypto by market cap, third only to Tether and Circle’s (CRCL) USDC in the stablecoin space.

Post-merger, StablecoinX will support the Ethena network by running validators and adopting a “permanent capital” model, using raised funds to buy and hold ENA tokens indefinitely.

Management believes this mirrors Strategy (MSTR), positioning TLGYF as a long-term crypto treasury asset.

The $360 million PIPE will fund a yield-generating treasury of ENA and USDe stablecoins. Backers include top crypto funds like Pantera, Dragonfly, Galaxy, and the Ethena Foundation.

Financial Backing and Capital Structure

As a SPAC, TLGYF has no operating business and no revenue.

Instead, its value lies in its cash and crypto on hand. Before the merger, TLGYF held roughly $10 per share in trust from its IPO proceeds. The merger with StablecoinX brings $360 million via PIPE commitments. Of that, $100 million comes as discounted ENA tokens, and $260 million is designated as cash to buy more ENA immediately.

After closing, the company will own a large ENA position on its balance sheet. Each share of StablecoinX will thus be backed by a piece of this treasury.

All future growth depends on ENA. StablecoinX’s board has approved the deal, and the transaction is on track for a late 2025 closing.

Should You Buy TLGY Stock Now?

From my perspective, TLGYF is a highly speculative investment which is completely dependent on the effectiveness of Ethena and the health of the crypto market. It is supported by the significant names in crypto, which does boost investor confidence.

It can potentially bring huge returns provided the Ethena ecosystem including its governance token and stablecoin does well, but there is a serious possibility of losing most or even all of your investment.

This is only a risk you should take if you are a true believer in cryptocurrencies, and specifically, in ENA.