Quantum computing stocks have moved from niche lab projects to center-stage investment themes, attracting long-term money despite timelines that can stretch years. While many quantum names read like venture bets, established blue chips with engineering depth could deliver steadier returns.

International Business Machines (IBM) may be that rare, boring blue-chip winner. According to the Wall Street Journal, IBM is leading the way in quantum advantage, and its Thomas J. Watson Research Center has become a crucible for hardware progress, from fault-tolerant qubit work to the Quantum System Two machines tackling real problems.

With an in-house chip fab, an Advanced Micro Devices (AMD) partnership on quantum-centric supercomputers, and a roadmap toward large, clustered, fault-tolerant systems by 2029, Big Blue is quietly building the "big iron" that could power commercial quantum breakthroughs.

For investors searching for long-term growth in the quantum era, IBM stock could offer an unexpected and potentially rewarding opportunity.

About IBM Stock

Founded in 1911, IBM is a globally integrated technology and consulting company, providing a wide array of integrated solutions and services. IMB operates across the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company is organized into four main segments: Software, Consulting, Infrastructure, and Financing. IBM's Software segment focuses on hybrid cloud and artificial intelligence (AI) platforms, which enable clients to undergo digital and AI transformations within their data and application environments.

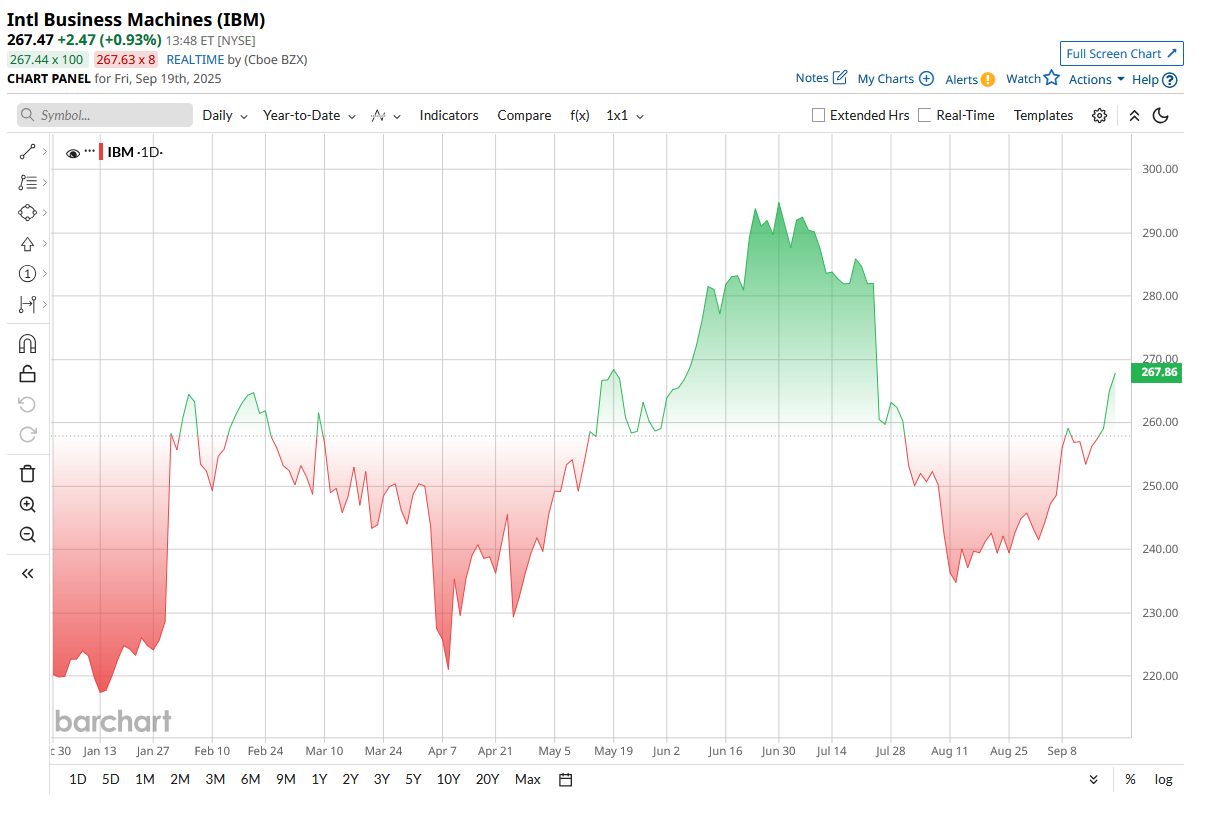

Valued at $240 billion by market cap, shares of IBM have been a little uneven in 2025. However, IBM has gained 21% year-to-date (YTD) thanks to progress in hybrid cloud, AI, and growing optimism about quantum computing.

IBM's valuation looks relatively stretched. Its price/book (P/B) ratio is 8.58 compared to the sector median of 3.72, indicating a higher price than its peers. However, the dividend yield is 2.64%, significantly higher than the sector median of 1.38%, suggesting good income potential.

Strategic AMD Partnership Accelerates Quantum Roadmap

A key catalyst was IBM’s announcement in August of a strategic partnership with AMD to create “quantum-centric supercomputing” platforms. This deal will marry IBM’s quantum processors with AMD’s high-performance CPUs/GPUs to accelerate error correction and scale. CEO Arvind Krishna said the joint effort will build “a powerful hybrid model that pushes past the limits of traditional computing,” underscoring IBM’s commitment to lead in the coming quantum era. These developments, along with IBM’s existing quantum roadmap (e.g., its planned “Quantum Starling” fault-tolerant computer by 2029), have re-energized the stock and set IBM apart in AI/quantum discussions.

IBM’s Quantum System Two, a modular quantum computer, exemplifies IBM’s advanced R&D in quantum hardware. Despite its 114-year history, IBM is suddenly back at the front of cutting-edge computing: a WSJ report notes that IBM is “leading the way” to quantum advantage and even in “pole position” among tech giants.

IBM Beats Q2 Earnings Estimates

On July 23, IBM's report on the second quarter of fiscal 2025 gave investors plenty to cheer about. Revenue came in at $17 billion, up 8% from last year, with growth led by software and cloud services. Software sales, including Red Hat, rose 10% to $7.4 billion, consulting brought in $5.3 billion, up 3%, and infrastructure/HPC jumped 14% to $4.1 billion.

Profits were also solid. Net income climbed 17% to $2.2 billion, with adjusted EPS rising 15% to $2.80. These gains highlight IBM’s progress in higher-margin segments like software and cloud.

On the cash front, IBM generated $6 billion in operating cash flow and $5.6 billion in free cash flow. The company also ended the quarter with $15.5 billion in cash and equivalents,

After this beat, management sounded upbeat. CEO Arvind Krishna said IBM once again exceeded expectations on revenue, profit, and cash flow, prompting a raised outlook for full-year free cash flow. CFO James Kavanaugh added that growth in software and productivity initiatives delivered “significant margin expansion and double-digit profit growth.”

Looking ahead, IBM reiterated its guidance. For the full year 2025, management expects at least 5% revenue growth and has raised its free cash flow target above $13.5 billion. For Q3, IBM had guided to about $16.4 to 16.75 billion in revenue.

Analyst's Opinion and Final Words

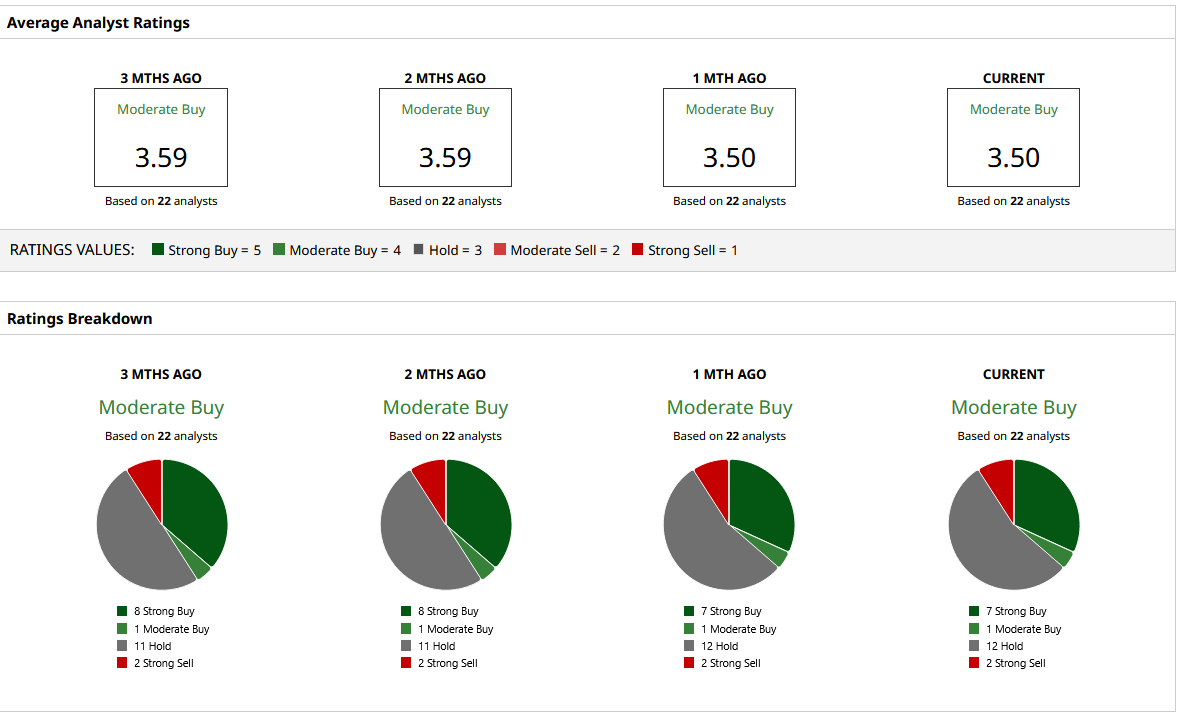

IBM stock holds a consensus "Moderate Buy" rating on Wall Street. Based on ratings from 22 analysts, the stock has received seven "Strong Buy," one "Moderate Buy," and 12 "Hold" recommendations. The mean price target of $282 suggests a potential 5.6% upside from its current price.

IBM is moving beyond its old-school image, gaining ground in AI, cloud, and quantum computing. Its strong cash flow, steady dividends, and AMD partnership boost investor confidence. While risks remain, its recent performance shows resilience, making IBM a stable, long-term opportunity with growing potential in next-gen computing.