Bitcoin’s (BTCUSD) rally has lit a fresh fire under crypto mining stocks on Sept. 24. With prices cruising past $113,000, the catalysts are stacking up—looser monetary policy, ETF inflows, and corporate adoption fueling the charge. Beyond crypto, the overlap between mining infrastructure and the booming demand for artificial intelligence (AI) computing opens up a longer-term runway for companies in the space.

Riot Platforms (RIOT) sits at the center of this trend. As one of the largest U.S.-based miners, Riot is not just crunching hashes. As a vertically integrated Bitcoin miner, Riot is building, supporting, and operating blockchain infrastructure, ramping up its capacity for the next phase of growth.

Wall Street is taking notice, too. Roth Capital just hiked the bitcoin miner’s price target from $17.50 to $42—the highest on the Street—sparking a 5% jump in shares, with the upgrade arriving as the BTC price was surging. But as BTC and other digital assets fell yesterday, driven by investor caution, forced liquidations, and faltering corporate crypto treasuries, RIOT slipped 7%, showing both stock and crypto moving in sync.

With fresh tailwinds and RIOT stock nearly doubling over six months and moving in lockstep with Bitcoin, is now the time to buy, or is the miner due for more dip?

About Riot Platforms Stock

Riot Platforms, based in Castle Rock, Colorado, has built a strong presence in Bitcoin mining and digital infrastructure. With operations across Texas, Kentucky, Denver, and Houston, the company blends mining and engineering, running institutional-scale facilities while designing and fabricating custom power and electrical solutions for large commercial, governmental, and energy clients.

Valued at $6.6 billion, Riot’s vertically integrated approach drives growth in crypto and critical infrastructure. Post the 2024 Bitcoin halving, revenue and hash rates climbed, aided by strategic MicroBT rig deals and the Block Mining acquisition. With U.S.-based sites, efficiency gains, and rising institutional demand, Riot continues to push the frontier of digital assets.

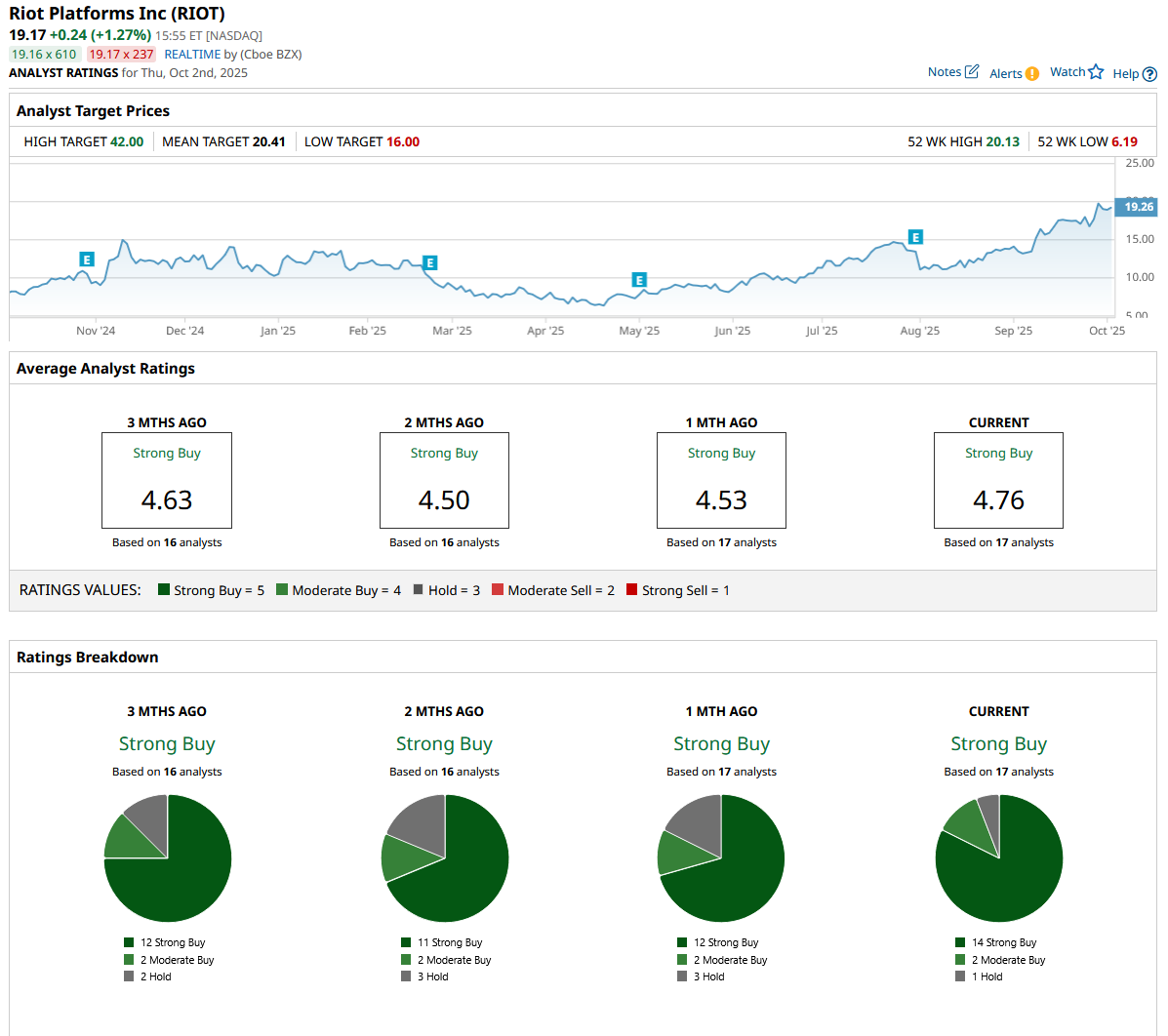

Shares of Riot Platforms have experienced significant volatility throughout the year. RIOT stock hit a 52-week high of $20.13 on Sept. 24, riding bullish projections from Roth Capital, before taking a breather and dipping roughly 16.8% as Bitcoin and broader digital asset prices cooled.

Even with the pullback, the momentum story is undeniable—RIOT has surged 164% over the past 52 weeks and returned more than 139% in just the last six months. The rally is even more dramatic from the April lows of $6.19, a spike of over 210%.

Technicals reflect the bullish undercurrent—RIOT stock remains well above both its 50-day moving average and 200-day moving average, signaling strong medium- and long-term trends. The 14-day RSI recently touched overbought territory, which hinted that short-term consolidation was due, but the trend now still favors the bulls. After a year of strong gains, Riot appears to be taking a pause, positioning itself for the potential next phase of growth in the crypto market.

After RIOT’s recent rally, the stock is priced at 10.55 times sales—above the sector median but still under its historical average—hinting it may be slightly stretched. For investors in crypto infrastructure, this is not a red flag; it reflects a high-powered operation priced for growth.

Plus, with analysts forecasting double-digit revenue expansion, the multiple could prove reasonable, as rising sales would make the P/S ratio look even more favorable over time, underscoring Riot’s positioning to capture the next phase of Bitcoin and blockchain growth.

Digging Into Riot’s Q2 Earnings Results

Riot Platforms’ Q2 earnings report on July 31 was stellar. Revenue more than doubled annually to $153 million, up over 118% year-over-year (YoY), but slightly missed the Street’s estimates. But profitability surged—net income hit $219.5 million, a sharp turnaround from last quarter’s GAAP net loss of -$84.4 million. The reversal was largely powered by Bitcoin’s appreciation, which delivered a hefty mark-to-market boost. EPS rose to $0.57 from last year’s loss, beating estimates by 400%.

The top line got a serious adrenaline shot, with Bitcoin mining raking in $140.9 million. The lift came courtesy of higher average BTC prices and an elevated operational hash rate, partially offset by the block subsidy “halving” and an increase in the average global network hash rate.

Operationally, Riot showed discipline and scale. The company lifted its self-mining hash rate 5% sequentially to 35.4 exahash, though the global network hash rate rose faster at 9%. Riot produced 1,426 BTC, but efficiency gains stole the spotlight. Hash rate utilization jumped from 61% in Q2 2024 to 87% in Q2 2025, driving a 50% gross margin in mining and solidifying Riot’s reputation as one of the most efficient operators in the industry.

Its financial footing has also strengthened. Riot closed the quarter with $330 million in cash and more than 19,000 BTC—about $2.4 billion in liquidity. A $200 million Bitcoin-backed loan with Coinbase (COIN) gave the company flexibility to fund growth while reducing reliance on dilutive ATM share offerings. Selling monthly production continues to support operations, while capital allocation favors high-return growth projects over legacy mining.

Earlier this month, Riot hit a new milestone, producing 477 BTC in August—a record for the month and a 48% YoY jump. The miner pulled it off while keeping all-in power costs ultra-low at 2.6¢/kWh, showcasing the edge of its power strategy and skilled management team. Meanwhile, the deployed hash rate climbed 56% annually to 36.4 EH/s, underlining Riot’s expanding footprint and growing operational muscle in the Bitcoin mining race.

Looking ahead, management raised its Q4 2025 hash rate guidance to 40 EH/s and projected 45 EH/s in Q1 2026, aiming to hold a 4% global share. The Corsicana data center design is slated for completion by Q3-end, with 600 MW of substation infrastructure secured and land positioned for up to 1 GW of capacity.

During the Q2 earnings call, the management also hinted at future diversification opportunities tied to high-performance computing and AI workloads—potentially unlocking new revenue streams beyond BTC mining. If executed well, Riot could evolve from a mining powerhouse into a broader infrastructure play, keeping it ahead of the curve in a fast-changing market.

Analysts tracking Riot are bracing for the company to take a hit this year, expecting a -$0.67 per-share loss, nearly triple last year’s pain—widening by 297% YoY. By 2026, the bleeding is anticipated to ease, with losses projected to shrink 23.9% annually to -$0.51 per share, hinting that the worst may be behind the miner.

What Do Analysts Expect for RIOT Stock?

Analysts are bullish on Riot, viewing it as more than just a Bitcoin miner. Roth Capital’s Darren Aftahi recently lifted his price target to $42 from $17.50 while maintaining a “Buy” rating, following meetings with Riot’s CEO. His thesis leans on a sum-of-the-parts analysis, applying net present value to Riot’s 1.7 GW portfolio as it transitions toward high-performance computing—a shift he believes could unlock meaningful upside.

Meanwhile, researcher Arete is looking even further ahead. The firm projects Riot could generate as much as $2.3 billion in recurring EBITDA by 2031, largely on the back of two high-performance compute data centers built on a co-location rental model. The logic is simple—leverage Riot’s massive energy infrastructure to tap into surging demand for AI and HPC workloads.

Putting it all together, the Street is clearly flashing green on RIOT, signaling strong confidence in the miner’s story. The stock has a consensus “Strong Buy” rating overall. Of the 17 analysts covering the stock, 14 recommend a “Strong Buy,” two suggest a “Moderate Buy,” and the remaining one is sitting on the sidelines with a “Hold” rating.

RIOT flirted with the average price target of $20.41, but it currently sits below that at about $19.17, which hints at a modest upside of 6.4%. Meanwhile, Roth Capital’s bullish, street-high target of $42 paints a much bigger picture, pointing to upside potential of nearly 119% from current levels.