/Caterpillar%20Inc_%20sign%20on%20building-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

In an era where artificial intelligence (AI) is rewriting the rules of power, infrastructure, and industry, one stalwart blue-chip is emerging as an unexpected winner of the AI boom: Caterpillar (CAT). Long celebrated for its dominance in heavy machinery, Caterpillar has quietly built a fortress of income, growing its dividend for decades while generating steady free cash flow.

As AI’s soaring electricity demands fuel growth in power infrastructure, investors are increasingly eyeing Caterpillar's high-margin turbine and power-generation business, propelling CAT stock to record highs. The shift highlights how Wall Street’s AI enthusiasm is expanding beyond chipmakers and cloud giants to industrial firms powering the AI economy.

As demand for reliable, resilient power scales with AI and cloud computing, Caterpillar might just be the dividend stock ready to be the next AI “power play.”

About Caterpillar Stock

Caterpillar is a leading global industrial firm specializing in construction and mining equipment, diesel and natural-gas engines, industrial gas turbines, and related services. Headquartered in Irving, Texas, Caterpillar’s scale and market presence are reflected in its market capitalization of roughly $230.2 billion.

CAT stock has delivered a standout performance so far this year, rising ahead of many benchmarks as investor sentiment has swelled around its expanding role in AI infrastructure and power generation. Shares have demonstrated solid momentum over the past month, surging by 16% and hitting a fresh high of $511.50 on Oct. 10, while propelling year-to-date (YTD) gains to 35%.

The rally appears to be driven in part by optimism that Caterpillar’s turbines and power systems will become vital components of AI data centers — a hidden growth engine beyond its legacy construction and mining business. CAT stock is up by 24% over the past 52 weeks.

CAT stock currently trades at 27.9 times forward earnings, a premium valuation compared to the sector median and its historical average.

Caterpillar is also widely viewed as a reliable dividend payer, boasting a streak of 31 consecutive years of dividend increases. Earlier this year, the board approved a quarterly dividend of $1.51 per share, marking a 7% increase. This brings its annualized dividend to about $6.04, translating to a yield of 1.21%.

Caterpillar’s payout ratio is modest at 28.95%, underscoring that the dividend is well covered by earnings and leaving headroom for future increases. While yields aren’t unusually high, the consistency, growth track record, and low payout ratio make the firm's dividend appealing to income-oriented investors seeking durability.

Caterpillar’s Expansion Into AI-Powered Energy and Infrastructure

Caterpillar is increasingly positioning itself as more than just a manufacturer of heavy machinery. Indeed, it’s becoming a foundational player in AI infrastructure through its power generation, energy storage, and autonomous technologies.

A prime example is the firm's agreement with Joule Capital Partners and Wheeler Machinery to deliver 4 gigawatts of power capacity for a 4,000-acre data center campus in Utah planned for 2026. This project will use Caterpillar’s G3520K generator sets, combined cooling, heat and power (CCHP) systems, and 1.1 gigawatt-hours of grid-forming battery storage, allowing the campus to reliably power AI workloads and even reuse waste heat to help cool servers.

Further, Caterpillar has entered a long-term strategic partnership with Hunt Energy to deliver up to 1 gigawatt of power generation capacity for data centers in North America, beginning with a project in Texas. This move reinforces Caterpillar’s footing in meeting the demands of AI facilities, emphasizing reliability, uptime, and performance.

Thus, Caterpillar is not just riding the AI wave — it’s building much of the power and reliability infrastructure that AI needs.

Caterpillar's Q2 Was a Mixed Bag

Caterpillar announced its second-quarter 2025 results on Aug. 5, reporting an adjusted profit per share of $4.72, down from $5.99 in Q2 2024. Total revenues came in at $16.6 billion, representing a 1% year-over-year (YOY) decline, largely driven by “unfavorable price realization” of $414 million, partially offset by higher volume of $237 million.

Adjusted operating margin narrowed to 17.6%, from 22.4 % a year ago, reflecting cost pressures and tariffs. On the cash front, Caterpillar generated $3.1 billion in enterprise operating cash flow and ended the quarter with $5.4 billion in cash. The company returned $1.5 billion to shareholders through dividends and share repurchases.

For guidance, Caterpillar now expects full-year 2025 revenues to grow slightly over 2024, revising prior flat expectations upward. Analysts predict EPS to be around $17.80 for fiscal 2025, down 19% YOY, before surging by 18% annually to $21.06 in fiscal 2026.

What Do Analysts Expect for Caterpillar Stock?

Recently, Erste Group analyst Hans Engel upgraded Caterpillar from “Hold” to “Buy.” Engel cited the firm's above-average operating margins, high return on equity, and expected significant earnings growth over the next year, driven by robust incoming orders, especially in the energy systems segment.

In September, BofA Securities also upgraded its price target for Caterpillar to $517 from $495 while maintaining a “Buy” rating, highlighting the company’s Solar Turbines unit as a “hidden gem” with high margins and strong growth potential in power, energy, and data-center applications.

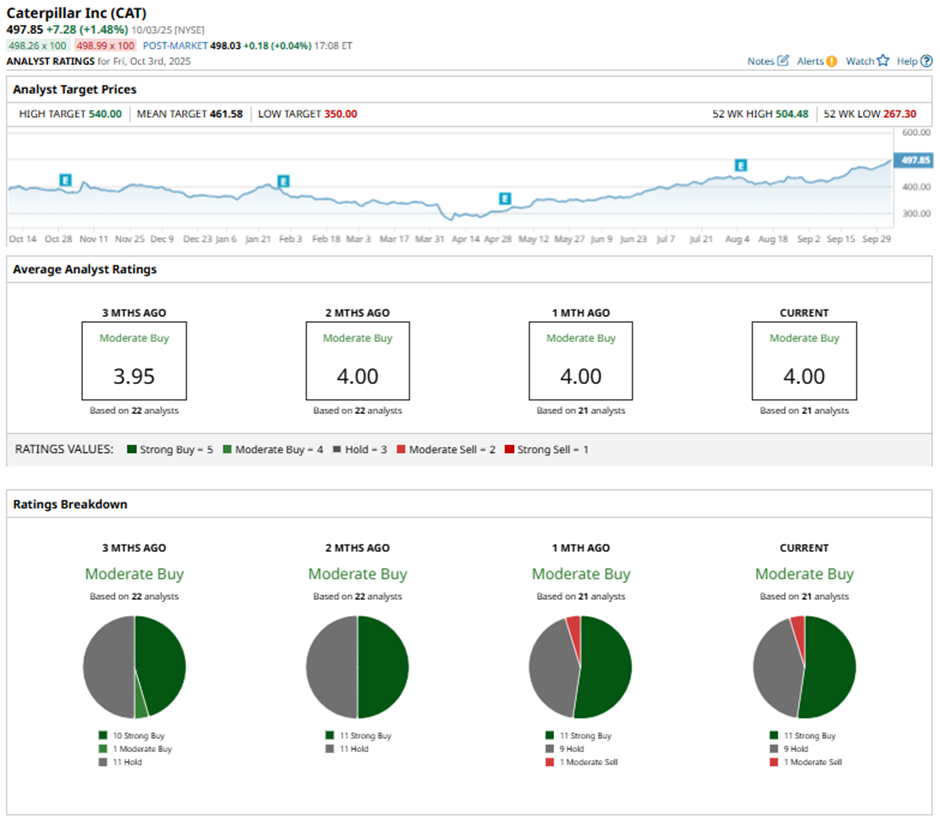

Wall Street is moderately bullish on CAT stock. Overall, CAT has a consensus “Moderate Buy” rating. Of the 22 analysts covering the stock, 12 advise a “Strong Buy,” nine analysts are on the sidelines with a “Hold” rating, and one gives a “Moderate Sell.”

While CAT is trading at a premium to its mean price target of $470.79, the Street-high target price of $582 suggests that the stock could rally 18% from here.