Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

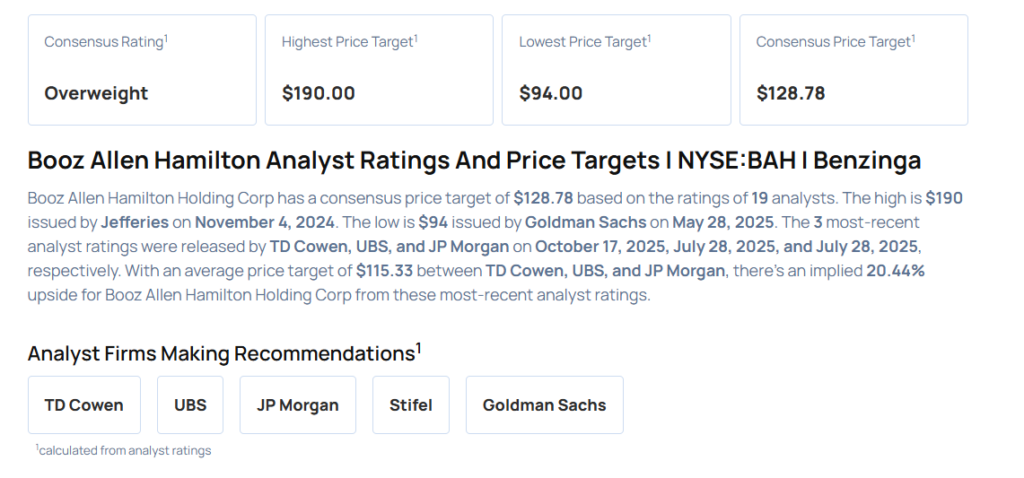

- TD Cowen analyst Gautam Khanna downgraded Booz Allen Hamilton Holding Corporation (NYSE:BAH) from Buy to Hold and lowered the price target from $125 to $105. Booz Allen Hamilton shares closed at $97.28 on Thursday. See how other analysts view this stock.

- Barclays analyst Mathieu Robilliard downgraded AST SpaceMobile, Inc. (NASDAQ:ASTS) from Overweight to Underweight and maintained the price target of $60. AST SpaceMobile shares closed at $89.50 on Thursday. See how other analysts view this stock.

- William Blair analyst Matt Phipps downgraded Kezar Life Sciences, Inc. (NASDAQ:KZR) from Outperform to Market Perform. Kezar Life Sciences shares closed at $4.18 on Thursday. See how other analysts view this stock.

- Lake Street analyst Frank Takkinen downgraded AVITA Medical, Inc. (NASDAQ:RCEL) from Buy to Hold and cut the price target from $8 to $4. AVITA Medical closed at $5.38 on Thursday. See how other analysts view this stock.

- Raymond James analyst Michael Rose downgraded Bank OZK (NASDAQ:OZK) from Outperform to Market Perform. Bank OZK shares closed at $47.02 on Thursday. See how other analysts view this stock.