/Apple%20logo%20on%20store%20front%20by%20frantic00%20via%20iStock.jpg)

Apple (AAPL) is the world's most recognizable consumer products brand and could be best known as the world's most valuable company for much of the past couple of decades.

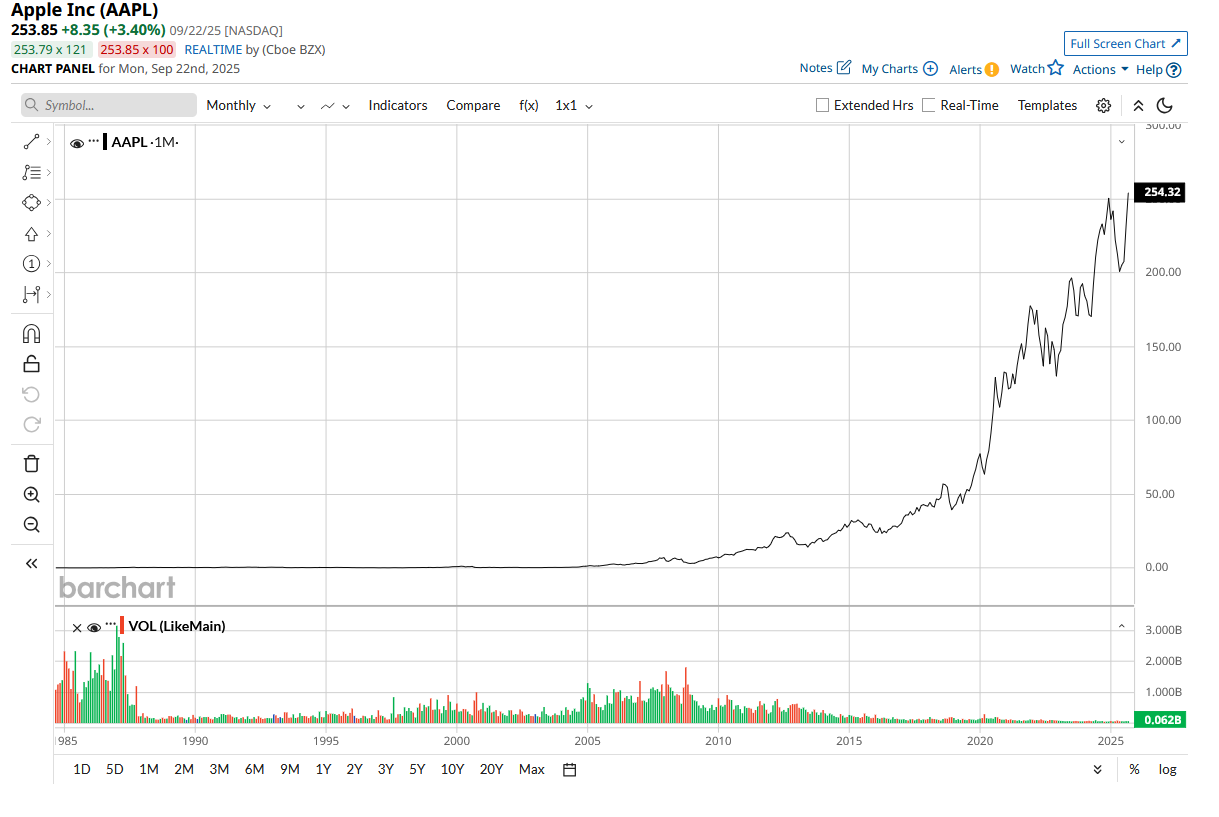

Of course, the rise of artificial intelligence (AI) and surging market capitalizations among companies in this space have changed the dynamics around how Apple is valued relative to other mega-cap tech behemoths. But it's also true that long-term investors who have stuck with this name have done screamingly well (just check out the stock price performance chart below).

With that said, not all investors and insiders are 100% sold on where Apple is likely headed from here. Let's dive into why one key Apple insider has been selling stock and what this could mean for the future of the stock and investors looking to put fresh capital to work in the iPhone maker right now.

Big $20 Million Stock Sale Rattling Investors

Much ado has been made of the many billions of dollars of Apple stock Berkshire Hathaway (BRK.A) (BRK.B) CEO Warren Buffett has sold recently. And that's certainly something to pay attention to, especially for those who believe the Oracle of Omaha is still one of the best stock pickers of all time.

But when the chair of Apple's board comes out and discloses a $20 million stock sale, such a divestiture could certainly ruffle just as many feathers, given how close this individual is to Apple's internal growth strategies and forward outlook. One could argue that Apple's board chair has much more insider knowledge than anyone on Wall Street, so as far as taking such trades with a grain of salt is concerned, less salt is required to review such a transaction.

Arthur Levinson, Apple's chairman, filed a Form 4 earlier this month that indicated a stock sale of 90,000 shares worth around $20.9 million. This is a notable sale, given that Levinson's initial purchase price in 2001 amounted to around $0.29 at that time.

We'd all like to turn $26,100 into more than $20 million with any given trade, even if it takes nearly 25 years. But the kind of patience someone like Levinson should be noted, and his foresight into seeing what Apple could become at that time, is truly remarkable.

What Do the Fundamentals Say About Where Apple Is Headed from Here?

By all accounts, Apple's recent price increases on its key iPhone models (and now Apple TV) have provided the stock with a big boost. Over the course of the past month, shares of AAPL stock are up roughly 7%, with most of that gain taking place in the last week. Indeed, price increases are key to investors' cash flow projections, as Apple has proven itself to be among the more mature (and stable) big tech companies out there.

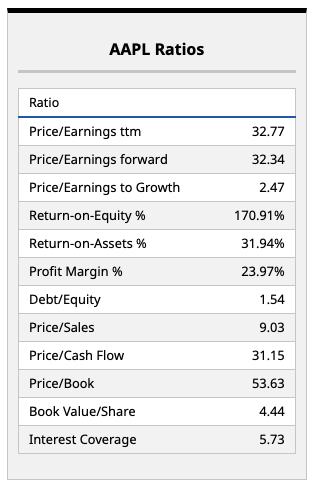

That said, most investors are right to point out that growth has slowed dramatically for Apple recently. Below, I highlight the company's key valuation metrics. In sum, Apple is an expensive big-name stock given its price/sales and price/earnings multiples, both of which are near historical highs for the company looking back a decade or so.

Of course, it's entirely possible that forward earnings expectations could pick up following these price increases. I'd argue that's what most investors are betting on. If Apple can indeed find a way to expand its profit margin and improve its cash flow (resulting in forward multiples on both fronts in the mid-20s), I think this recent rally could be warranted. Additionally, Apple's recent earnings beat (which showed iPhone sales that were much stronger than expected) should spur solid demand for this company's highly liquid shares moving forward.

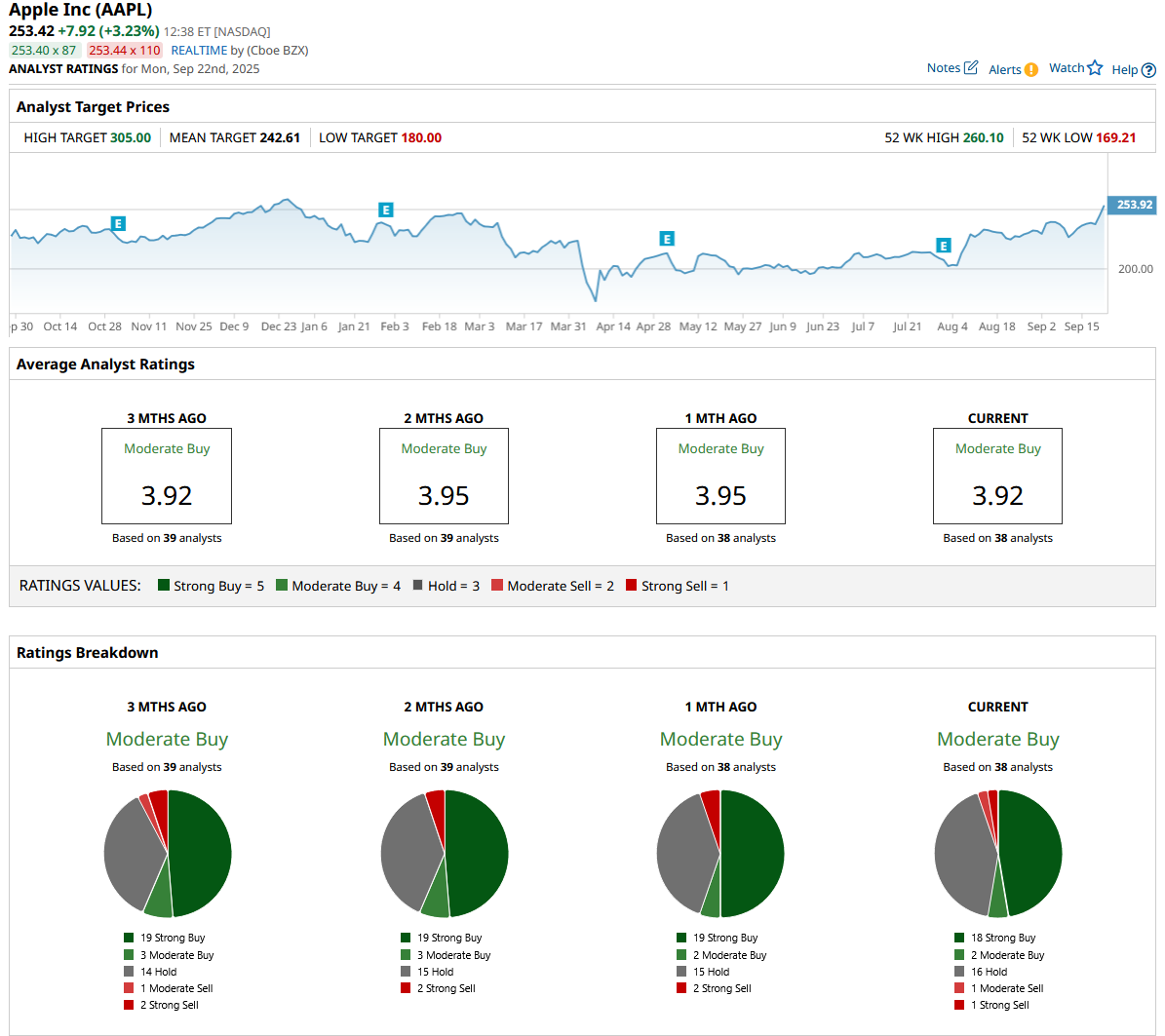

What Do the Analysts Think?

It should be no surprise to most investors who have followed Apple closely lately that Wall Street analysts remain bullish on the company's stock. Currently, the consensus price target for AAPL stock sits at $305 per share, implying upside of around 25% from here.

This price target does appear to be reasonable if Apple can continue to provide top- and bottom-line beats in the quarters to come, with margin expansion and an improved cash flow picture as well.

Of course, the entire investing journey is one that involves uncertainty, and no one has a crystal ball to see what's ahead. But given recent developments, I do think Apple's surge makes sense, and this is a stock that could see significant momentum moving forward so long as the macro picture remains strong.