Billionaire activist investor Jeff Smith remains bullish on Kenvue (KVUE) despite the stock plunging roughly 28% year-to-date (YTD) amid controversy surrounding its Tylenol brand. Smith's enthusiasm stems from rapid management changes he helped orchestrate. Former CEO Thibaut Mongon was ousted in July and replaced by interim chief Kirk Perry, while Amit Banat took over as CFO in May.

Smith noted he would have been "really happy" a year ago if told these leadership transitions could happen so quickly, and he sees improvement in several of Kenvue's brands and business lines.

KVUE stock's recent troubles center on the Trump administration's controversial and scientifically questionable position linking Tylenol to autism when used during pregnancy. Shares dropped over 10% after reports that Health and Human Services Secretary Robert F. Kennedy Jr. plans to release findings drawing that connection. Kennedy has pledged to determine the cause of rising autism rates and eliminate exposures.

Meanwhile, Kenvue has urged regulators to reject citizen petitions seeking autism warning labels. A federal judge dismissed similar lawsuits in 2024 for a lack of scientific evidence.

Is KVUE Stock a Good Buy Right Now?

During the Q2 earnings call, interim CEO Kirk Perry outlined an aggressive turnaround strategy while acknowledging operational challenges. Kenvue, which owns brands like Listerine and Neutrogena, posted a 2.7% decline in sales for the first half of the year and maintained guidance for low single-digit revenue declines for 2025.

Perry identified excessive complexity in product lines, insufficient focus on consumer insights, and poor execution in retail and e-commerce channels as key performance-holding issues.

According to Perry, Kenvue has too many products spread across multiple markets without enough strategic focus. Perry spent 23 years at Procter & Gamble (PG) before leading tech companies like Circana and Alphabet (GOOG) (GOOGL). The board has initiated a comprehensive review of strategic alternatives, including potentially reshaping the brand portfolio.

Retail inventory destocking continued to weigh on results, while seasonal products struggled due to a delayed summer start. China operations remained weak, though Kenvue expects easier comparisons in the fourth quarter.

Management highlighted a robust innovation pipeline for the second half but stressed that execution improvements are mandatory rather than optional. Cash flow performance remained ahead of last year despite earnings pressure, with Kenvue expecting similar full-year cash generation.

Is Kenvue Stock Undervalued?

Analysts tracking KVUE stock forecast sales to rise from $15.13 billion in 2025 to $17.11 billion in 2029. In this period, free cash flow is forecast to expand from $1.73 billion to $2.83 billion. A widening cash flow base should allow the company to raise its annual dividend from $0.83 per share in 2025 to $0.99 per share in 2029.

KVUE stock trades at 14.8x forward FCF, which is reasonable, given its growth estimates. At a similar multiple, it should gain 50% within the next four years. If we adjust for dividends, cumulative returns could be closer to 70%.

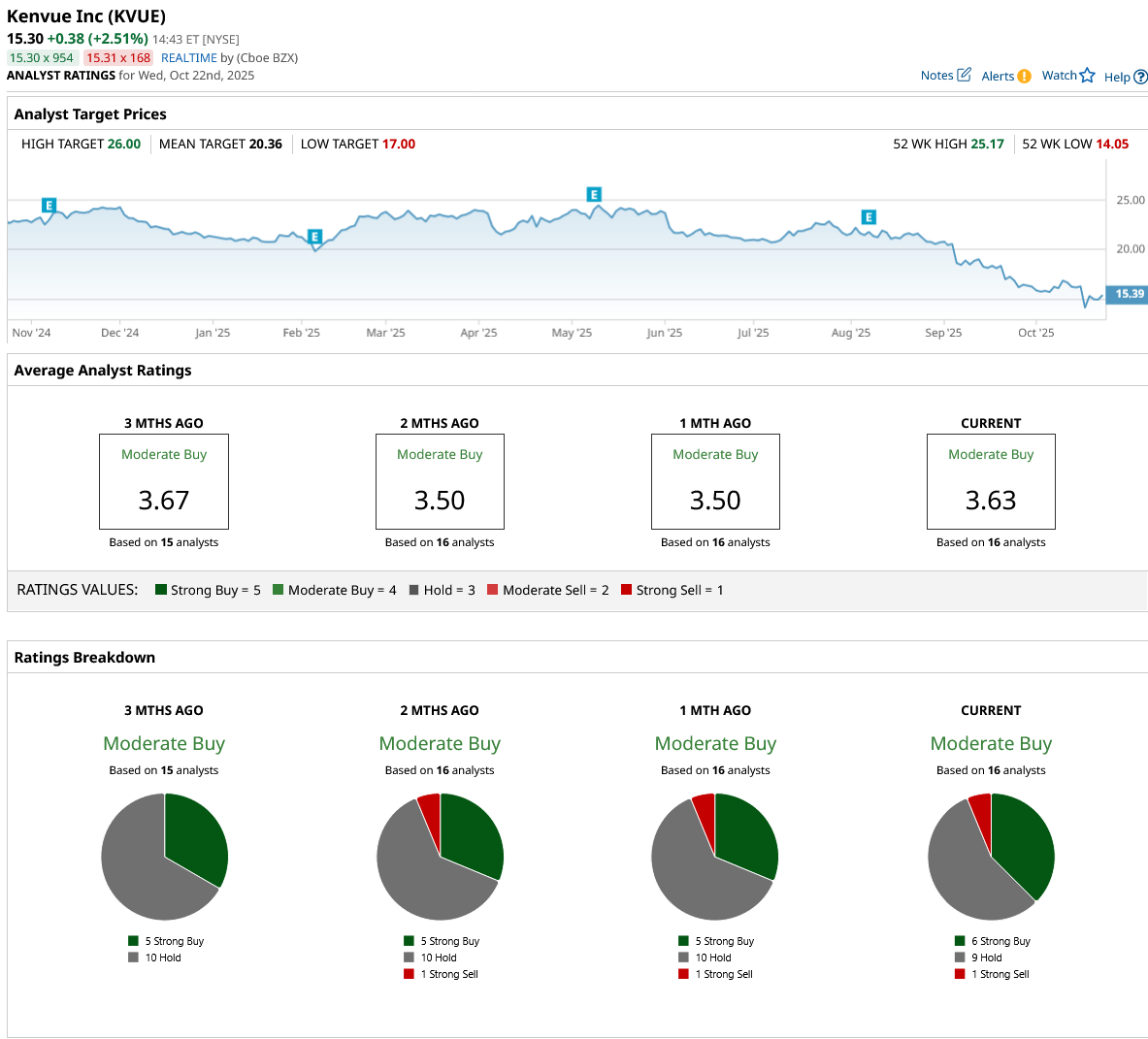

Out of the 16 analysts covering KVUE stock, six recommend “Strong Buy,” nine recommend “Hold,” and one recommends “Strong Sell.” The average KVUE stock price target is $20.36, indicating an upside potential of 35% from current levels.